Please help me out with the answers/ process for part B. Thanks!

Please help me out with the answers/ process for part B. Thanks!

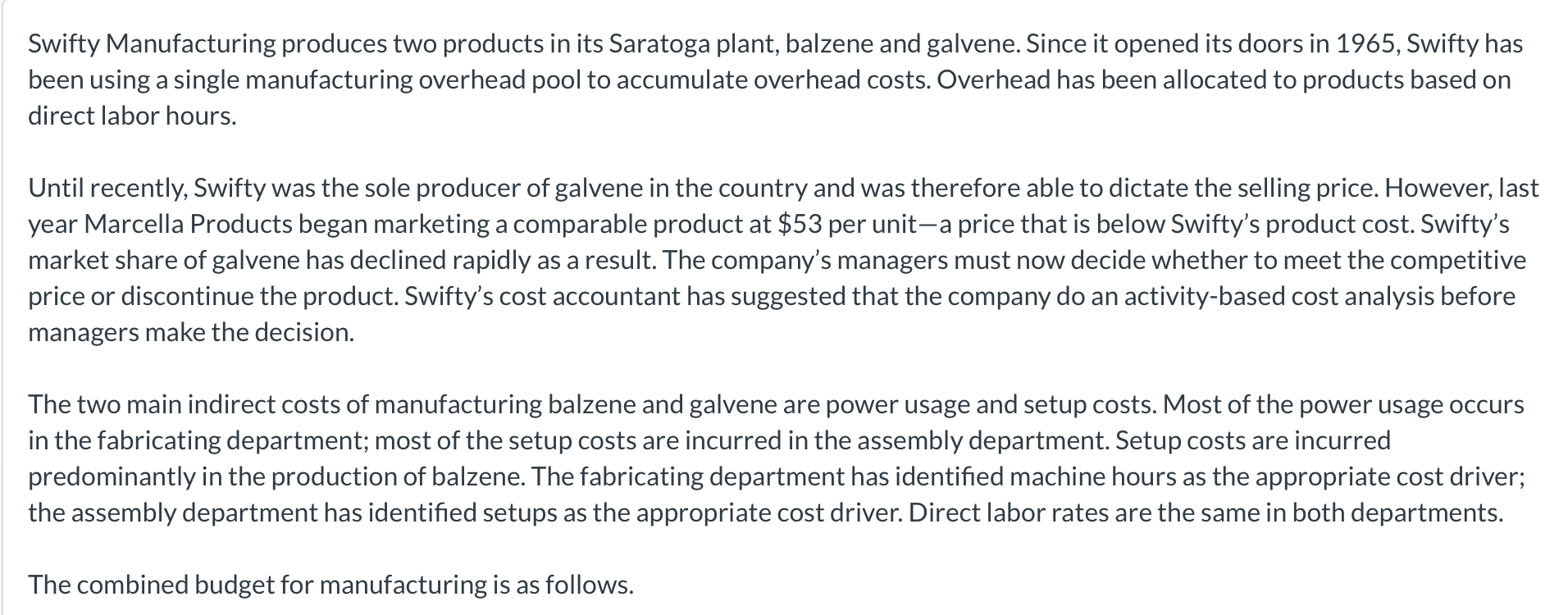

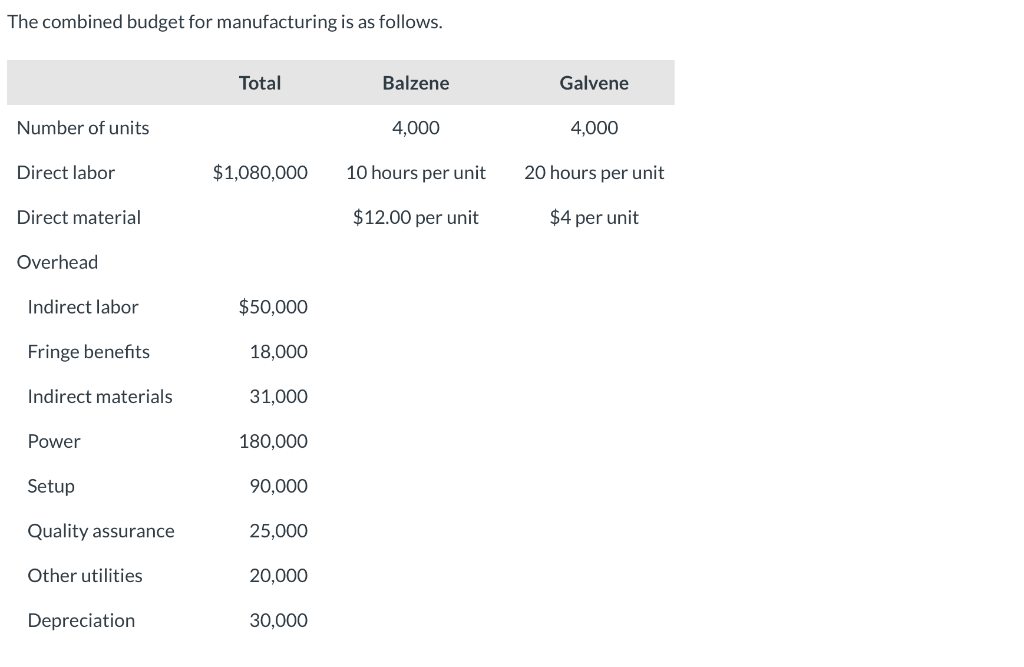

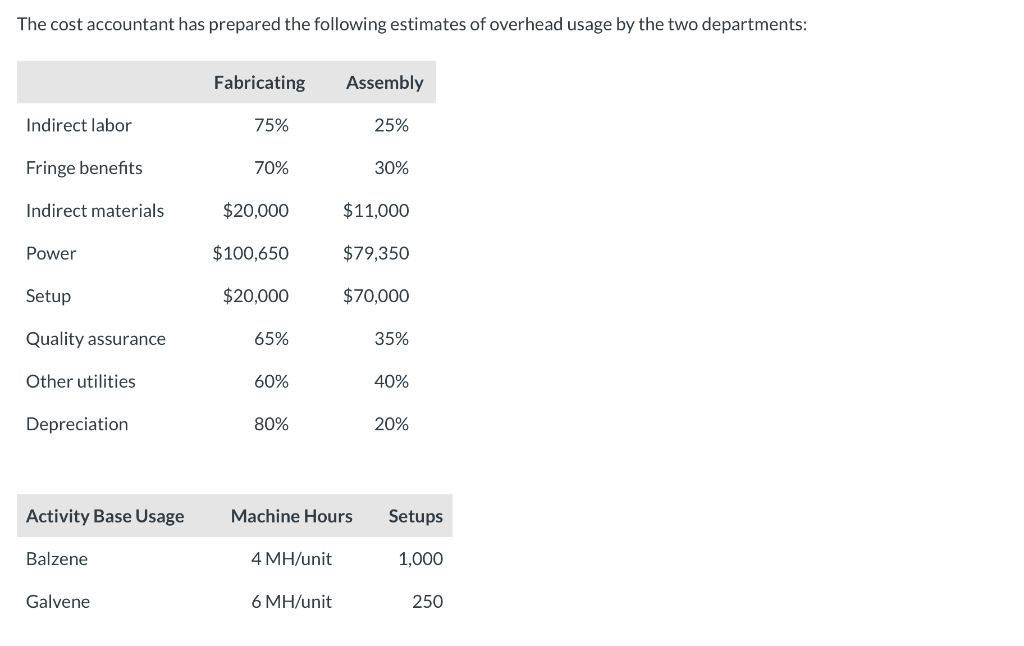

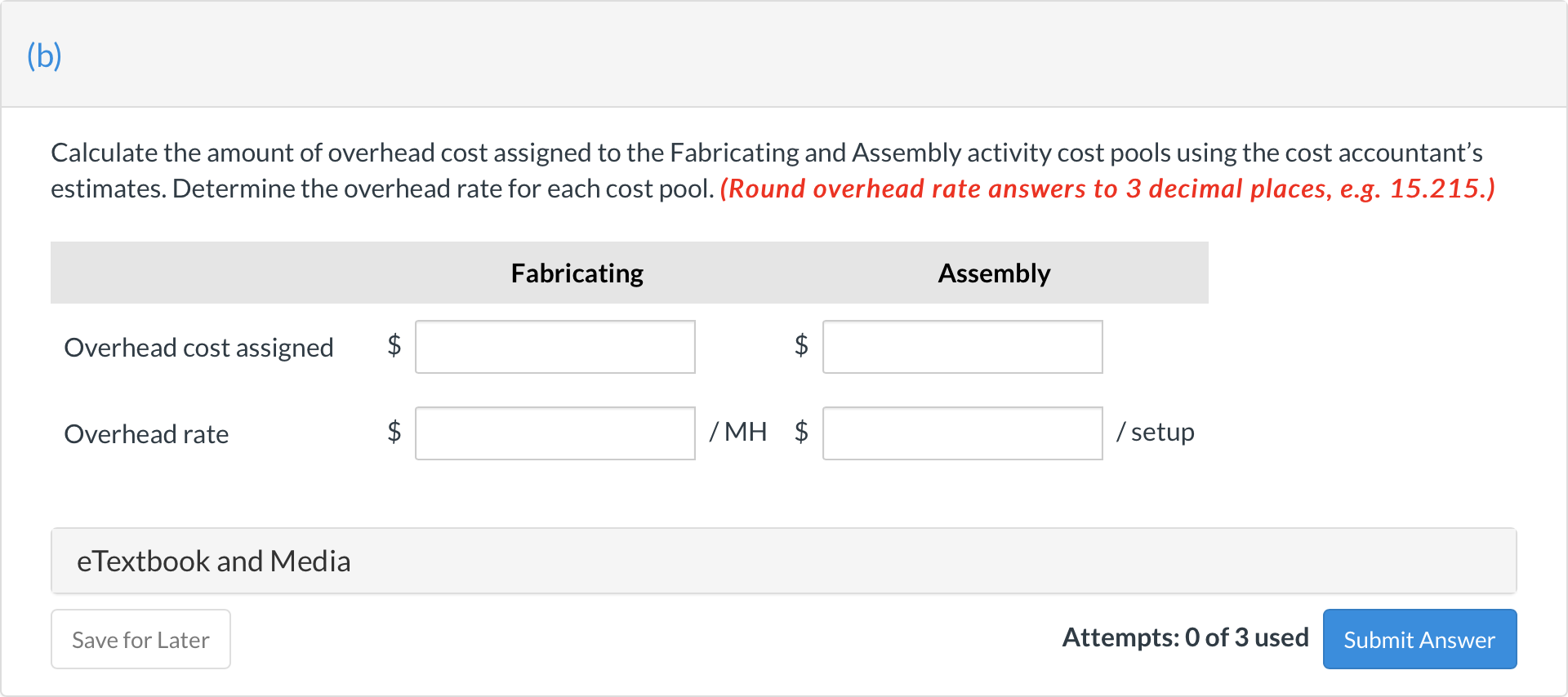

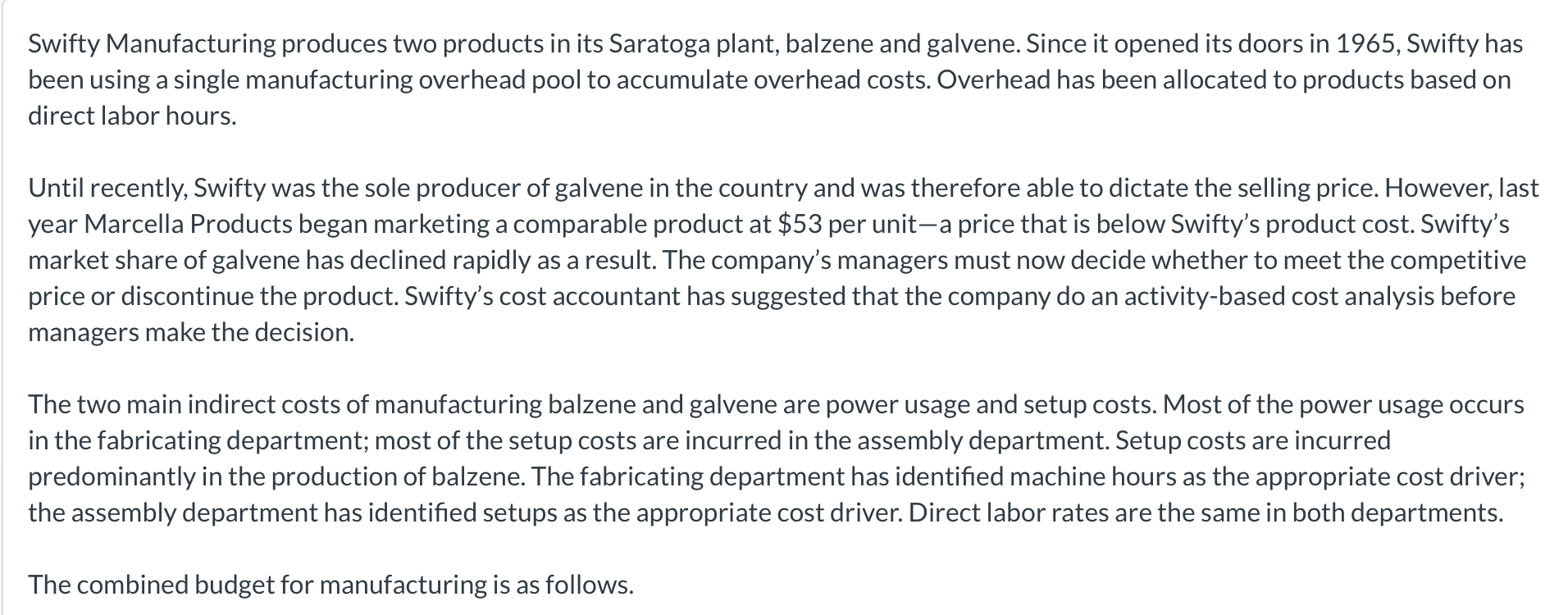

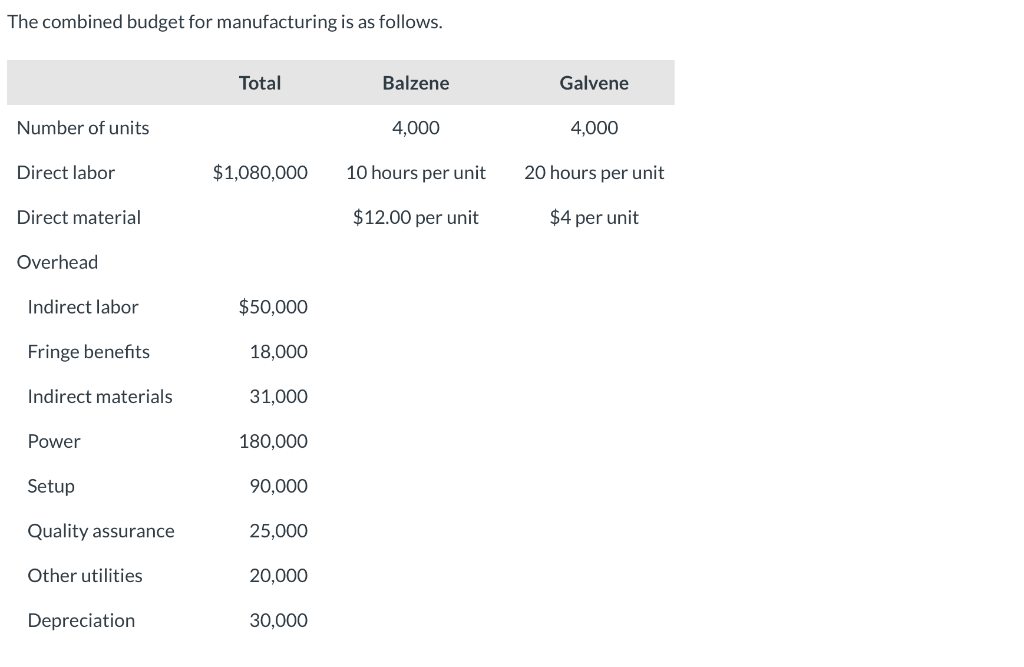

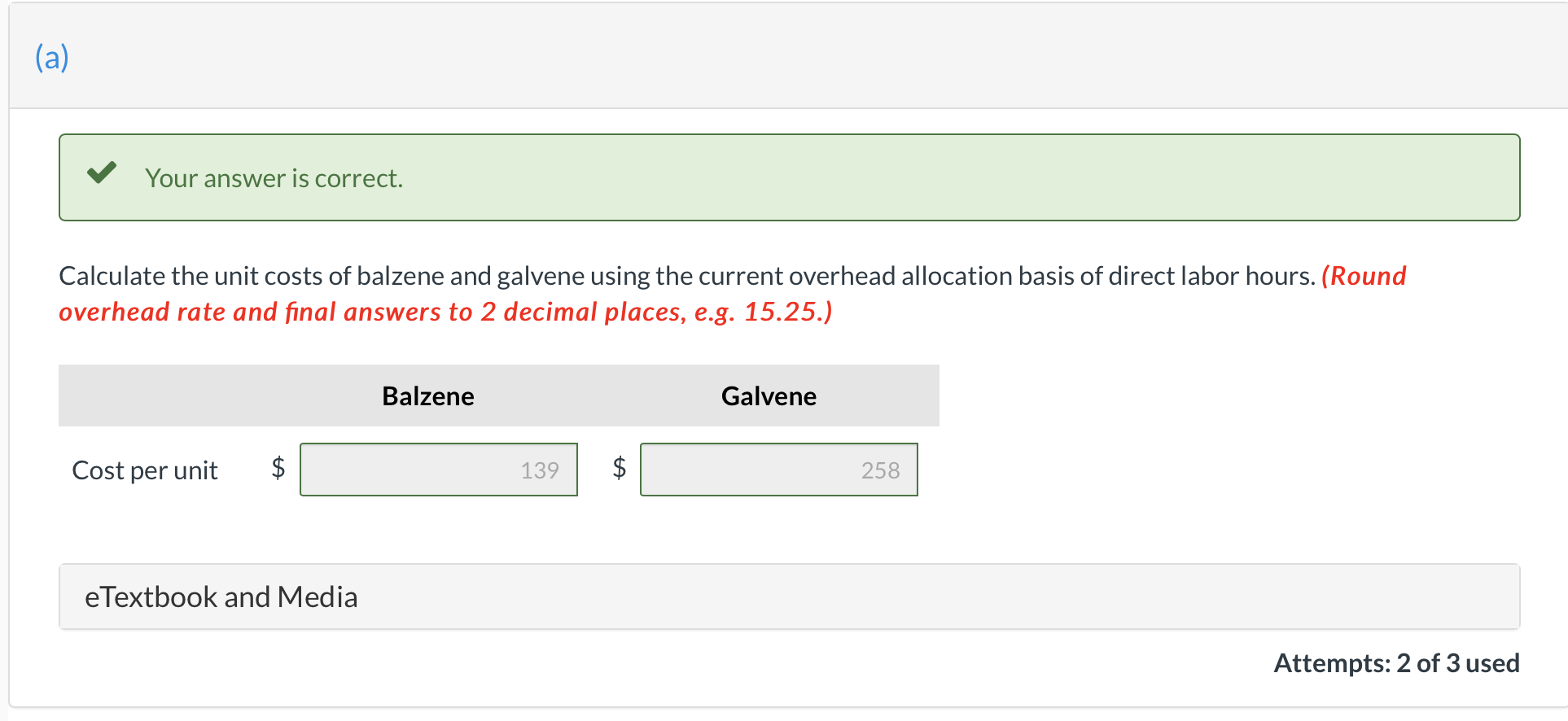

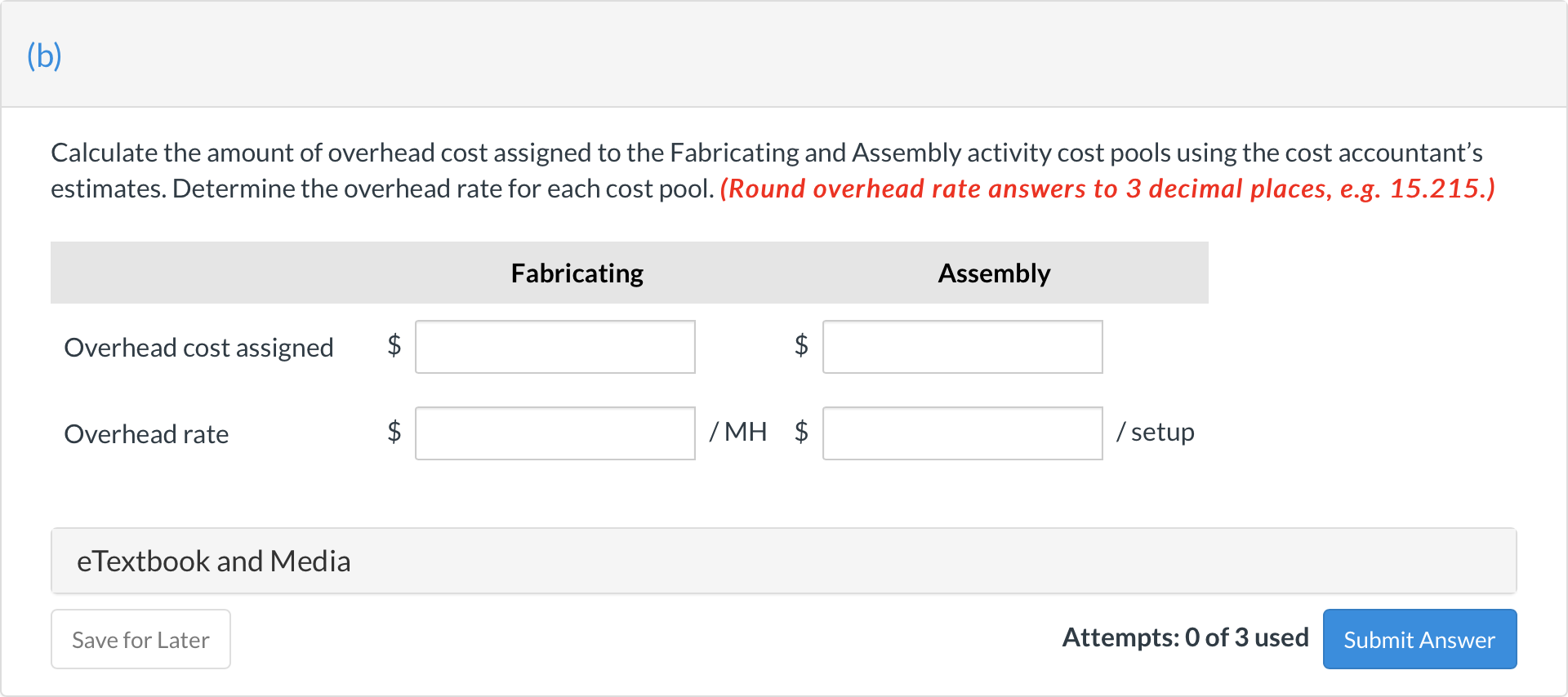

Swifty Manufacturing produces two products in its Saratoga plant, balzene and galvene. Since it opened its doors in 1965, Swifty has been using a single manufacturing overhead pool to accumulate overhead costs. Overhead has been allocated to products based on direct labor hours. a Until recently, Swifty was the sole producer of galvene in the country and was therefore able to dictate the selling price. However, last year Marcella Products began marketing a comparable product at $53 per unit-a price that is below Swifty's product cost. Swifty's market share of galvene has declined rapidly as a result. The company's managers must now decide whether to meet the competitive price or discontinue the product. Swifty's cost accountant has suggested that the company do an activity-based cost analysis before managers make the decision. The two main indirect costs of manufacturing balzene and galvene are power usage and setup costs. Most of the power usage occurs in the fabricating department; most of the setup costs are incurred in the assembly department. Setup costs are incurred predominantly in the production of balzene. The fabricating department has identified machine hours as the appropriate cost driver; the assembly department has identified setups as the appropriate cost driver. Direct labor rates are the same in both departments. The combined budget for manufacturing is as follows. The combined budget for manufacturing is as follows. Total Balzene Galvene Number of units 4,000 4,000 Direct labor $1,080,000 10 hours per unit 20 hours per unit Direct material $12.00 per unit $4 per unit Overhead Indirect labor $50,000 Fringe benefits 18,000 Indirect materials 31,000 Power 180,000 Setup 90,000 Quality assurance 25,000 Other utilities 20,000 Depreciation 30,000 The cost accountant has prepared the following estimates of overhead usage by the two departments: Fabricating Assembly Indirect labor 75% 25% Fringe benefits 70% 30% Indirect materials $20,000 $11,000 Power $100,650 $79,350 Setup $20,000 $70,000 Quality assurance 65% 35% Other utilities 60% 40% Depreciation 80% 20% Activity Base Usage Machine Hours Setups Balzene 4 MH/unit 1,000 Galvene 6 MH/unit 250 (a) Your answer is correct. Calculate the unit costs of balzene and galvene using the current overhead allocation basis of direct labor hours. (Round overhead rate and final answers to 2 decimal places, e.g. 15.25.) Balzene Galvene Cost per unit 139 $ 258 eTextbook and Media Attempts: 2 of 3 used (b) Calculate the amount of overhead cost assigned to the Fabricating and Assembly activity cost pools using the cost accountant's estimates. Determine the overhead rate for each cost pool. (Round overhead rate answers to 3 decimal places, e.g. 15.215.) Fabricating Assembly Overhead cost assigned ta $ Overhead rate ta /MH $ / setup e Textbook and Media Save for Later Attempts: 0 of 3 used Submit

Please help me out with the answers/ process for part B. Thanks!

Please help me out with the answers/ process for part B. Thanks!