Can anyone help me this assignment?

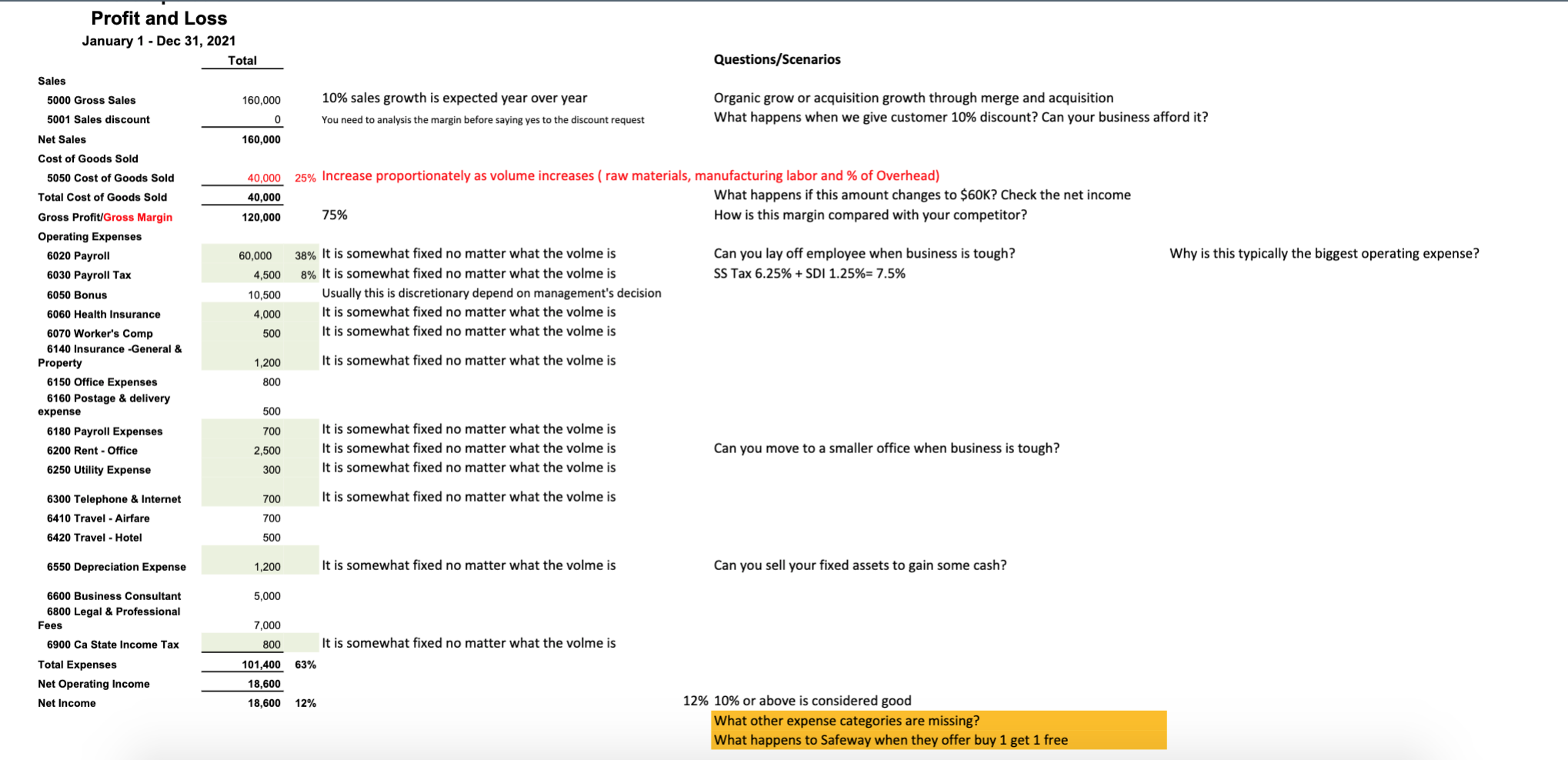

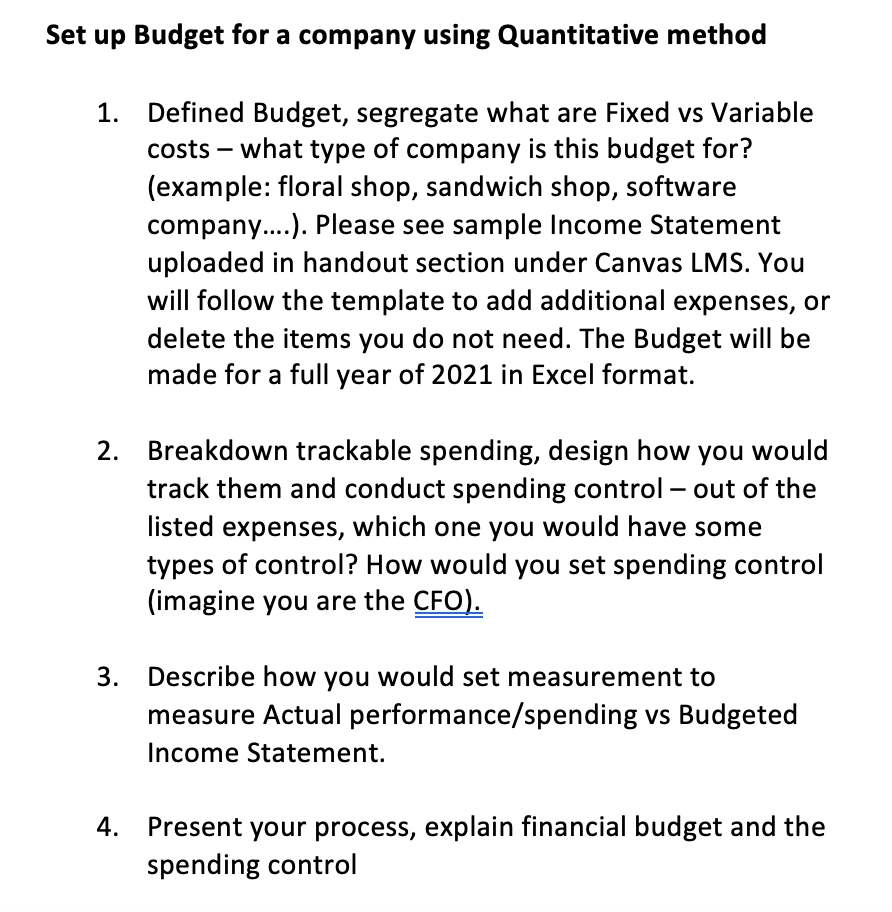

Profit and Loss January 1 - Dec 31, 2021 Total Questions/Scenarios Sales 5000 Gross Sales 160,000 0 10% sales growth is expected year over year You need to analysis the margin before saying yes to the discount request Organic grow or acquisition growth through merge and acquisition What happens when we give customer 10% discount? Can your business afford it? 5001 Sales discount Net Sales 160,000 Cost of Goods Sold 5050 Cost of Goods Sold Total Cost of Goods Sold Gross Profit/Gross Margin Operating Expenses 6020 Payroll 6030 Payroll Tax 40,000 25% Increase proportionately as volume increases ( raw materials, manufacturing labor and % of Overhead) 40,000 What happens if this amount changes to $60K? Check the net income 120,000 75% How is this margin compared with your competitor? 60,000 4,500 Can you lay off employee when business is tough? SS Tax 6.25% + SDI 1.25%= 7.5% Why is this typically the biggest operating expense? 6050 Bonus 10,500 4,000 38% It is somewhat fixed no matter what the volme is 8% It is somewhat fixed no matter what the volme is Usually this is discretionary depend on management's decision It is somewhat fixed no matter what the volme is It is somewhat fixed no matter what the volme is 500 1,200 It is somewhat fixed no matter what the volme is 6060 Health Insurance 6070 Worker's Comp 6140 Insurance -General & Property 6150 Office Expenses 6160 Postage & delivery expense 6180 Payroll Expenses 800 500 700 6200 Rent - Office 2,500 It is somewhat fixed no matter what the volme is It is somewhat fixed no matter what the volme is It is somewhat fixed no matter what the volme is Can you move to a smaller office when business is tough? 6250 Utility Expense 300 700 It is somewhat fixed no matter what the volme is 6300 Telephone & Internet 6410 Travel - Airfare 6420 Travel - Hotel 700 500 6550 Depreciation Expense 1,200 It is somewhat fixed no matter what the volme is Can you sell your fixed assets to gain some cash? 5,000 6600 Business Consultant 6800 Legal & Professional Fees 7,000 800 It is somewhat fixed no matter what the volme is 63% 6900 Ca State Income Tax Total Expenses Net Operating Income Net Income 101,400 18,600 18,600 12% 12% 10% or above is considered good What other expense categories are missing? What happens to Safeway when they offer buy 1 get 1 free Set up Budget for a company using Quantitative method 1. Defined Budget, segregate what are Fixed vs Variable costs what type of company is this budget for? (example: floral shop, sandwich shop, software company...). Please see sample Income Statement uploaded in handout section under Canvas LMS. You will follow the template to add additional expenses, or delete the items you do not need. The Budget will be made for a full year of 2021 in Excel format. 2. Breakdown trackable spending, design how you would track them and conduct spending control - out of the listed expenses, which one you would have some types of control? How would you set spending control (imagine you are the CFO). 3. Describe how you would set measurement to measure Actual performance/spending vs Budgeted Income Statement. 4. Present your process, explain financial budget and the spending control Profit and Loss January 1 - Dec 31, 2021 Total Questions/Scenarios Sales 5000 Gross Sales 160,000 0 10% sales growth is expected year over year You need to analysis the margin before saying yes to the discount request Organic grow or acquisition growth through merge and acquisition What happens when we give customer 10% discount? Can your business afford it? 5001 Sales discount Net Sales 160,000 Cost of Goods Sold 5050 Cost of Goods Sold Total Cost of Goods Sold Gross Profit/Gross Margin Operating Expenses 6020 Payroll 6030 Payroll Tax 40,000 25% Increase proportionately as volume increases ( raw materials, manufacturing labor and % of Overhead) 40,000 What happens if this amount changes to $60K? Check the net income 120,000 75% How is this margin compared with your competitor? 60,000 4,500 Can you lay off employee when business is tough? SS Tax 6.25% + SDI 1.25%= 7.5% Why is this typically the biggest operating expense? 6050 Bonus 10,500 4,000 38% It is somewhat fixed no matter what the volme is 8% It is somewhat fixed no matter what the volme is Usually this is discretionary depend on management's decision It is somewhat fixed no matter what the volme is It is somewhat fixed no matter what the volme is 500 1,200 It is somewhat fixed no matter what the volme is 6060 Health Insurance 6070 Worker's Comp 6140 Insurance -General & Property 6150 Office Expenses 6160 Postage & delivery expense 6180 Payroll Expenses 800 500 700 6200 Rent - Office 2,500 It is somewhat fixed no matter what the volme is It is somewhat fixed no matter what the volme is It is somewhat fixed no matter what the volme is Can you move to a smaller office when business is tough? 6250 Utility Expense 300 700 It is somewhat fixed no matter what the volme is 6300 Telephone & Internet 6410 Travel - Airfare 6420 Travel - Hotel 700 500 6550 Depreciation Expense 1,200 It is somewhat fixed no matter what the volme is Can you sell your fixed assets to gain some cash? 5,000 6600 Business Consultant 6800 Legal & Professional Fees 7,000 800 It is somewhat fixed no matter what the volme is 63% 6900 Ca State Income Tax Total Expenses Net Operating Income Net Income 101,400 18,600 18,600 12% 12% 10% or above is considered good What other expense categories are missing? What happens to Safeway when they offer buy 1 get 1 free Set up Budget for a company using Quantitative method 1. Defined Budget, segregate what are Fixed vs Variable costs what type of company is this budget for? (example: floral shop, sandwich shop, software company...). Please see sample Income Statement uploaded in handout section under Canvas LMS. You will follow the template to add additional expenses, or delete the items you do not need. The Budget will be made for a full year of 2021 in Excel format. 2. Breakdown trackable spending, design how you would track them and conduct spending control - out of the listed expenses, which one you would have some types of control? How would you set spending control (imagine you are the CFO). 3. Describe how you would set measurement to measure Actual performance/spending vs Budgeted Income Statement. 4. Present your process, explain financial budget and the spending control