Question

Cam and Anna are very satisfied with their first month of operations. Their major effort centered on signing various artists to live performance contracts, and

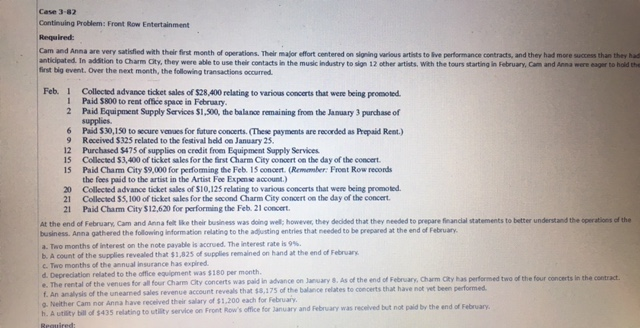

Cam and Anna are very satisfied with their first month of operations. Their major effort centered on signing various artists to live performance contracts, and they had more success than they had anticipated. In addition to Charm City, they were able to use their contacts in the music industry to sign 12 other artists. With the tours starting in February, Cam and Anna were eager to hold their first big event. Over the next month, the following transactions occurred.

At the end of February, Cam and Anna felt like their business was doing well; however, they decided that they needed to prepare financial statements to better understand the operations of the business. Anna gathered the following information relating to the adjusting entries that needed to be prepared at the end of February.

Two months of interest on the note payable is accrued. The interest rate is 9%.

A count of the supplies revealed that $1,825 of supplies remained on hand at the end of February.

Two months of the annual insurance has expired.

Depreciation related to the office equipment was $180 per month.

The rental of the venues for all four Charm City concerts was paid in advance on January 8. As of the end of February, Charm City has performed two of the four concerts in the contract.

An analysis of the unearned sales revenue account reveals that $8,175 of the balance relates to concerts that have not yet been performed.

Neither Cam nor Anna have received their salary of $1,200 each for February.

A utility bill of $435 relating to utility service on Front Row's office for January and February was received but not paid by the end of February.

1. Analyze and journalize the February transactions.

2.Front Row Entertainment Inc. had the following list of account balances on February 1, 2013:

| Cash | $14,100 |

| Accounts Receivable | 400 |

| Supplies | 2,500 |

| Prepaid Insurance | 3,600 |

| Prepaid Rent | 10,000 |

| Equipment | 7,000 |

| Accounts Payable | 1,500 |

| Unearned Sales Revenue | 3,800 |

| Notes Payable | 25,000 |

| Common Stock | 16,000 |

| Sales Revenue | 1,000 |

| Artist Fee Expense | 800 |

| Rent Expense | 800 |

| Salaries Expense | 2,400 |

| Advertising Expense | 4,500 |

| Legal Expense | 1,200 |

3. Prepare a trial balance at February 28, 2013. If an amount box does not require an entry, leave it blank. List all accounts in the order of assets, liabilities, stockholders equity, revenues, and expenses.

4. Prepare the adjusting entries needed at February 28, 2013.

5. By how much would net income be overstated or understated if the adjusting entries were not made?

Net income would have been

6a. Prepare an income statement for the 2-month period ending February 28, 2013.

6b. Prepare a retained earnings statement for the 2-month period ending February 28, 2013. If an amount is zero, enter "0"

6C. Prepare a classified balance sheet as of February 28, 2013.

7. Prepare the necessary closing entries. If an amount box does not require an entry, leave it blank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started