Answered step by step

Verified Expert Solution

Question

1 Approved Answer

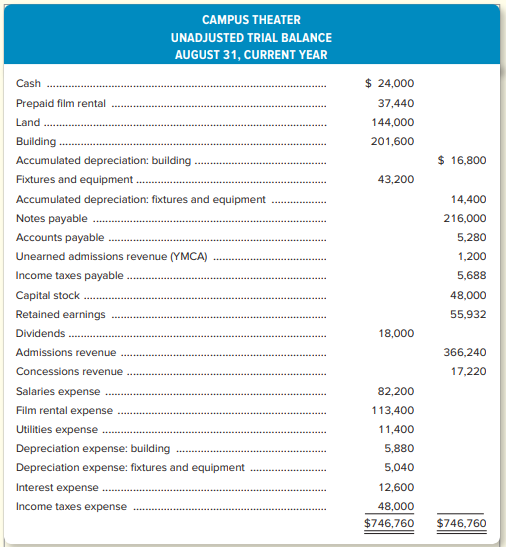

Campus Theater adjusts its accounts every month. The companys unadjusted trial balance dated August 31, current year, appears as follows. Additional information is provided for

Campus Theater adjusts its accounts every month. The companys unadjusted trial balance dated August 31, current year, appears as follows. Additional information is provided for use in preparing the companys adjusting entries for the month of August. (Bear in mind that adjusting entries have already been made for the first seven months of current year, but not for August.)

Need all of these questions answered!! Please and thank you!!

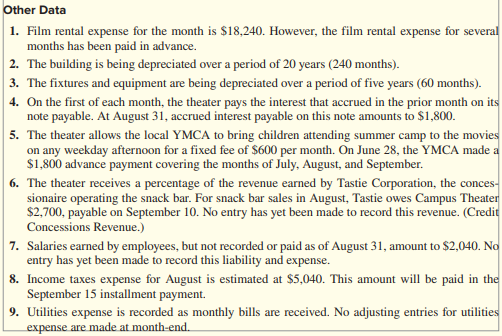

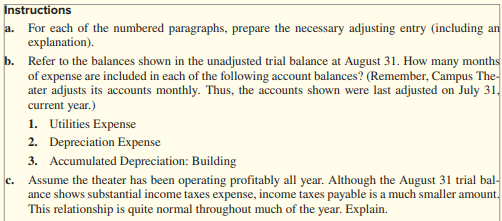

CAMPUS THEATER UNADJUSTED TRIAL BALANCE AUGUST 31, CURRENT YEAR Cash Prepaid film rental Land Building $24,000 37,440 144,000 201,600 Accumulated depreciation: building $16,800 Fixtures and equipment 43,200 Accumulated depreciation: fixtures and equipment Notes payable Accounts payable Unearned admissions revenue (YMCA) Income taxes payable Capital stock Retained earnings Dividends Admissions revenue Concessions revenue Salaries expense Film rental expense Utilities expense Depreciation expense: building Depreciation expense: fixtures and equipment Interest expense Income taxes expense \( \underline{\underline{\$ 746,760}} \quad \stackrel{\$ 746,760}{\hline} \) 1. Film rental expense for the month is $18,240. However, the film rental expense for several months has been paid in advance. 2. The building is being depreciated over a period of 20 years ( 240 months). 3. The fixtures and equipment are being depreciated over a period of five years ( 60 months). 4. On the first of each month, the theater pays the interest that accrued in the prior month on its note payable. At August 31, accrued interest payable on this note amounts to $1,800. 5. The theater allows the local YMCA to bring children attending summer camp to the movies on any weekday afternoon for a fixed fee of $600 per month. On June 28, the YMCA made a $1,800 advance payment covering the months of July, August, and September. 6. The theater receives a percentage of the revenue earned by Tastie Corporation, the concessionaire operating the snack bar. For snack bar sales in August, Tastie owes Campus Theater $2,700, payable on September 10 . No entry has yet been made to record this revenue. (Credit Concessions Revenue.) 7. Salaries earned by employees, but not recorded or paid as of August 31, amount to $2,040. No entry has yet been made to record this liability and expense. 8. Income taxes expense for August is estimated at $5,040. This amount will be paid in the September 15 installment payment. 9. Utilities expense is recorded as monthly bills are received. No adjusting entries for utilities expense are made at month-end. a. For each of the numbered paragraphs, prepare the necessary adjusting entry (including an explanation). b. Refer to the balances shown in the unadjusted trial balance at August 31. How many months of expense are included in each of the following account balances? (Remember, Campus Theater adjusts its accounts monthly. Thus, the accounts shown were last adjusted on July 31 , current year.) 1. Utilities Expense 2. Depreciation Expense 3. Accumulated Depreciation: Building c. Assume the theater has been operating profitably all year. Although the August 31 trial balance shows substantial income taxes expense, income taxes payable is a much smaller amount. This relationship is quite normal throughout much of the year. Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started