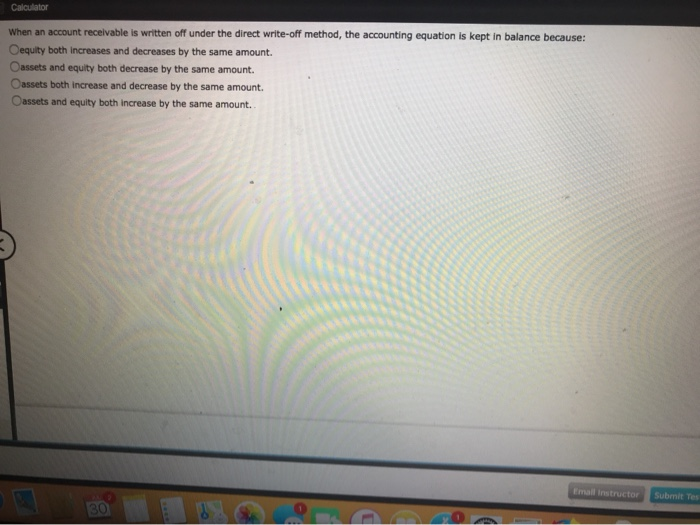

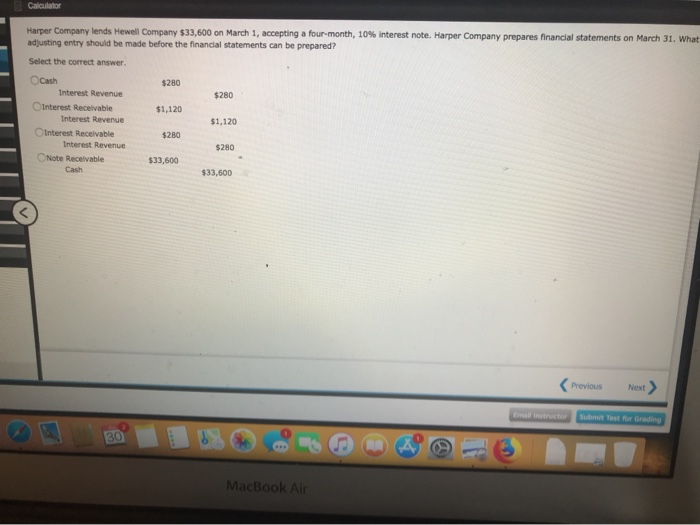

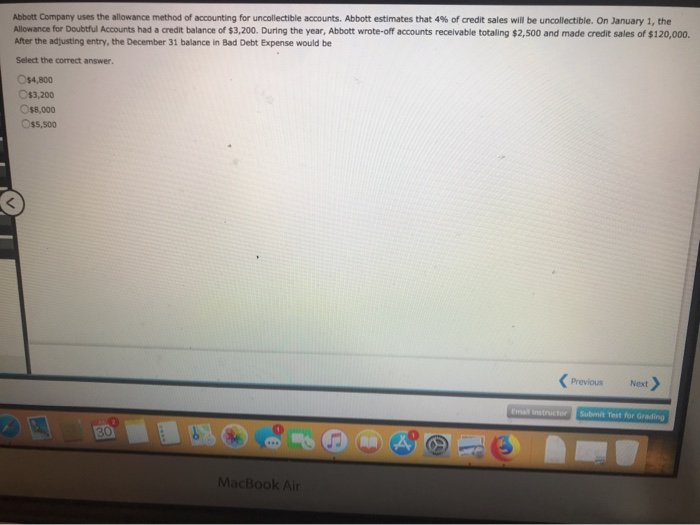

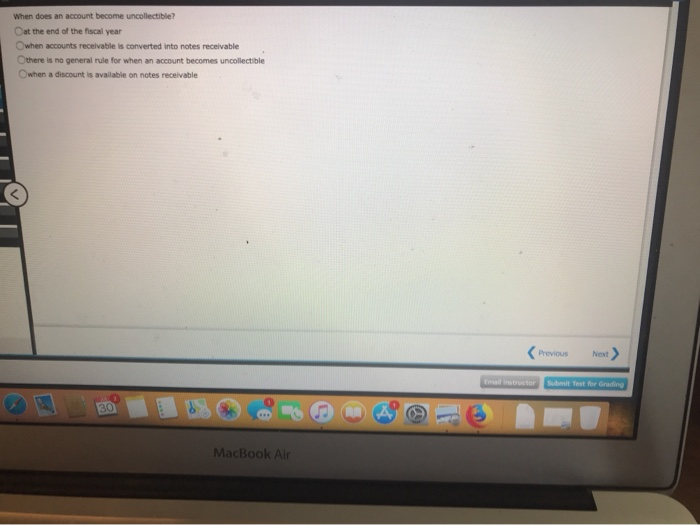

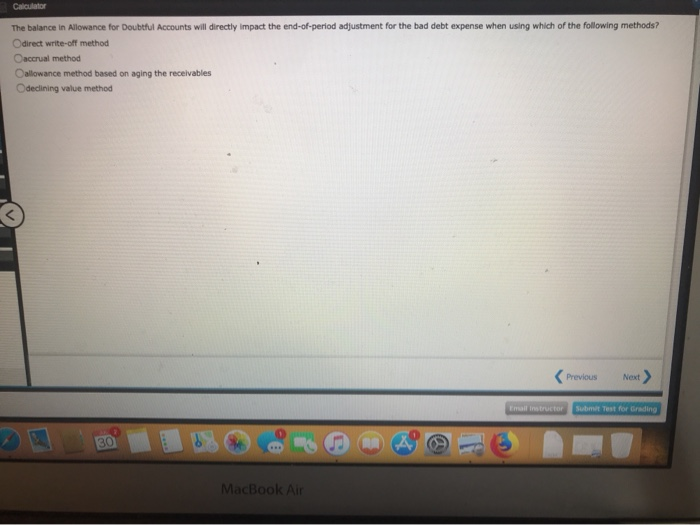

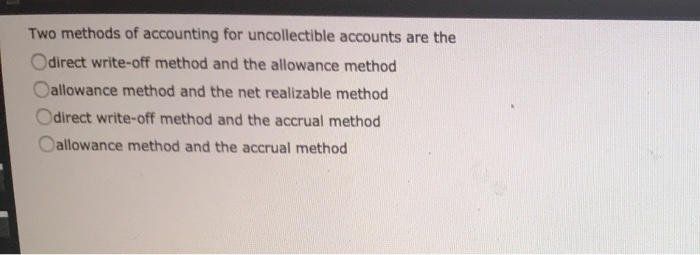

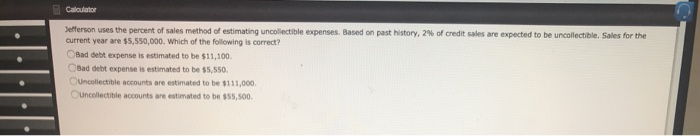

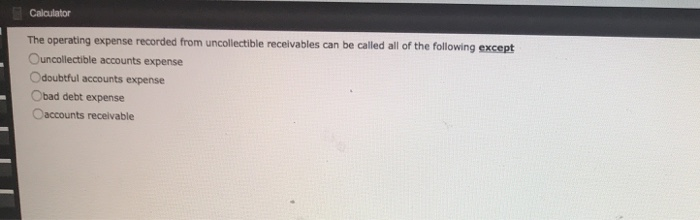

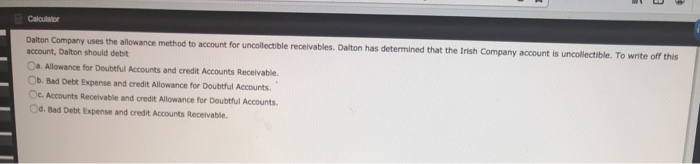

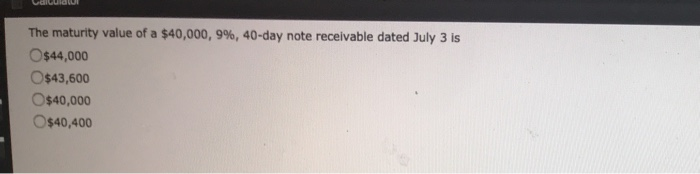

Calculator When an account receivable is written off under the direct writ e-off method, the accounting equation is kept in balance because: Oequity both increases and decreases by the same amount. Oassets and equity both decrease by the same amount. Oassets both increase and decrease by the same amount. Oassets and equity both increase by the same amount. Fmail Instructor Submit Tes 30 Calculator Harper Company lends Hewell Company $33,600 on March 1, accepting a four-month, 10% interest note. Harper Company prepares financial statements on March 31, What adjusting entry should be made before the financial statements can be prepared? Select the correct answer. OCash $280 Interest Revenue $280 Otnterest Receivable $1,120 Interest Revenue $1,120 Otnterest Recelvable $280 Interest Revenue $280 ONote Receivable $33,600 Cash $33,600 Previous Next Email Instructor Submit Test for Grading 30 MacBook Air When does an account become uncollectible? Oat the end of the fiscal year Owhen accounts receivable is converted into notes receivable Othere is no general rule for when an account becomes uncollectible Owhen a discount is available on notes receivable Previous Next Submit Test for Gradings Emal instructor 30 MacBook Air Calculator the b ad debt expense when using which of the following methods? The balance in Allowance for Doubtful Accounts will directly impact the end-of-period adjustment for Odirect write-off method Oaccrual method Oallowance method based on aging the receivables Odeclining value method Previous Next Email Instructor Submit Test for Grading 30 MacBook Air Two methods of accounting for uncollectible accounts are the Odirect write-off method and the allowance method Oallowance method and the net realizable method Odirect write-off method and the accrual method Oallowance method and the accrual method Caloulator Defferson uses the percent of sales method of estimating uncollectible expenses. Based on past history, 2% of credit sales are expected to be uncollectible. Sales for the current year are $5,550,000. Which of the following is correct? OBad debt expense is estimated to be $1,100. OBad debt expense is estimated to be $5,550 Ouncollectible accounts are estimated to be $111,000. OUncollectible accounts are estimated to be $55,500. Calculator The operating expense recorded from uncollectible receivables can be called all of the following except Ouncollectible accounts expense Odoubtful accounts expense Obad debt expense Oaccounts receivable Calculator Dalton Company uses the allowance method to account for uncollectible receivables. Dalton has determined that the Irish Company account is uncollectible. To write off this account, Dalton should debit Ca. Allowance for Doubtful Accounts and credit Accounts Receivable. Ob. Bad Debt Expense and credit Allowance for Doubtful Accounts. Oc. Accounts Receivable and credit Allowance for Doubtful Accounts Od. Bad Debt Expense and credit Accounts Receivable. vaivuiau The maturity value of a $40,000, 9%, 40-day note receivable dated July 3 is O$44,000 O$43,600 O$40,000 O$40,400