Question

Refer to the attached article Key Highlights: Financial Stability Review First Half 2021 published by Bank Negara Malaysia (BNM). You are required to read it

Refer to the attached article Key Highlights: Financial Stability Review First Half 2021 published by Bank Negara Malaysia (BNM). You are required to read it carefully and answer the questions below. You may also support your answer with relevant Policy or/ and Guidelines issued by BNM.

Required

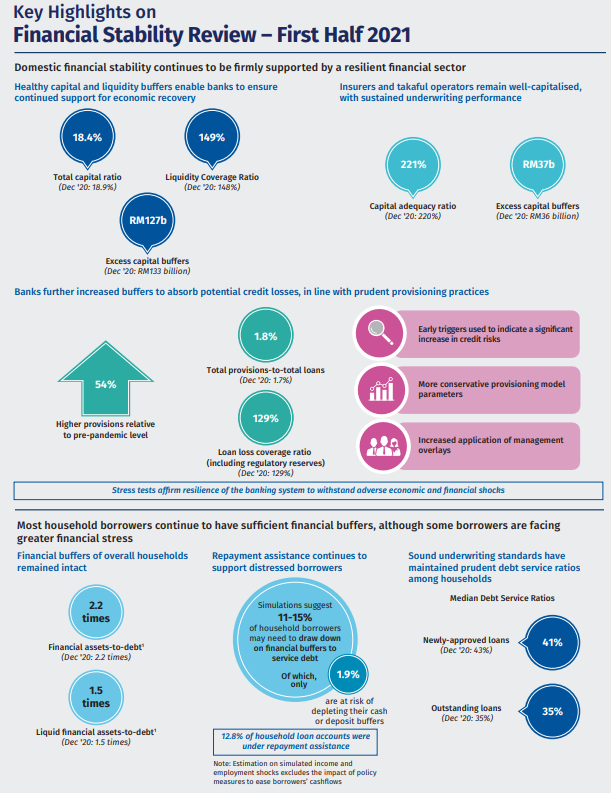

The banking sector's total capital ratio stood at 18.4% for the first half of 2021 as compared to 18.9% at 31 December 2020. In addition, the banking sector also recorded excess capital buffers of RM127 billion, slightly lower than RM133 billion in December 2020.

(i) Based on the above statistics, explain the overall position of bankings sector capital in the first half of 2021.

(ii) Explain how the capital position of the banking institution facilitates the financial stability of Malaysia.

(iii) Explain the three types of capital buffer that need to be maintained by banking institutions.

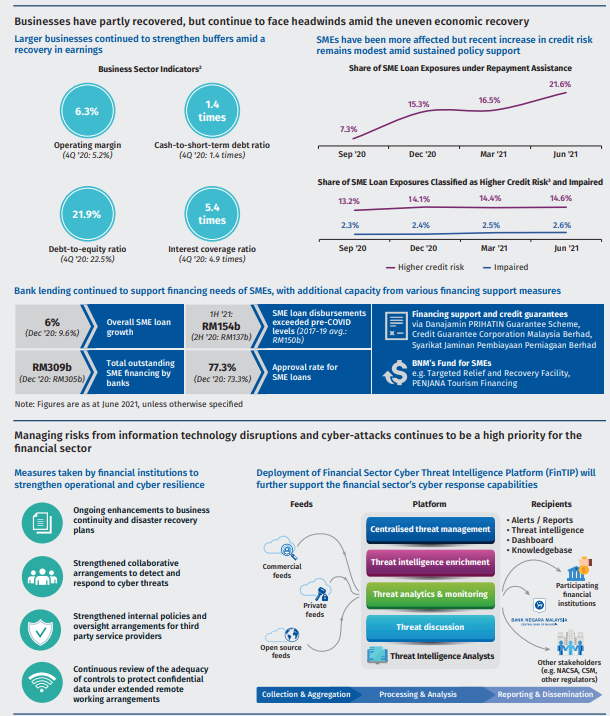

Key Highlights on Financial Stability Review - First Half 2021 Domestic financial stability continues to be firmly supported by a resilient financial sector Healthy capital and liquidity buffers enable banks to ensure Insurers and takaful operators remain well-capitalised, continued support for economic recovery with sustained underwriting performance 18.4% 149% 221% RM37b Total capital ratio (Dec 20: 18.9%) Liquidity Coverage Ratio (Dec 20:148%) RM127b Capital adequacy ratio (Dec 20:220%) Excess capital buffers (Dec 20: RM36 billion) Excess capital buffers (Dec 20: RM133 billion) Banks further increased buffers to absorb potential credit losses, in line with prudent provisioning practices 1.8% Early triggers used to indicate a significant increase in credit risks Total provisions-to-total loans 54% (Dec 20:1.7%) More conservative provisioning model parameters 129% Higher provisions relative to pre-pandemic level Increased application of management Loan loss coverage ratio overlays (including regulatory reserves) (Dec 20: 129%) Stress tests affirm resilience of the banking system to withstand adverse economic and financial shocks Most household borrowers continue to have sufficient financial buffers, although some borrowers are facing greater financial stress Financial buffers of overall households Repayment assistance continues to Sound underwriting standards have remained intact support distressed borrowers maintained prudent debt service ratios among households 2.2 Simulations suggest Median Debt Service Ratios times 11-15% of household borrowers may need to draw down Newly-approved loans Financial assets-to-debt 41% on financial buffers to (Dec 20: 43%) (Dec "20:2.2 times) service debt of which, 1.9% 1.5 only times are at risk of depleting their cash Outstanding loans 35% or deposit buffers (Dec 20:35%) Liquid financial assets-to-debt 12.8% of household loan accounts were (Dec '20: 1.5 times) under repayment assistance Note: Estimation on simulated income and employment shocks excludes the impact of policy measures to ease borrowers' cashflows Businesses have partly recovered, but continue to face headwinds amid the uneven economic recovery Larger businesses continued to strengthen buffers amid a SMEs have been more affected but recent increase in credit risk recovery in earnings remains modest amid sustained policy support Business Sector Indicators' Share of SME Loan Exposures under Repayment Assistance 21.6% 6.3% 15.3% 16.5% times 7.3% Operating margin (40 20:5.2%) Cash-to-short-term debt ratio (4Q 20:1.4 times) Sep 20 Dec '20 Mar 21 Jun 21 Share of SME Loan Exposures Classified as Higher Credit Risk and Impaired 13.2% 14.1% 14.4% 14.6% 21.9% 5.4 times 2.3% 2.4% 2.5% 2.6% Sep 20 Dec 20 Jun 21 Debt-to-equity ratio (40 20:22.5%) Interest coverage ratio (4020: 4.9 times) Mar 21 - Impaired - Higher credit risk Bank lending continued to support financing needs of SMEs, with additional capacity from various financing support measures 1H 21: SME loan disbursements Financing support and credit guarantees 6% Overall SME loan RM154b exceeded pre-COVID (Dec 20:9.6%) via Danajamin PRIHATIN Guarantee Scheme, growth levels (2017-19 avg.: (2H 20: RM1375) Credit Guarantee Corporation Malaysia Berhad, RM150b) Syarikat Jaminan Pembiayaan Perniagaan Berhad RM3095 Total outstanding 77.3% Approval rate for BNM's Fund for SMES (Dec 20: RM305b) SME financing by banks e-g. Targeted Relief and Recovery Facility, SME loans (Dec 20:73.3%) PENJANA Tourism Financing Note: Figures are as at June 2021, unless otherwise specified $ Managing risks from information technology disruptions and cyber-attacks continues to be a high priority for the financial sector Measures taken by financial institutions to Deployment of Financial Sector Cyber Threat Intelligence Platform (FinTIP) will strengthen operational and cyber resilience further support the financial sector's cyber response capabilities Feeds Ongoing enhancements to business Platform Recipients continuity and disaster recovery - Alerts / Reports plans Centralised threat management - Threat intelligence Dashboard - Knowledgebase Strengthened collaborative Commercial Threat intelligence enrichment arrangements to detect and feeds MIT on respond to cyber threats Participating Threat analytics & monitoring financial Private institutions Strengthened internal policies and feeds BANK NEGARA MALAYSIA oversight arrangements for third Threat discussion party service providers Open source feeds Threat Intelligence Analysts Other stakeholders Continuous review of the adequacy (e.g. NACSA, CSM of controls to protect confidential other regulators) data under extended remote Collection & Aggregation working arrangements Processing & Analysis Reporting & Dissemination Key Highlights on Financial Stability Review - First Half 2021 Domestic financial stability continues to be firmly supported by a resilient financial sector Healthy capital and liquidity buffers enable banks to ensure Insurers and takaful operators remain well-capitalised, continued support for economic recovery with sustained underwriting performance 18.4% 149% 221% RM37b Total capital ratio (Dec 20: 18.9%) Liquidity Coverage Ratio (Dec 20:148%) RM127b Capital adequacy ratio (Dec 20:220%) Excess capital buffers (Dec 20: RM36 billion) Excess capital buffers (Dec 20: RM133 billion) Banks further increased buffers to absorb potential credit losses, in line with prudent provisioning practices 1.8% Early triggers used to indicate a significant increase in credit risks Total provisions-to-total loans 54% (Dec 20:1.7%) More conservative provisioning model parameters 129% Higher provisions relative to pre-pandemic level Increased application of management Loan loss coverage ratio overlays (including regulatory reserves) (Dec 20: 129%) Stress tests affirm resilience of the banking system to withstand adverse economic and financial shocks Most household borrowers continue to have sufficient financial buffers, although some borrowers are facing greater financial stress Financial buffers of overall households Repayment assistance continues to Sound underwriting standards have remained intact support distressed borrowers maintained prudent debt service ratios among households 2.2 Simulations suggest Median Debt Service Ratios times 11-15% of household borrowers may need to draw down Newly-approved loans Financial assets-to-debt 41% on financial buffers to (Dec 20: 43%) (Dec "20:2.2 times) service debt of which, 1.9% 1.5 only times are at risk of depleting their cash Outstanding loans 35% or deposit buffers (Dec 20:35%) Liquid financial assets-to-debt 12.8% of household loan accounts were (Dec '20: 1.5 times) under repayment assistance Note: Estimation on simulated income and employment shocks excludes the impact of policy measures to ease borrowers' cashflows Businesses have partly recovered, but continue to face headwinds amid the uneven economic recovery Larger businesses continued to strengthen buffers amid a SMEs have been more affected but recent increase in credit risk recovery in earnings remains modest amid sustained policy support Business Sector Indicators' Share of SME Loan Exposures under Repayment Assistance 21.6% 6.3% 15.3% 16.5% times 7.3% Operating margin (40 20:5.2%) Cash-to-short-term debt ratio (4Q 20:1.4 times) Sep 20 Dec '20 Mar 21 Jun 21 Share of SME Loan Exposures Classified as Higher Credit Risk and Impaired 13.2% 14.1% 14.4% 14.6% 21.9% 5.4 times 2.3% 2.4% 2.5% 2.6% Sep 20 Dec 20 Jun 21 Debt-to-equity ratio (40 20:22.5%) Interest coverage ratio (4020: 4.9 times) Mar 21 - Impaired - Higher credit risk Bank lending continued to support financing needs of SMEs, with additional capacity from various financing support measures 1H 21: SME loan disbursements Financing support and credit guarantees 6% Overall SME loan RM154b exceeded pre-COVID (Dec 20:9.6%) via Danajamin PRIHATIN Guarantee Scheme, growth levels (2017-19 avg.: (2H 20: RM1375) Credit Guarantee Corporation Malaysia Berhad, RM150b) Syarikat Jaminan Pembiayaan Perniagaan Berhad RM3095 Total outstanding 77.3% Approval rate for BNM's Fund for SMES (Dec 20: RM305b) SME financing by banks e-g. Targeted Relief and Recovery Facility, SME loans (Dec 20:73.3%) PENJANA Tourism Financing Note: Figures are as at June 2021, unless otherwise specified $ Managing risks from information technology disruptions and cyber-attacks continues to be a high priority for the financial sector Measures taken by financial institutions to Deployment of Financial Sector Cyber Threat Intelligence Platform (FinTIP) will strengthen operational and cyber resilience further support the financial sector's cyber response capabilities Feeds Ongoing enhancements to business Platform Recipients continuity and disaster recovery - Alerts / Reports plans Centralised threat management - Threat intelligence Dashboard - Knowledgebase Strengthened collaborative Commercial Threat intelligence enrichment arrangements to detect and feeds MIT on respond to cyber threats Participating Threat analytics & monitoring financial Private institutions Strengthened internal policies and feeds BANK NEGARA MALAYSIA oversight arrangements for third Threat discussion party service providers Open source feeds Threat Intelligence Analysts Other stakeholders Continuous review of the adequacy (e.g. NACSA, CSM of controls to protect confidential other regulators) data under extended remote Collection & Aggregation working arrangements Processing & Analysis Reporting & DisseminationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started