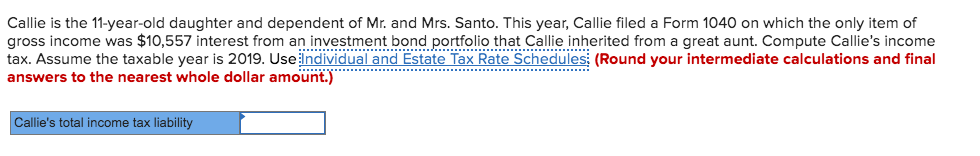

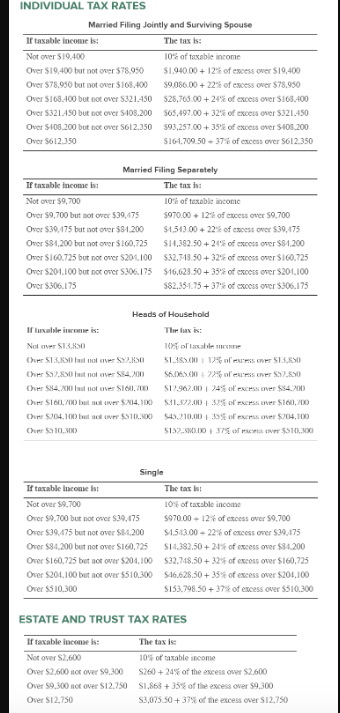

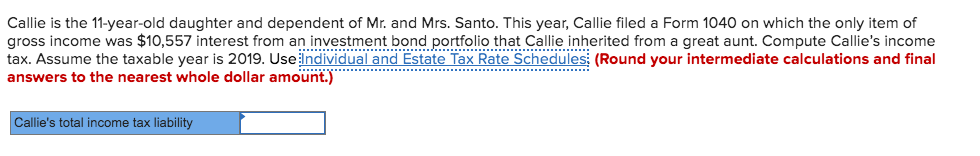

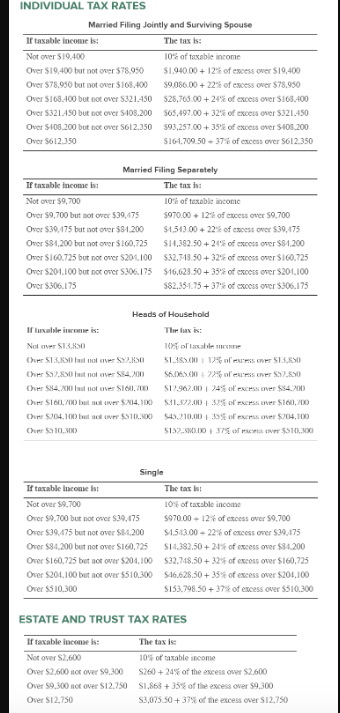

Callie is the 11-year-old daughter and dependent of Mr. and Mrs. Santo. This year, Callie filed a Form 1040 on which the only item of gross income was $10,557 interest from an investment bond portfolio that Callie inherited from a great aunt. Compute Callie's income tax. Assume the taxable year is 2019. Uselndividual and Estate Tax Rate Schedules; (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Callie's total income tax liability INDIVIDUAL TAX RATES Married Filing Jointly and Surviving Spouse The tax is If taxable income is Not over $19,400 10% of taxable income Over $19,400 but not over $78,950 S1,9400012% of excess over $19,400 Over $78,950 but not over $168.400 $9,086.00+22% of excess over $78,950 Over $168.400 but not over S321450 $28,765.00 +24% of excess over $168.400 Over $321.450 but not over S408.200 S65,497.00 +32% of excess over $321.450 Over $408.200 but not over S612.350 $93,257.00+35% of excess oer $408.200 S164.709.50 37% of excess over $612.350 Over S612.350 Married Filing Separately The tax is If taxable income is Not over $9,700 J0% of texable income Over $9,700 but not over $39,475 $970.00 12% of ccess over S9,700 Over $39,475 but not over $81,200 $1.543.00 22% of encess over $39,475 Over $84,200 but not over $160,725 S14,382 50+24 of excess over $81.200 Oer $160.725 but not over $204,100 $32,713.50+32% of excess oer $160.725 $16,623.50+35% of excss over $201,.100 Orer $201,100 but not over $306.175 $82,354.75+37% of excess over $306.175 Over $306.175 Heads of Household If Nable ince is The ax is Nol ver S13.830 12% feress over S13,80 Over S13,850 l not aver SR0 S1 38500 S6060072% of eress nver S580 Oer S280 ht not over S84,00 Oer S84 200 bl not aver S160, 00 S12.962.004% of excess ver $84.200 S1.22.0032 ol ecess ver $160,/00 Oher $160,/00 bat aot over $04, 100 $43.210.0033g of escess aver $/04,100 Oer S204.100 but at over 5510300 37% ofescs ver 5510,300 Oer S510,300 $132-380.D0 Single The tax is If taxable income s Not over $9,700 10% of tatable income Over $9,700 but not over $39,475 S970.00 12% of excess over $9,700 $1543.00 22% of cxcess over $39,475 Over $39,475 but not over $84,200 Over $84,200 but not over S160,725 S14,382.50+21% of excess over $84.200 Over $160,725 but not over $204,100 $32.48.50+32% of excess over $160,725 S46.628.50+35% of excess over $201,100 Over $204,100 but not over $510,300 Over $510.300 $13.798.50+37% of excess over $510,300 ESTATE AND TRUST TAX RATES If taxable inconse is The tax is Not over S2,600 10% of taxable income Over $2,600 nor over $9,300 S260+24% of the escess over S2.600 Over $9.300 nor over S12.750 SI,86835% of the excess over $9.300 Over S12,750 S3,075.50+37% of the excess over S12,750