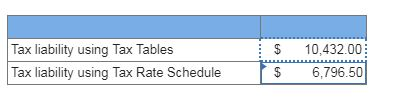

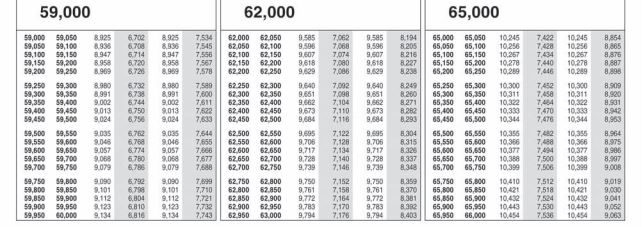

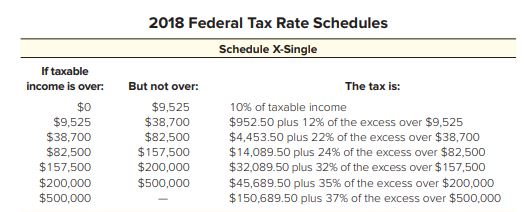

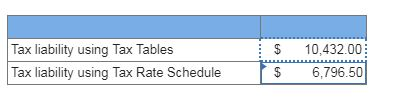

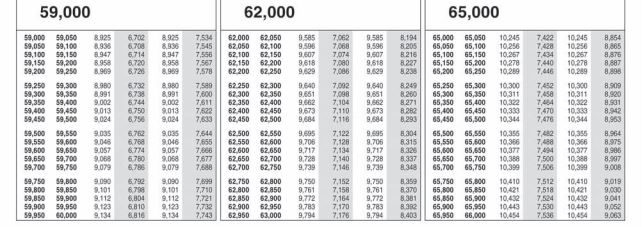

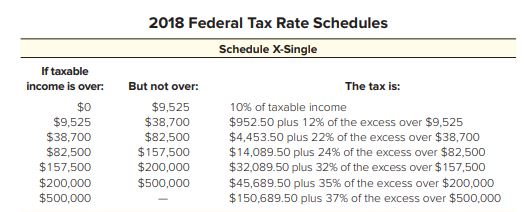

Cameron is single and has taxable income of $65,886. Determine his tax liability using the tax tables and using the tax rate schedules. (Round your intermediate computations and final answers to 2 decimal places.)

S 10,432.00 $ 6,796.50 Tax liability using Tax Tables Tax liability using Tax Rate Schedule 59,000 62,000 65,000 9,000 9,050 925 67 8925 7,534 62.000 62.050 9585 7062 9585 8194 65,000 65,050 10.245 7422 10,245 8.854 59,050 59,100 893870 ,938 7,545 62,050 62,100 9598 7068 9,596 8205 65,050 65,100 10256 7428 10,256 8,865 59,100 $9,150 .947 6,714 8.947 , 7,556 | | 62100 62,150 9.607 7,074 9.607 8216 | | 65,100 65,150 10.267 7,434 10267 8876 59,150 59,200 958 6728,958 75762,150 62,200 18 78809818 8227 65,150 65,200 10,278 74 102788,887 s9,200 59,250 9 6,726 8.909 7,578 | | 62.200 62.250 9.629 7,086 9.29 8238 | | 65.20065250 102e9 7,446 10.289 8898 59,25059.30 6,732 8,980 7,589 | | 62.250 62.300 9.640 7,092 9,640 8249 | | 65,250 65.300 10.300 7A52 8509 7458 1031 8,920 ,350 9,400 9.002 744 9,002 711 2.350 62,40D 962 7,04 . 82716,30 65,400 03227,484 10.322 8.93 59,400 59,450 9013509013 7562400 2450 973 710 9.673 8.28265,400 65,450 10333 7470 10,333 8942 59,450 9,500 .024 6 ,024 7,633 62450 .500 4 9.6848293 65,450 65,500 10,344 7,476 10,344 8963 59,300 59,350 99 673 8,99 7,600 62.300 62.350 9.651 7.098 9.851 8260 65,300 65,350 10.311 59,500 sasso a0as 6,762 9.035 7844 | | 62.500 62550 9695 7,122 9695 8.304 65,500 65550 10.355 7,482 10,355 8.964 9,550 59,600 06.7680765562550 62,600 970 7,1 9.706 8.315 65,550 65,600 10366 7488 10,366 8975 59,500 S9,650 2.057 6.774 9.057 7,00 ! 62.600 62.650 9,717 | 7,134 9.717 8326 | | 65.600 6SAS0 10,377 7,494 10.377 8996 ,650 9,700 9068 67 9068 767762650 62,700 9,728 7,1409,728 8337 65,650 65,700 10,388 7,500 1038 8,907 59,700 59,750 09 788 909 7,88 62,700 2750 9,739 7,46 9,739 83486,700 65,750 10399 7,506 0,39 9,008 59.750 S9,809,090 792 9,090 7.6 99 | | 62750 62.800 9750 7,152 9,750 8.359 | | 65.750 65,800 10.410 7,512 10,410 9,019 7,152 9,7508359 65,750 65,800 040 7,512 10,410 9.01 9,800 59,850 9101 678 0 7710 62800 62.850 9,761 7,158 9,76 8370 65,800 65,80 10421 7,58 10421 9030 9,850 9,900 1 804 17,721 62.850 290 9,7727,1649,72838165,850 65,900 10,432 7,52410432 9.041 ,900 9,950 123 6810 123 7,7362.900 62.950 9,783 7,170 9,783 8302 65,900 65,950 10443 7,530 10443 902 59,950 60,000 34 8816 134 7.743 62960 6 9.7947176 9.794 8403 0 66,00010454 7,53 10454 9,063 2018 Federal Tax Rate Schedules Schedule X-Single If taxable income is over: The tax is: But not over: $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 $0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 10% of taxable income $952.50 plus 12% of the excess over $9,525 $4,453.50 plus 22% of the excess over $38,700 $14,089.50 plus 24% of the excess over $82,500 $32,089.50 plus 32% of the excess over $ 1 57,500 $45,689.50 plus 35% of the excess over $200,000 $150,689.50 plus 37% of the excess over $500,000