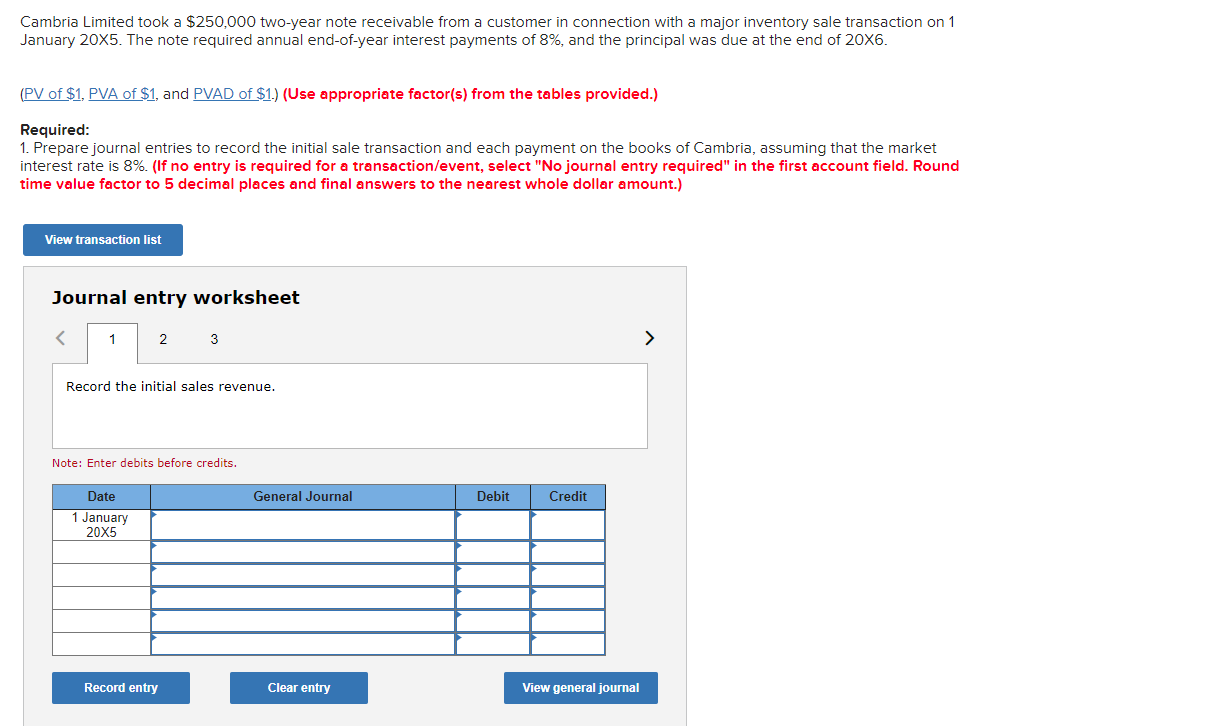

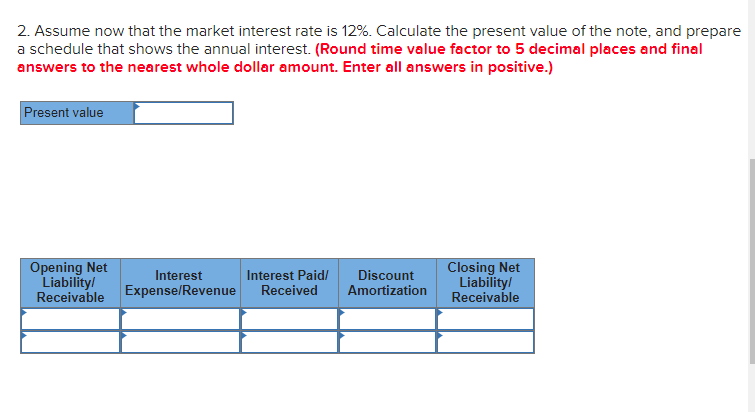

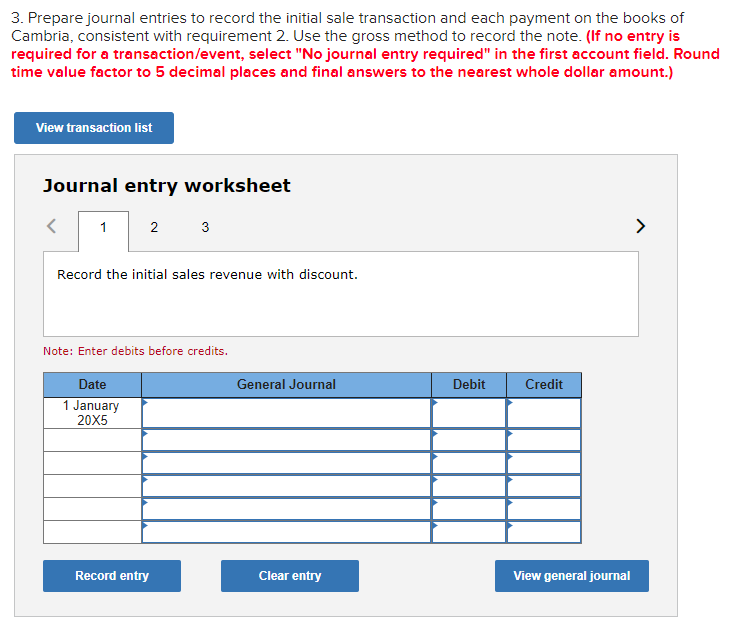

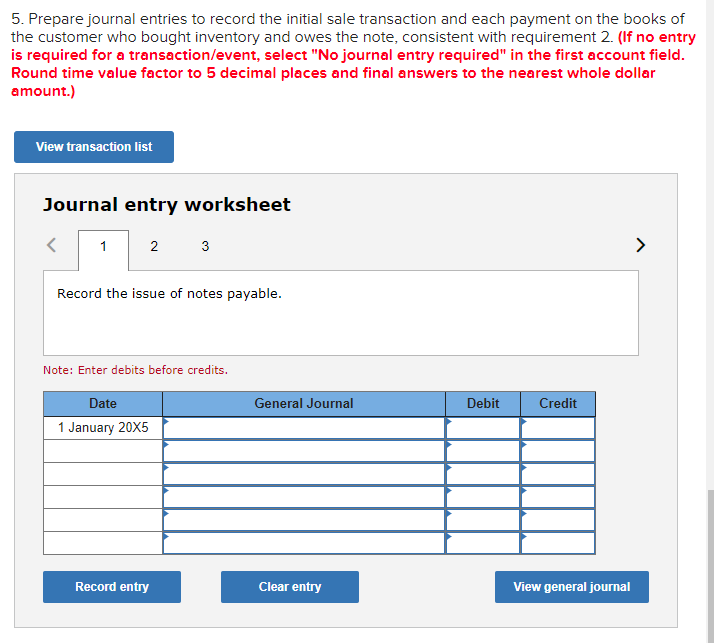

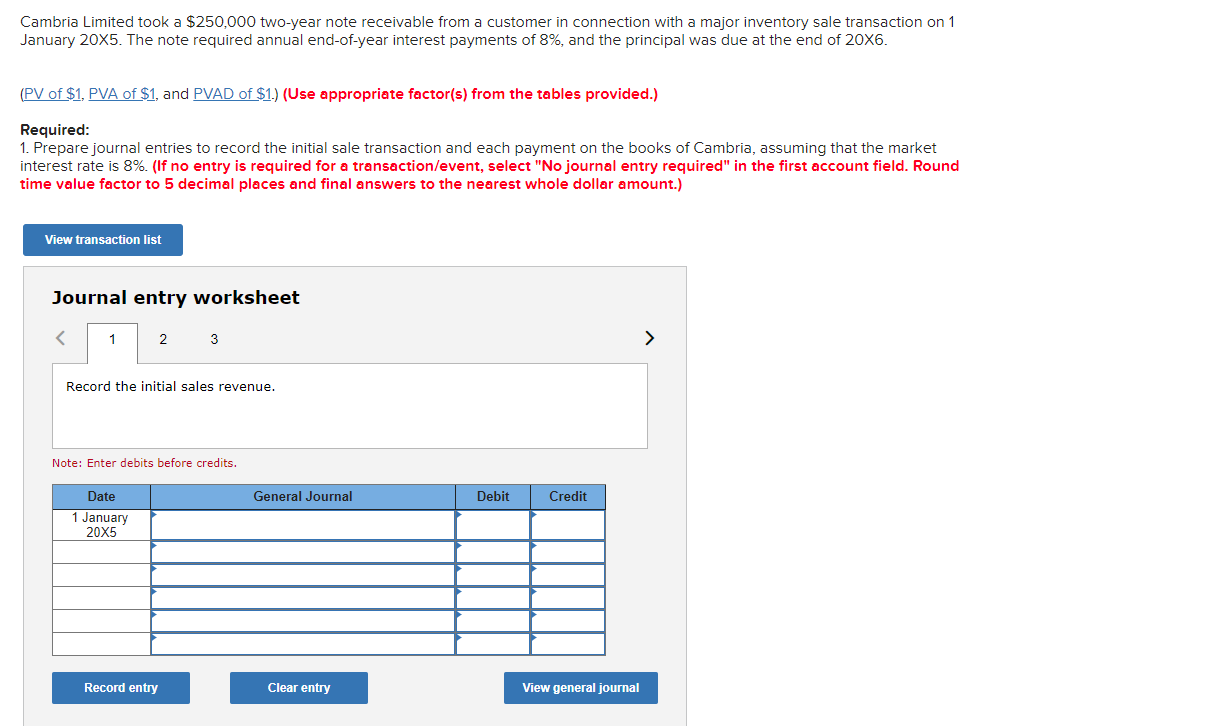

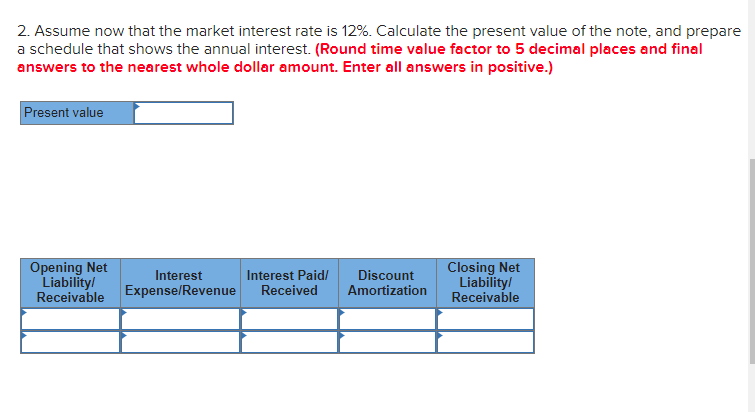

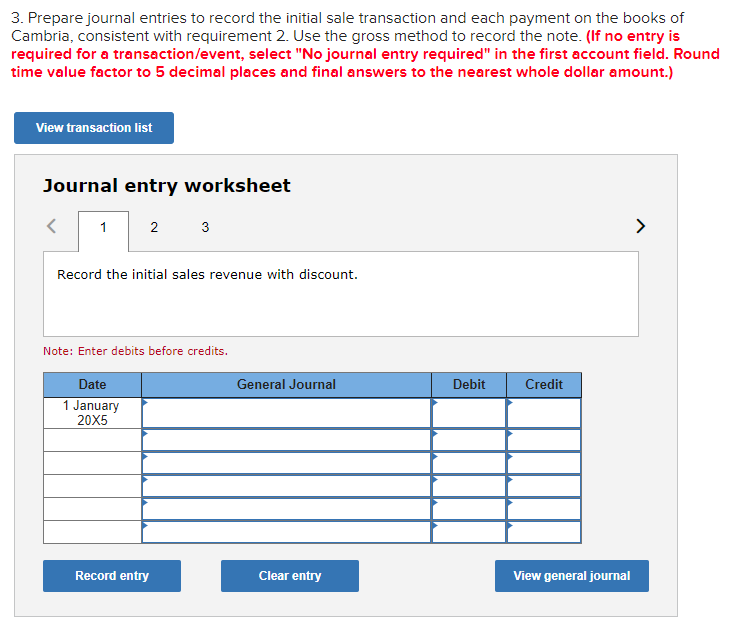

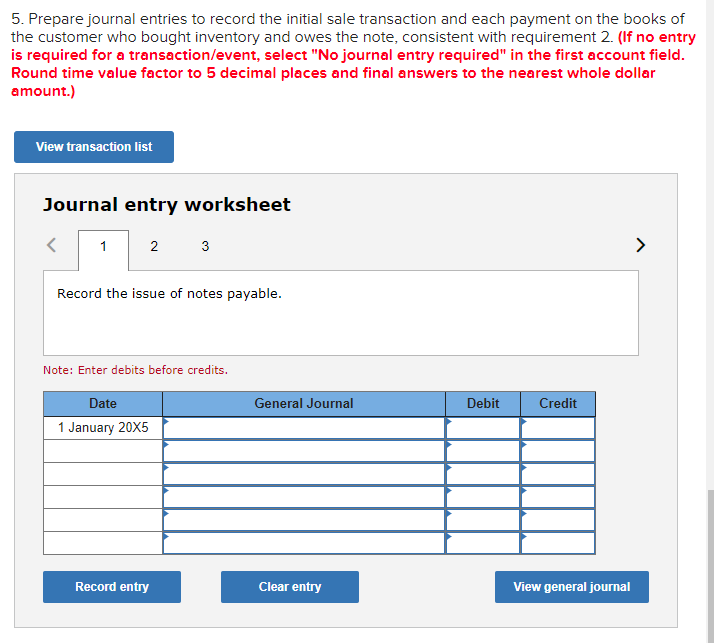

Cambria Limited took a $250,000 two-year note receivable from a customer in connection with a major inventory sale transaction on 1 January 20X5. The note required annual end-of-year interest payments of 8%, and the principal was due at the end of 20X6. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare journal entries to record the initial sale transaction and each payment on the books of Cambria, assuming that the market interest rate is 8%. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round time value factor to 5 decimal places and final answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the initial sales revenue. Enter before credits. General Journal Debit Credit Date 1 January 20X5 Record entry Clear entry View general journal 2. Assume now that the market interest rate is 12%. Calculate the present value of the note, and prepare a schedule that shows the annual interest. (Round time value factor to 5 decimal places and final answers to the nearest whole dollar amount. Enter all answers in positive.) Present value Opening Net Liability Receivable Interest Expense/Revenue Interest Paid/ Received Discount Amortization Closing Net Liability Receivable 3. Prepare journal entries to record the initial sale transaction and each payment on the books of Cambria, consistent with requirement 2. Use the gross method to record the note. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round time value factor to 5 decimal places and final answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record the initial sales revenue with discount. Note: Enter debits before credits. General Journal Debit Credit Date 1 January 20X5 Record entry Clear entry View general journal 5. Prepare journal entries to record the initial sale transaction and each payment on the books of the customer who bought inventory and owes the note, consistent with requirement 2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round time value factor to 5 decimal places and final answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 1 2 3 3 > Record the issue of notes payable. Note: Enter debits before credits. General Journal Debit Credit Date 1 January 20X5 Record entry Clear entry View general journal