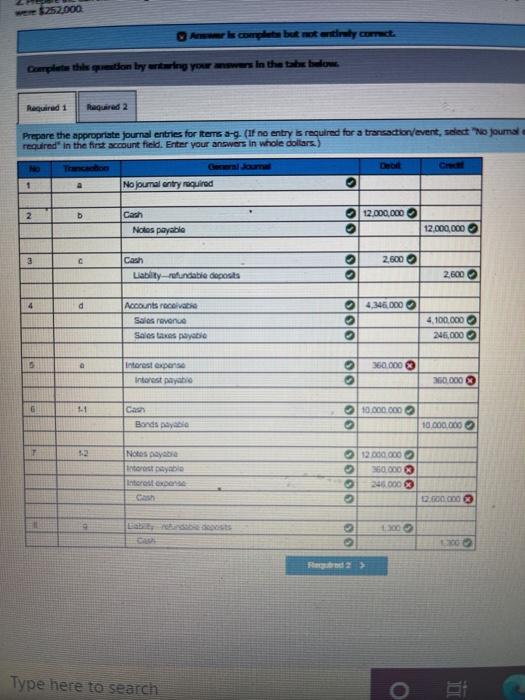

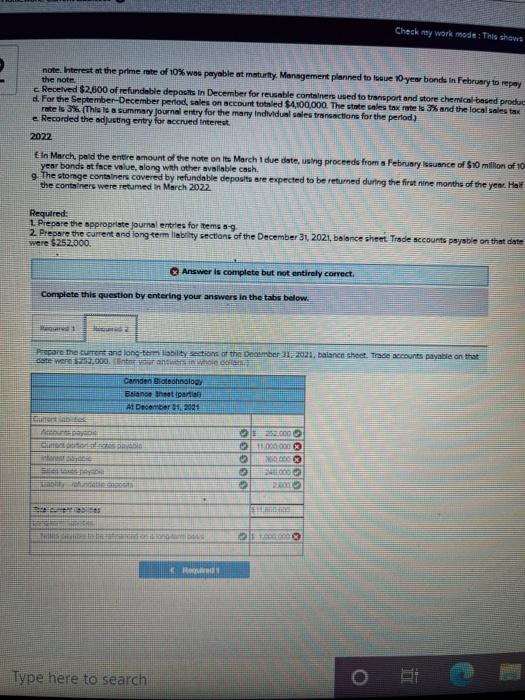

Camden Biotechnology began operations in September 2021. The following selected transactions relate to abides of the company for September 2021 through March 2022 Camden's fiscal year ends on December 31 ks financial statements are sted in April 2021 On September 5, opened checking accounts at Second Commercial Bank and negotiated a short-term line of credit of up to $15,000,000 st the bank's prime rate (10.5% at the time. The company will pay no commitment fees. b. On October l borrowed $12 million cash from Second Commercial Bank under the line of credit and Issued a five-month promissory note. Interest at the prime rate of 10% was payable at maturity Management planned to sue 10-year bonds In February to repay the note c. Received $2.600 of refundable deposits in December for reusable containers used to transport and store chemical-based products d. For the September-December period, sales on account totaled $4100,000. The state sales tax rate and the local sales tax rate is 3. (This is a summary Journal entry for the many individual sales transactions for the period.) Recorded the adjusting entry for accrued interest 2022 la March, paid the entire amount of the note on its March 1 due date, using proceeds from a February louance of $10 million of 10- yeni bonds et fece vue, along with other available cash 9. The storage containers covered by refundable deposits are expected to be returned during the first nine months of the year wall of the containers were returned in March 2022 Required 1 Precere the propriate jour etres forms 2 Drepore the content and angebrity sections on December 312021, bance sheet Trade sccounts payable on that date a $252.000 Answer is complete but not entirely correct Complete this question by entering your answers in the tabs below O jou Debit Credit OS GO Type here to search O were $252000 A couple but notwy correct. Complete the only ring your in the tablo Required 1 Required 2 Prepare the appropriate journal entries for tems -9. (If no entry is required for a transaction/event, select No journal required in the first account field. Enter your answers in whole dollars) Gemljama No journal entry required 1 2 D 12.000.000 Cash Notos payable olol 12.000.000 2.600 Cash Liability-refundable deposits OO 2.600 4 d 4,346.000 Accounts receiv Sales revenue Sales taxes pel OOO 4.100.000 245,000 350.000 Interest expense Interest payable OO 360.000 G 10.000.000 Casa Bonds payable lolol 10.000.000 T 12 Notes lolololo 12.000.000 360.000 245.000 Intratto 2.000.000 100 Type here to search Check my work mode: This shows note. Interest at the prime mte of 10% was payable at maturity Management planned to love 10 year bonds in February to repay the note Received $2,600 of refundable deposits in December for reusable containers used to transport and store chemical based produe d. For the September-December period, sales on account totaled $4,100,000. The state sales tax rates 3% and the local sales tax rate le 3%. Thiu is a summary journal entry for the many Individual sales transactions for the period) e Recorded the adjusting entry for accrued interest 2022 In March, paid the entire amount of the note on its March 1 due date, using proceeds from a February Issuance of $10 million of 10 year bonds at face value, along with other available cash. 9 The stomge containers covered by refundable deposits are expected to be returned during the first nine months of the year. Half the containers were retumed in March 2022 Required 1 Prepare the appropriate journal entries for items a- 2. Prepare the current and long term liability sections of the December 31, 2021, balance sheet Trade sccounts payable on that date were $252.000 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below are the current and long-term ability section of the nomber 11, 2021, balance sheet. Trade accounts payable on that te wen 253,000. Eta Camden Biotechnology Be their Al December 2007 Citate 2200 Son P1000000 MAGERE GOGO El R Type here to search