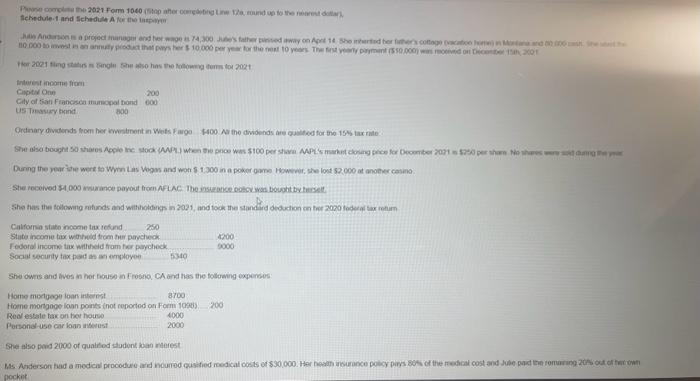

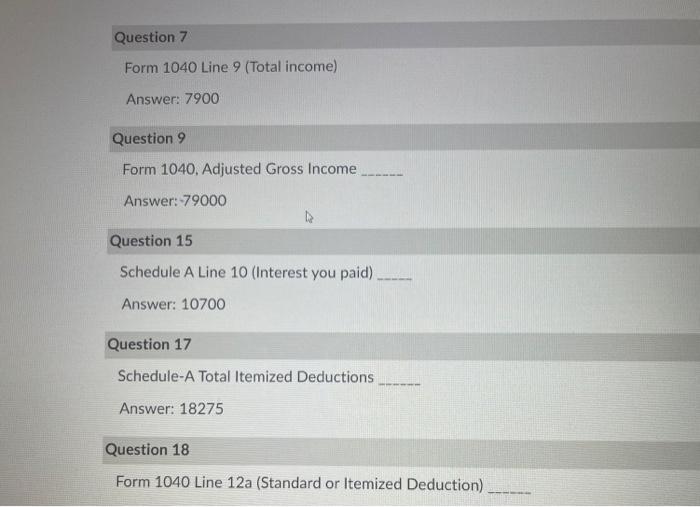

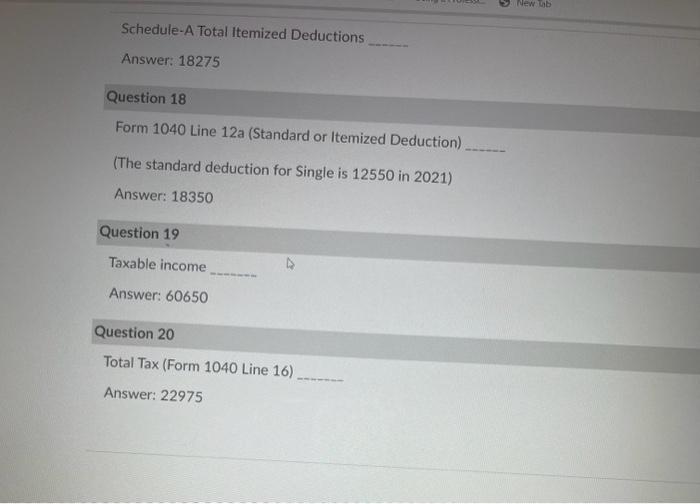

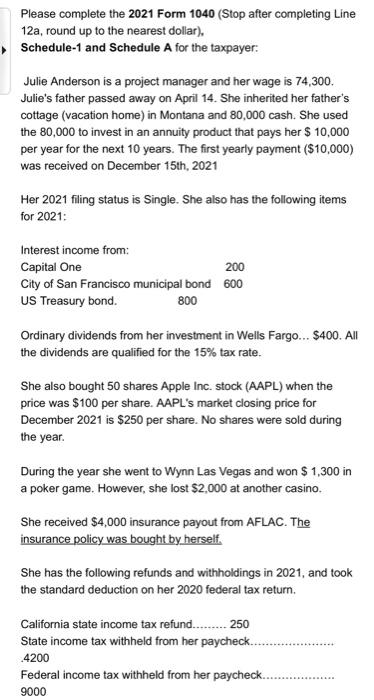

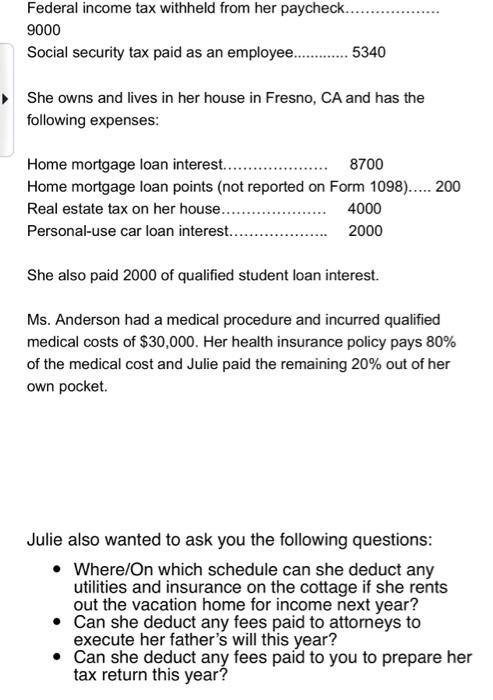

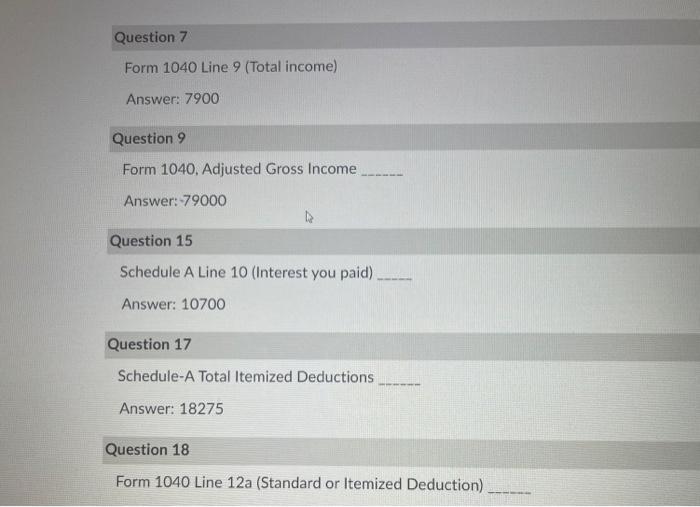

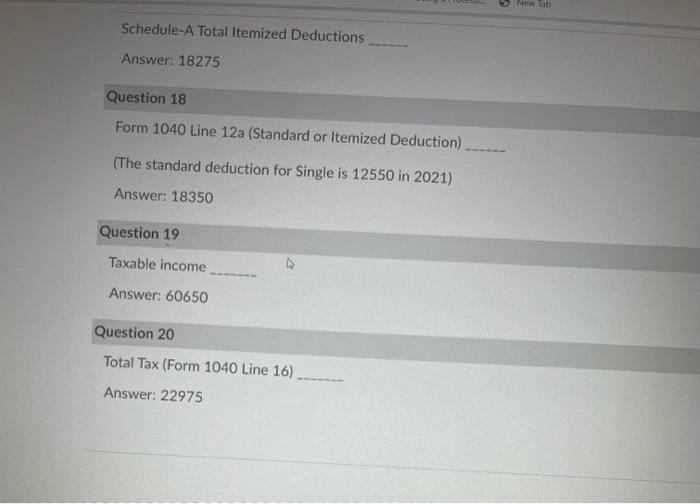

During the your the wore to Whin Las Vogss and won 51,300 in a poher ormo kowwer, the lont 52.000 at anoever casino. sho owrs and dues in her frouse in frosio, CA ond has the folowing oxperses: She also poid 2000 of qualifod thodent loan marest Question 7 Form 1040 Line 9 (Total income) Answer: 7900 Question 9 Form 1040, Adjusted Gross Income Answer: 79000 Question 15 Schedule A Line 10 (Interest you paid) Answer: 10700 Question 17 Schedule-A Total Itemized Deductions Answer: 18275 Question 18 Question 18 Form 1040 Line 12 a (Standard or Itemized Deduction) (The standard deduction for Single is 12550 in 2021) Answer: 18350 Please complete the 2021 Form 1040 (Stop after completing Line 12a, round up to the nearest dollar), Schedule-1 and Schedule A for the taxpayer: Julie Anderson is a project manager and her wage is 74,300 . Julie's father passed away on April 14. She inherited her father's cottage (vacation home) in Montana and 80,000 cash. She used the 80,000 to invest in an annuity product that pays her $10,000 per year for the next 10 years. The first yearly payment ($10,000) was received on December 15 th, 2021 Her 2021 filing status is Single. She also has the following items for 2021: Ordinary dividends from her investment in Wells Fargo... \$400. All the dividends are qualified for the 15% tax rate. She also bought 50 shares Apple Inc. stock (AAPL) when the price was $100 per share. AAPL's market closing price for December 2021 is $250 per share. No shares were sold during the year. During the year she went to Wynn Las Vegas and won $1,300 in a poker game. However, she lost $2,000 at another casino. She received $4,000 insurance payout from AFLAC. The insurance policy was bought by herself. She has the following refunds and withholdings in 2021, and took the standard deduction on her 2020 federal tax return. California state income tax refund......... 250 State income tax withheld from her paycheck. .4200 Federal income tax withheld from her paycheck. 9000 Federal income tax withheld from her paycheck. 9000 Social security tax paid as an employee. 5340 She owns and lives in her house in Fresno, CA and has the following expenses: She also paid 2000 of qualified student loan interest. Ms. Anderson had a medical procedure and incurred qualified medical costs of $30,000. Her health insurance policy pays 80% of the medical cost and Julie paid the remaining 20% out of her own pocket. Julie also wanted to ask you the following questions: - Where/On which schedule can she deduct any utilities and insurance on the cottage if she rents out the vacation home for income next year? - Can she deduct any fees paid to attorneys to execute her father's will this year? - Can she deduct any fees paid to you to prepare her tax return this year? Question 7 Form 1040 Line 9 (Total income) Answer: 7900 Question 9 Form 1040, Adjusted Gross Income Answer: 79000 Question 15 Schedule A Line 10 (Interest you paid) Answer: 10700 Question 17 Schedule-A Total Itemized Deductions Answer: 18275 Question 18 Question 18 Form 1040 Line 12 a (Standard or Itemized Deduction) (The standard deduction for Single is 12550 in 2021) Answer: 18350 During the your the wore to Whin Las Vogss and won 51,300 in a poher ormo kowwer, the lont 52.000 at anoever casino. sho owrs and dues in her frouse in frosio, CA ond has the folowing oxperses: She also poid 2000 of qualifod thodent loan marest Question 7 Form 1040 Line 9 (Total income) Answer: 7900 Question 9 Form 1040, Adjusted Gross Income Answer: 79000 Question 15 Schedule A Line 10 (Interest you paid) Answer: 10700 Question 17 Schedule-A Total Itemized Deductions Answer: 18275 Question 18 Question 18 Form 1040 Line 12 a (Standard or Itemized Deduction) (The standard deduction for Single is 12550 in 2021) Answer: 18350 Please complete the 2021 Form 1040 (Stop after completing Line 12a, round up to the nearest dollar), Schedule-1 and Schedule A for the taxpayer: Julie Anderson is a project manager and her wage is 74,300 . Julie's father passed away on April 14. She inherited her father's cottage (vacation home) in Montana and 80,000 cash. She used the 80,000 to invest in an annuity product that pays her $10,000 per year for the next 10 years. The first yearly payment ($10,000) was received on December 15 th, 2021 Her 2021 filing status is Single. She also has the following items for 2021: Ordinary dividends from her investment in Wells Fargo... \$400. All the dividends are qualified for the 15% tax rate. She also bought 50 shares Apple Inc. stock (AAPL) when the price was $100 per share. AAPL's market closing price for December 2021 is $250 per share. No shares were sold during the year. During the year she went to Wynn Las Vegas and won $1,300 in a poker game. However, she lost $2,000 at another casino. She received $4,000 insurance payout from AFLAC. The insurance policy was bought by herself. She has the following refunds and withholdings in 2021, and took the standard deduction on her 2020 federal tax return. California state income tax refund......... 250 State income tax withheld from her paycheck. .4200 Federal income tax withheld from her paycheck. 9000 Federal income tax withheld from her paycheck. 9000 Social security tax paid as an employee. 5340 She owns and lives in her house in Fresno, CA and has the following expenses: She also paid 2000 of qualified student loan interest. Ms. Anderson had a medical procedure and incurred qualified medical costs of $30,000. Her health insurance policy pays 80% of the medical cost and Julie paid the remaining 20% out of her own pocket. Julie also wanted to ask you the following questions: - Where/On which schedule can she deduct any utilities and insurance on the cottage if she rents out the vacation home for income next year? - Can she deduct any fees paid to attorneys to execute her father's will this year? - Can she deduct any fees paid to you to prepare her tax return this year? Question 7 Form 1040 Line 9 (Total income) Answer: 7900 Question 9 Form 1040, Adjusted Gross Income Answer: 79000 Question 15 Schedule A Line 10 (Interest you paid) Answer: 10700 Question 17 Schedule-A Total Itemized Deductions Answer: 18275 Question 18 Question 18 Form 1040 Line 12 a (Standard or Itemized Deduction) (The standard deduction for Single is 12550 in 2021) Answer: 18350