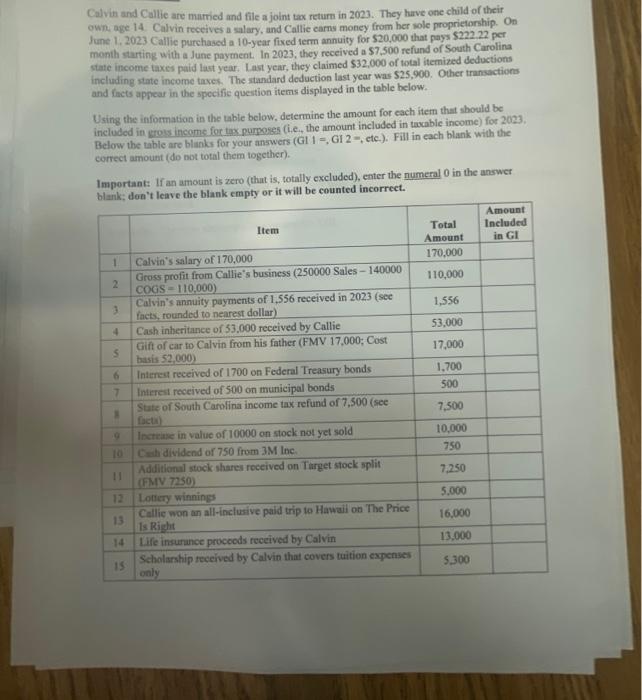

Calvin and Callie are married and file a joint tax return in 2023. They have one child of their own, age 14. Calvin treeives a salary, and Callie earns money from her sole proprietorship. On June 1.2023 Callie purchased a 10-year fixed ierm annuity for $20,000 that pays $222.22 per month starting with a June payment. In 2023, they received a \$7,500 refund of South Carolina state income taxes paid last year. Last year, they claimed $32,000 of total itemized deductions including state income taxes. The standard deduction last year was $25,900. Other transactions and facts appear in the specific question items displayed in the table below. Using the information in the table below, determine the amount for each item that should be included in gross incoms for tax purposes (i.e., the amount included in taxable income) for 2023. Below the table are blanks for your answers (GI 1=,GI2=, etc.). Fill in each blank with the correct amount (do not total them together). Important: If an amount is zero (that is, totally excluded), enter the numeral 0 in the answer blank; dea't leave the blank empty or it will be counted incorreet. Calvin and Callie are married and file a joint tax return in 2023. They have one child of their own, age 14. Calvin treeives a salary, and Callie earns money from her sole proprietorship. On June 1.2023 Callie purchased a 10-year fixed ierm annuity for $20,000 that pays $222.22 per month starting with a June payment. In 2023, they received a \$7,500 refund of South Carolina state income taxes paid last year. Last year, they claimed $32,000 of total itemized deductions including state income taxes. The standard deduction last year was $25,900. Other transactions and facts appear in the specific question items displayed in the table below. Using the information in the table below, determine the amount for each item that should be included in gross incoms for tax purposes (i.e., the amount included in taxable income) for 2023. Below the table are blanks for your answers (GI 1=,GI2=, etc.). Fill in each blank with the correct amount (do not total them together). Important: If an amount is zero (that is, totally excluded), enter the numeral 0 in the answer blank; dea't leave the blank empty or it will be counted incorreet