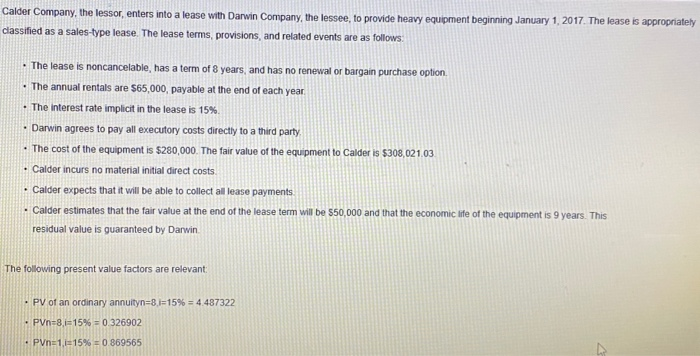

Calder company, the lesser, enters into a lease with the Darwin company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows

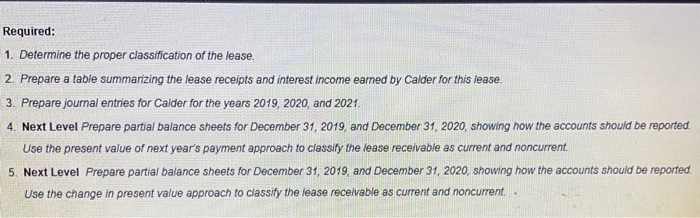

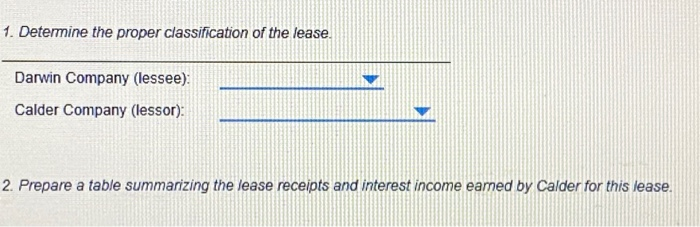

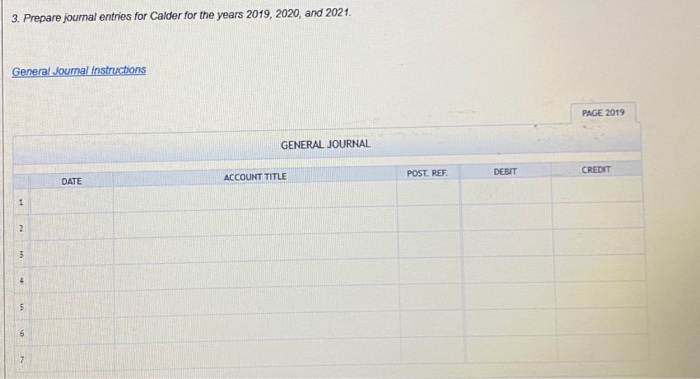

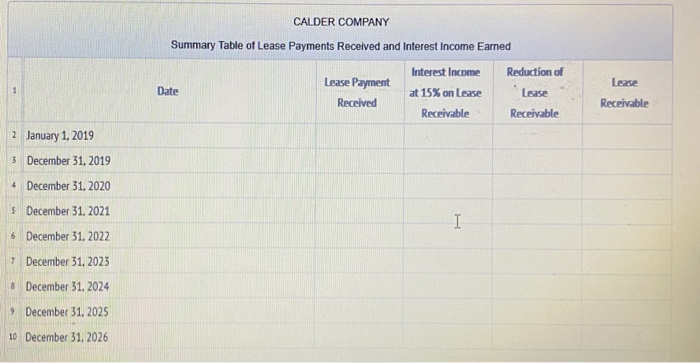

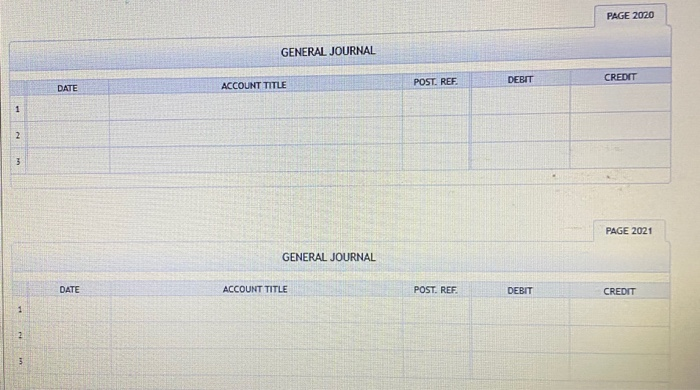

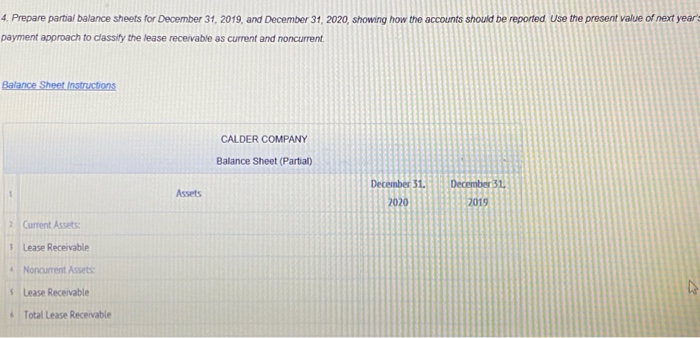

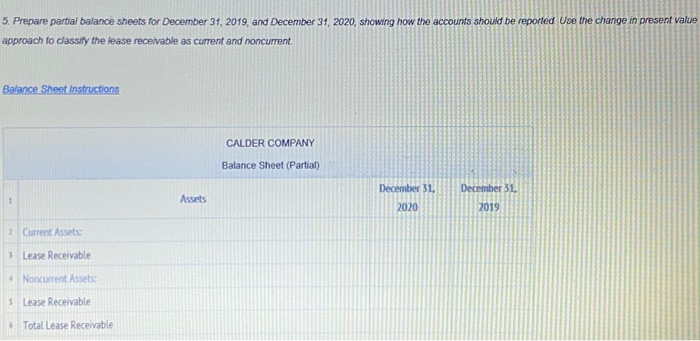

Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows. The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option The annual rentals are $65,000, payable at the end of each year The interest rate implicit in the lease is 15% Darwin agrees to pay all executory costs directly to a third party The cost of the equipment is $280,000. The fair value of the equipment to Calder is $308,021.03 Calder incurs no material initial direct costs Calder expects that it will be able to collect all lease payments Calderestimates that the fair value at the end of the lease term will be $50,000 and that the economic ite of the equipment is 9 years. This residual value is guaranteed by Darwin The following present value factors are relevant PV of an ordinary annuityn=8-15% = 4.487322 PVn=8,i=15% = 0 326902 - PVna 1. i 15% = 869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next year's payment approach to classify the lease receivable as current and noncurrent 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent. 1. Determine the proper classification of the lease Darwin Company (lessee) Calder Company (lessor) 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. General Journal instructions PAGE 2019 GENERAL JOURNAL CREDIT POST. REF ACCOUNT TITLE CALDER COMPANY Summary Table of Lease Payments Received and Interest Income Earned Interest Income at 15% on Lease Lease Payment Received Reduction of Lease Date Lease Receivable Receivable Receivable 2 January 1, 2019 December 31, 2019 December 31, 2020 December 31, 2021 6 December 31, 2022 December 31, 2023 8 December 31, 2024 9 December 31, 2025 10 December 31, 2026 PAGE 2020 GENERAL JOURNAL DEBITA POST REF ACCOUNT TITLE CREDIT PAGE 2021 GENERAL JOURNAL ACCOUNT TITLE POST. REF. DEBITE CREDIT 4. Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported Use the present value of next year's payment approach to classify the lease receivable as current and noncurrent Balance Sheet Instructions CALDER COMPANY Balance Sheet (Partial) Assets Current A Lease Receivable Noncurrent Assets Lease Receivable 6 Total Lease Receivable 5. Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported Use the change in present value approach to classify the lease receivable as current and noncurrent Balance Sheet Instructions CALDER COMPANY Balance Sheet (Partial) December 31, Assets Current Assets Lease Receivable Noncurrent Assets Lease Receivable Total Lease Receivable