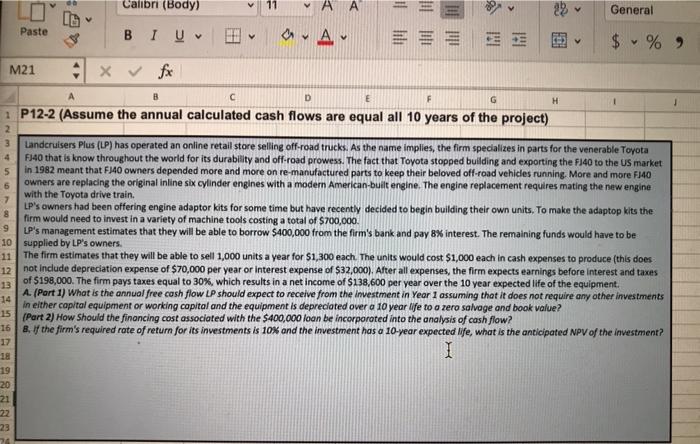

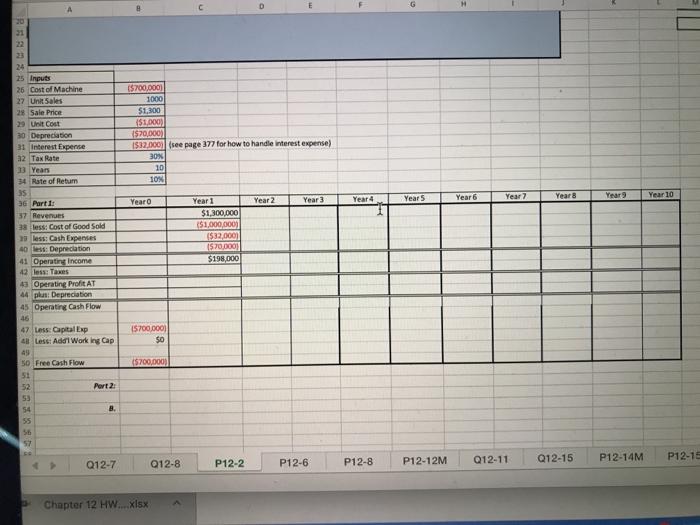

Calibri (Body) General Paste BIU V A === $ % ) M21 B C D F H 1 P12-2 (Assume the annual calculated cash flows are equal all 10 years of the project) 2 6 3 Landcruisers Plus (LP) has operated an online retail store selling off-road trucks. As the name implies, the firm specializes in parts for the venerable Toyota 4 FJ40 that is know throughout the world for its durability and off-road prowess. The fact that Toyota stopped building and exporting the FJ40 to the US market 5 in 1982 meant that F40 owners depended more and more on re-manufactured parts to keep their beloved off-road vehides running. More and more F140 owners are replacing the original inline six cylinder engines with a modern American-built engine. The engine replacement requires mating the new engine with the Toyota drive train. 7 LP's owners had been offering engine adaptor kits for some time but have recently decided to begin building their own units. To make the adaptop kits the 8 firm would need to invest in a variety of machine tools costing a total of $700,000. 9 LP's management estimates that they will be able to borrow $400,000 from the firm's bank and pay 8% interest. The remaining funds would have to be 10 supplied by LP's owners. 11 The firm estimates that they will be able to sell 1,000 units a year for $1,300 each. The units would cost $1,000 each in cash expenses to produce this does 12 not include depreciation expense of $70,000 per year or interest expense of $32,000). After all expenses, the firm expects earnings before interest and taxes 13 of S198,000. The firm pays taxes equal to 30%, which results in a net income of $138,600 per year over the 10 year expected life of the equipment. A. (Part 1) What is the annual free cash flow LP should expect to receive from the Investment in Year 1 assuming that it does not require any other investments in either capital equipment or working capital and the equipment is deprecated over a 10 year life to o zero salvage and book value? 15 (Part 2) How Should the financing cost associated with the $400,000 loan be incorporated into the analysis of cash flow? 16 8.1f the firm's required rate of return for its investments is 10% and the investment has a 10-year expected Wife, what is the anticipated NPV of the investment? I 18 19 20 21 23 20 D $700,0001 1000 $1,300 {$1,000) $70,000 1932.0001 free page 377 for how to handle interest expense) 30% 10 10% Year 5 Year 2 Year Year 6 Year Year 10 Year Year 4 Year 8 Year 24 25 Inputs 26 Cost of Machine 27 Unit Sales 28 Sale Price 29 Unit Cost 30 Depreciation 31 Interest Expense az Tax Rate 13 Years 34 Rate of Return 35 36 Part 1 37 Revenues 38 less: Cost of Good Sold 13 less: Cash Expenses 40 let: Depreciation 41 Operating income 42 less: Taxes 43 Operating Profit AT 44 plus Depreciation 45 Operating Cash Flow 46 47. Less: Capital Exp 4 Less: Add Working Cap 49 50 Free Cash Flow 51 52 Port2 53 54 B. 55 56 57 Year 1 $1,300,000 ($1,000,000 $32,000 15.70,000) $198.000 15700.000) 50 (5700,000 Q12-7 Q12-8 P12-6 P12-2 P12-8 P12-12M P12-14M Q12-11 Q12-15 P12-15 Chapter 12 HW....xlsx