Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please help with the parts of the questions that are filled on the excel sheets. Could you please verify if all information is

Could you please help with the parts of the questions that are filled on the excel sheets. Could you please verify if all information is correct? Thank you.

*not filled in

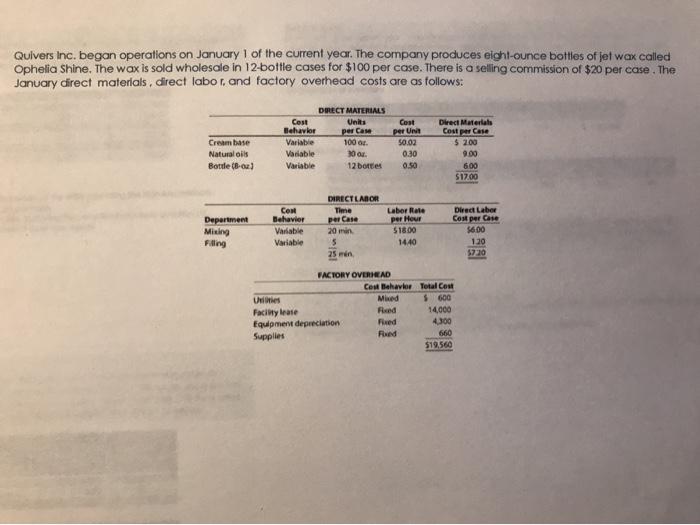

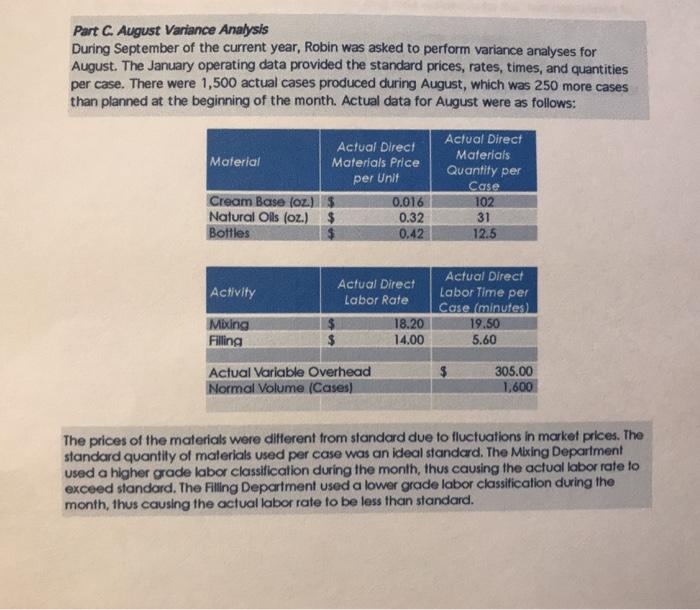

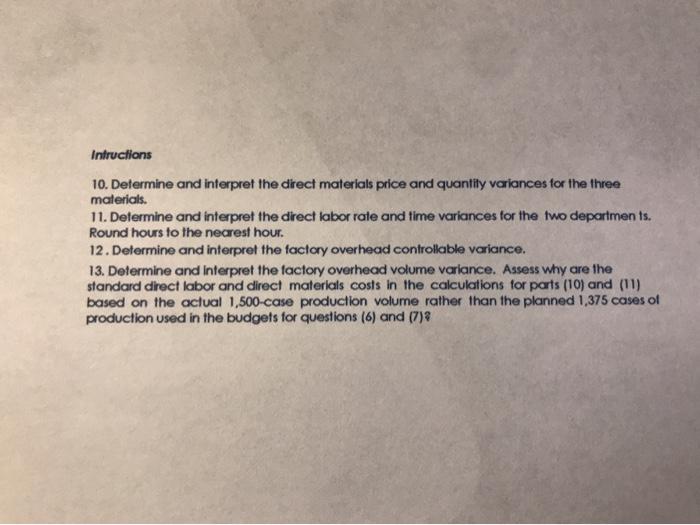

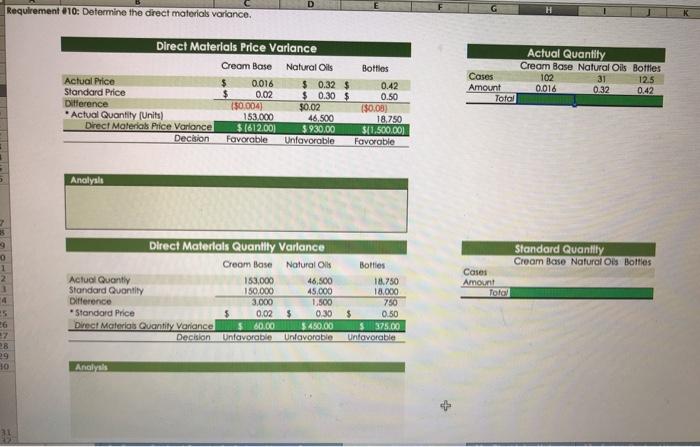

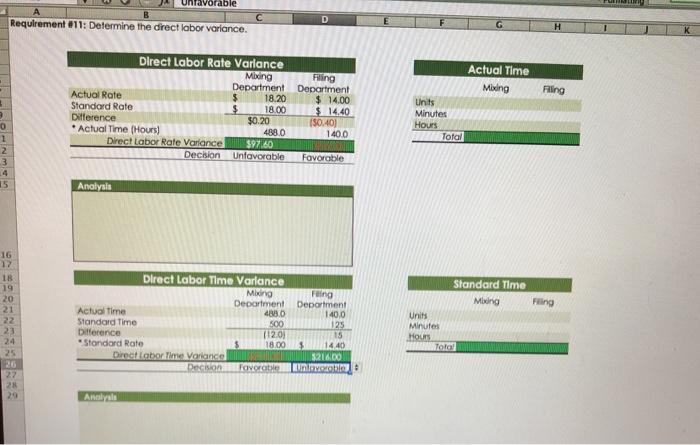

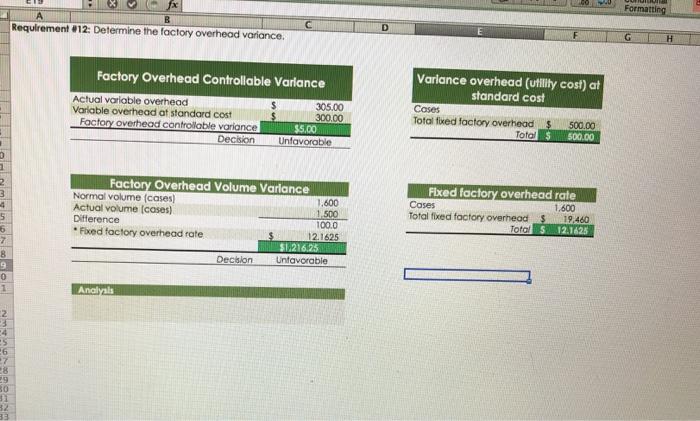

Quivers Inc. began operations on January 1 of the current year. The company produces eight-ounce bottles of jet wax called Ophelia Shine. The wax is sold wholesale in 12 bottle cases for $100 per case. There is a selling commission of $20 per case. The January direct materials, direct labor and factory overhead costs are as follows: DRECT MATERIALS Cost Units Behavior per Case Variable Vadable 700. Variable 12 bottes Direct Materials Cost per Case $ 200 Creambase Natural oils Bottle B-02) 1000 Cont per Un 50.00 0.30 0.50 600 $17.00 DIRECT LABOR Time per Case Department Mixing Filling Behavior Variable Variable 20 min Laber Rate per Hour $1800 1440 Direct Laber Com per Case 5600 120 $7.30 25 min FACTORY OVERHEAD COM Behavior Total Cout Us Mind $ 600 Facility case Fixed 14,000 Equipmeni depreciation Fixed 4.300 Supplies RU 650 $19,560 Part C. August Variance Analysis During September of the current year, Robin was asked to perform variance analyses for August. The January operating data provided the standard prices, rates, times, and quantities per case. There were 1,500 actual cases produced during August, which was 250 more cases than planned at the beginning of the month. Actual data for August were as follows: Actual Direct Material Materials Price per Unit Cream Base (oz. $ 0.016 Natural Oils (oz.) $ 0.32 Bottles 0.42 Actual Direct Materials Quantity per Case 102 31 12.5 Activity Actual Direct Labor Rate Actual Direct Labor Time per Case (minutes 19.50 5.60 Mixing Filling 18.20 14.00 $ Actual Variable Overhead Normal Volume (Cases) 305.00 1,600 The prices of the materials were different from standard due to fluctuations in market prices. The standard quantity of materials used per case was an ideal standard. The Mixing Department used a higher grade labor classification during the month, thus causing the actual labor rate to exceed standard. The Filing Department used a lower grade labor classification during the month, thus causing the actual labor rate to be less than standard. Intructions 10. Determine and interpret the direct materials price and quantity variances for the three materials. 11. Determine and interpret the direct labor rate and time variances for the two departments. Round hours to the nearest hour. 12. Determine and interpret the factory overhead controllable variance. 13. Determine and interpret the factory overhead volume variance. Assess why are the standard direct labor and direct materials costs in the calculations for parts (10) and (11) based on the actual 1,500-case production volume rather than the planned 1,375 cases of production used in the budgets for questions (6) and (7) Requirement 10: Determine the direct materials variance H Direct Materials Price Variance Cream Bose Natural Oils Bottles Actual Price 0.016 $ 0.32 $ 0.42 Standard Price 0.02 $ 0.30 $ 0.50 Ditference (50.004) $0.02 ($0.08) Actual Quantity (Units) 153,000 46,500 18.750 Direct Materials Price Variance $(612.001 $.930,00 $(1.500.00) Decision Favorable Unfavorable Favorable Actual Quantity Cream Base Natural Oils Bottles 102 31 12.5 0.016 0.32 0.42 Cases Amount Total Analysis 9 Direct Materials Quantity Varlance 1 Bottles 18.750 18.000 Standard Quantity Cream Base Natural Oils Bottles Cases Amount Toto 1 4 Cream Base 153,000 150.000 3.000 0.02 60.00 Unfavorable Actual Quantly Standard Quantity Difference Standard Price Direct Mater Quantity Variance Decision Natural Oils 46,500 45.000 1,500 $ 0.30 $ 480,00 Unfavorable 750 5 26 $ 0.50 375.00 Unfavorable 28 29 10 Analysis unfavorable B Requirement 011: Determine the direct labor variance. D H Filing Direct Labor Rate Variance Moong Filling Department Department Actual Rate 18.20 $ 14.00 Standard Rate $ 18.00 $ 14.40 Difference $0.20 1$0.40) Actual Time (Hours) 488.0 140.0 Direct Labor Rate Variance $97.60 Decision Unfavorable Favorable Actual Time Miding Units Minutes Hours Total 0 1 2 3 15 Analysis Fing 16 17 18 19 20 21 22 23 24 25 Filing Direct Labor Time Varlance Mixing Department Actualtime VO Standard Time 500 Difference (120) *Stondord Rate $ 18.00 Director Ime Vorance Decision Favorite Department 140,0 125 15 $14.40 $216.00 noble Standard Time Meng Units Minutes Hours Total 22 Analysis Formatting fx B Requirement #12: Determine the factory overhead variance. Factory Overhead Controllable Variance Actual variable overhead 305.00 Variable overhead at standard cost 300.00 Factory overhead controllable variance $5.00 Decision Unfavorable Variance overhead (utility cost) at standard cost Cases Totalfixed factory overhead $ 500.00 Total $ 500.00 2 3 4 5 6 -7 B 9 0 Factory Overhead Volume Variance Normal volume (cases) 1.600 Actual volume (cases) 1.500 Difference 100.0 * Fixed factory overhead rate 12.1625 $1,216,23 Decision Unfavorable Fixed factory overhead rate Cases 1.600 Total fixed factory overhead $ 19,460 Totol S.12.1625 Analysis 06 7 29 30 11 82 33 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started