Answered step by step

Verified Expert Solution

Question

1 Approved Answer

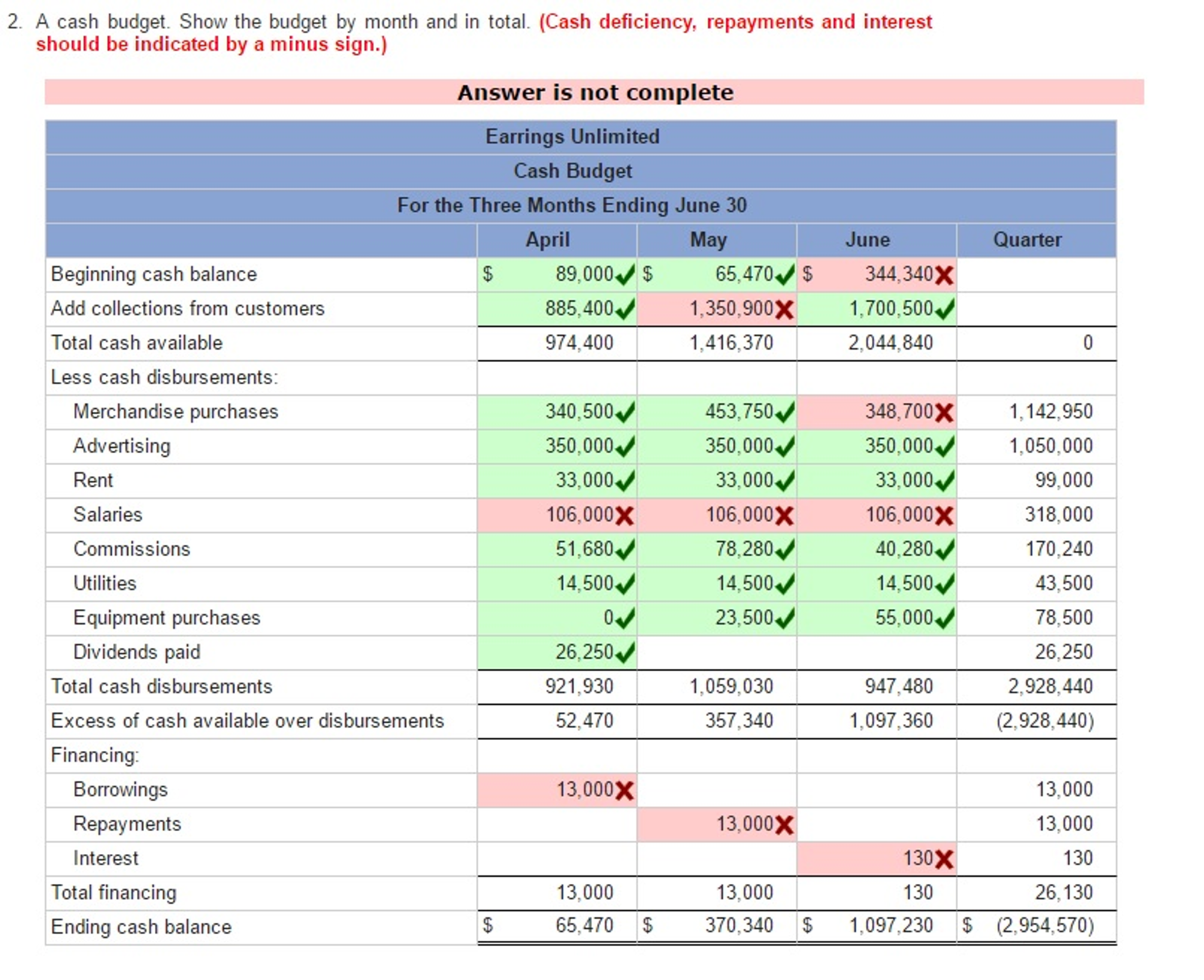

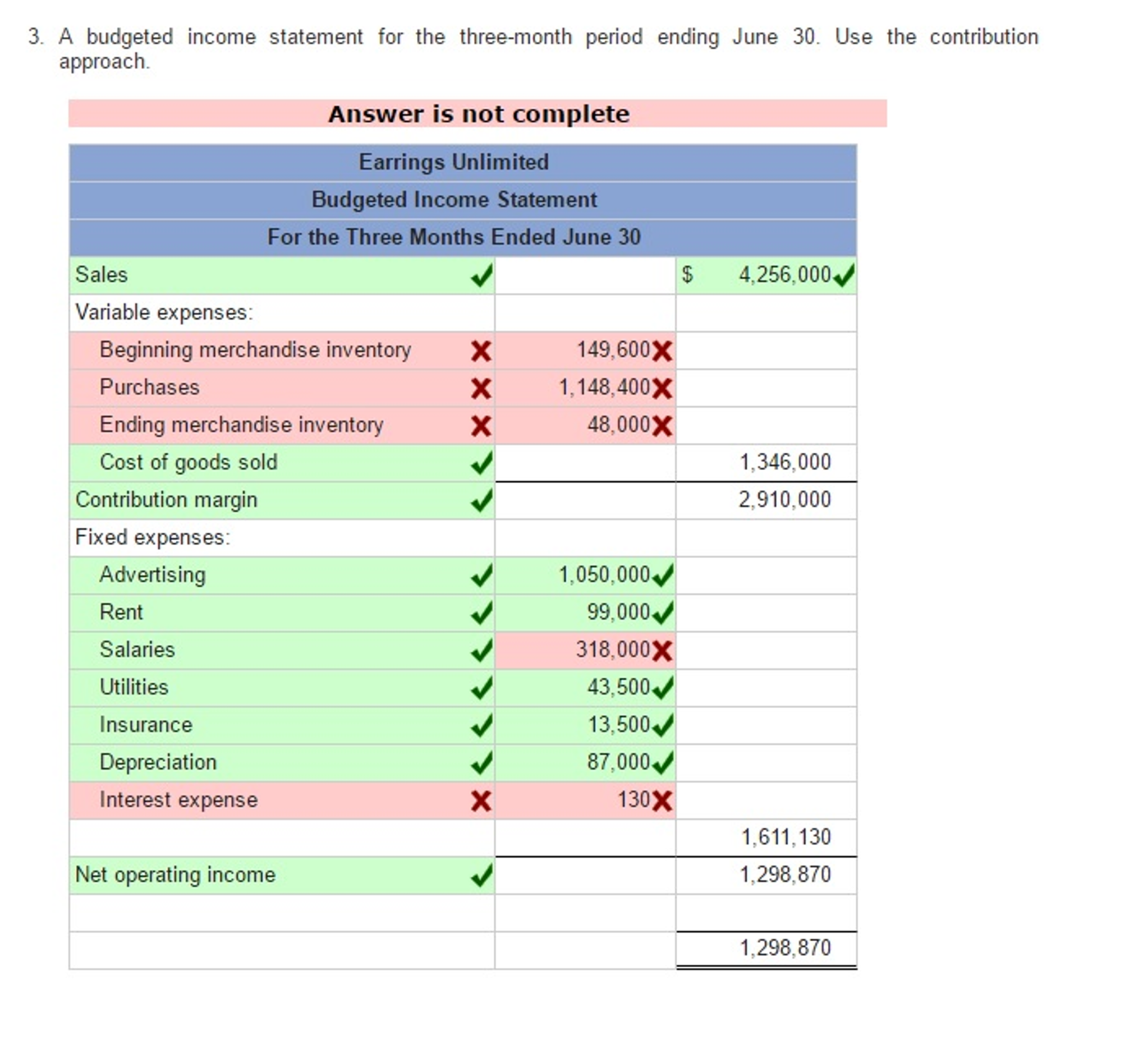

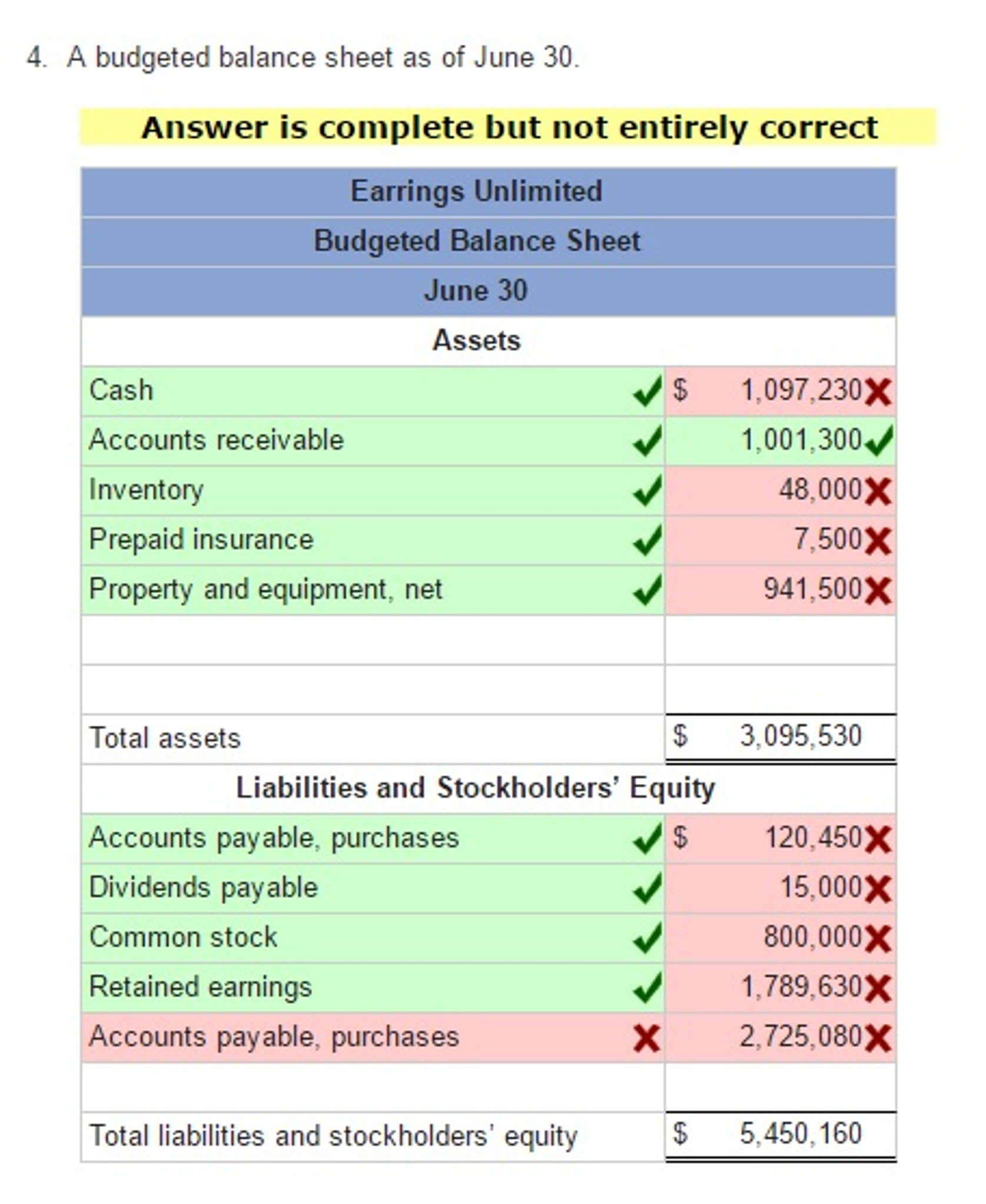

Can anyone help me fix what I got wrong... I can't seem to figure it out...IT says answers are not complete as well.. Case 8-31

Can anyone help me fix what I got wrong... I can't seem to figure it out...IT says answers are not complete as well..

Case 8-31 Master Budget with Supporting Schedules [LO8-2, LO8-4, LO8-8, LO8-9, LO8-10] You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare comprehensive budgets for the upcoming second quarter in order to show management the benefits that can be gained from an integrated budgeting program. To this end, you have worked with accounting and other areas to gather the information assembled below. The company sells many styles of earrings, but all are sold for the same price$19 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings ). January (actual) February (actual) March (actual) April (budget) May (budget) 23,000 June (budget) 29,000 July (budget) 43,000 August (budget) 68,000 September (budget) 103,000 53,000 33,000 31,000 28,000 The concentration of sales before and during May is due to Mothers Day. Sufficient inventory should be on hand at the end of each month to supply 40% of the earrings sold in the following month. Suppliers are paid $5.5 for a pair of earrings. One-half of a month's purchases is paid for in the month of purchase, the other half is paid for in the following month. All sales are on credit, with no discount, and payable within 15 days. The company has found, however, that only 20% of a month's sales are collected in the month of sale. An additional 70D% is collected in the following month, and the remaining 10% is collected in the second month following sale. Bad debts have been negligible. Monthly operating expenses for the company are given below: Variable: Sales commissions Fixed: Advertising Rent Salaries Utilities nsurance Depreciation 4% of sales $ 350,000 $ 33,000 $ 136,000 $ 14,500 $ 4,500 $ 29,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started