Can anyone help me with the ones in RED? Thank you in advance!

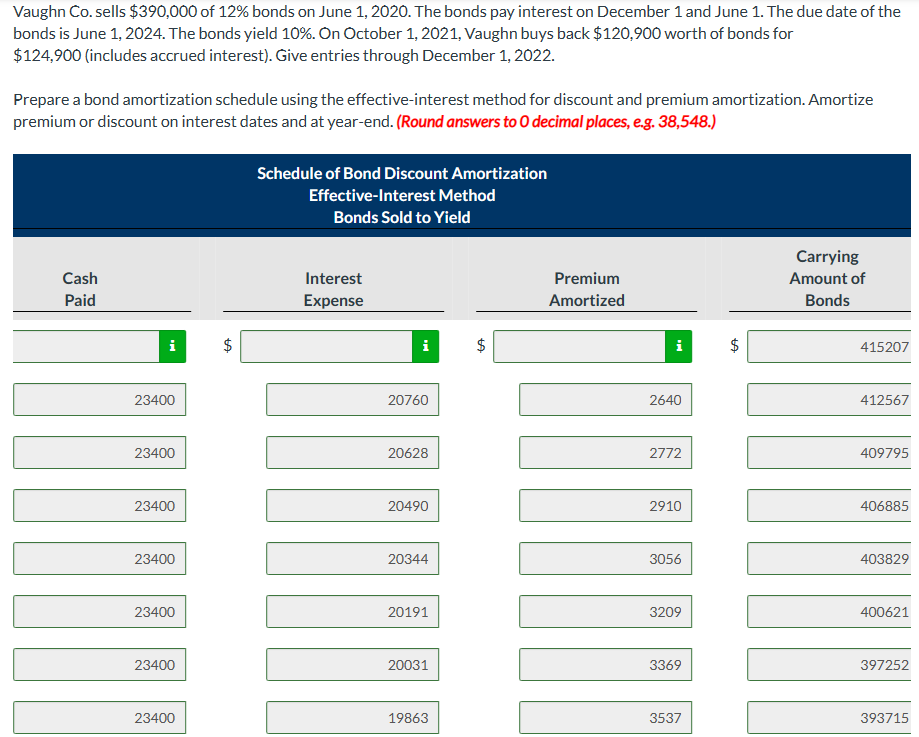

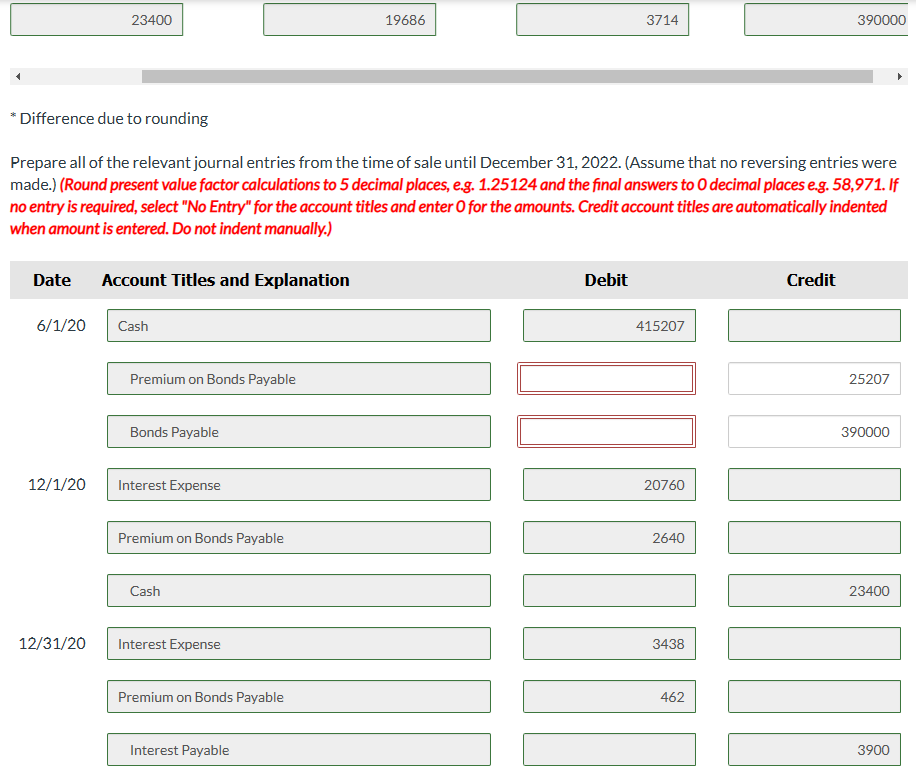

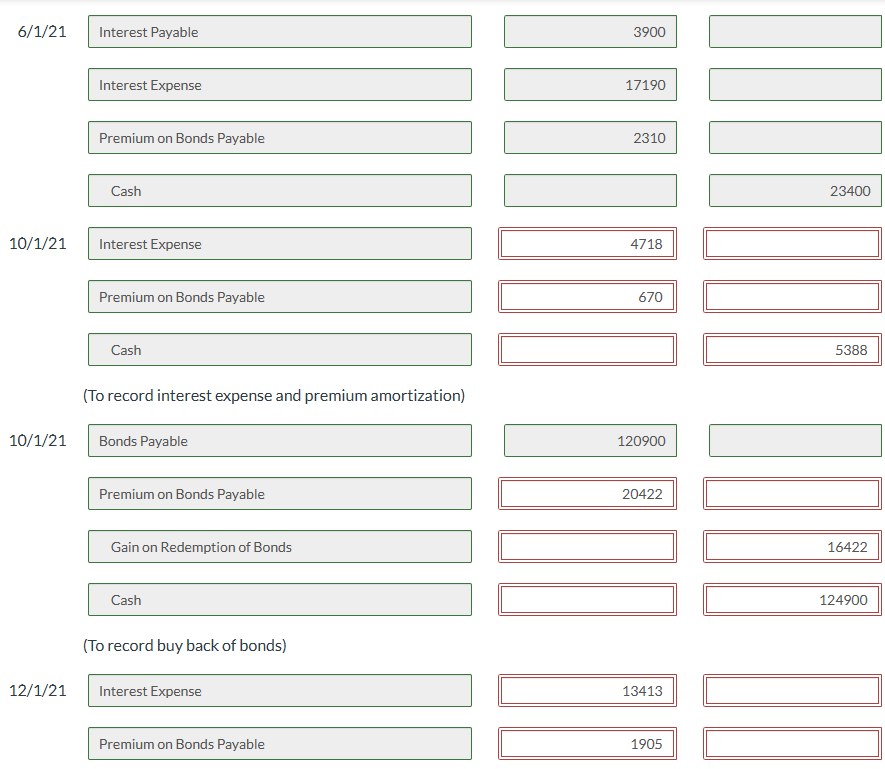

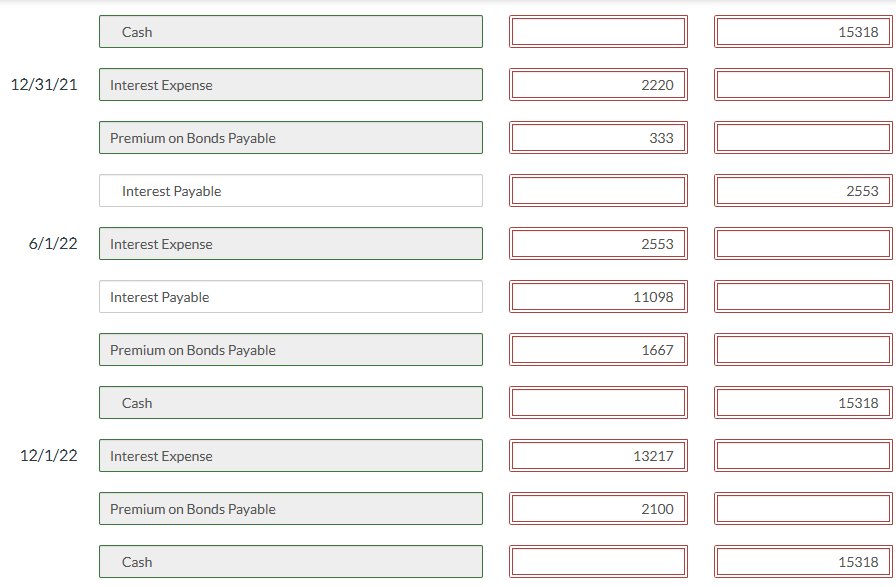

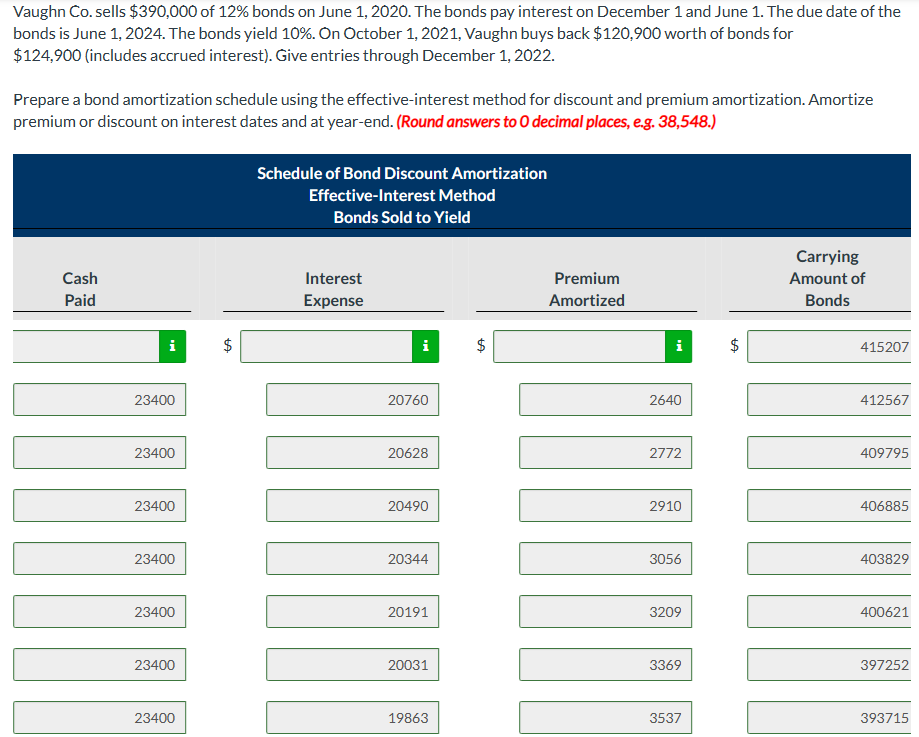

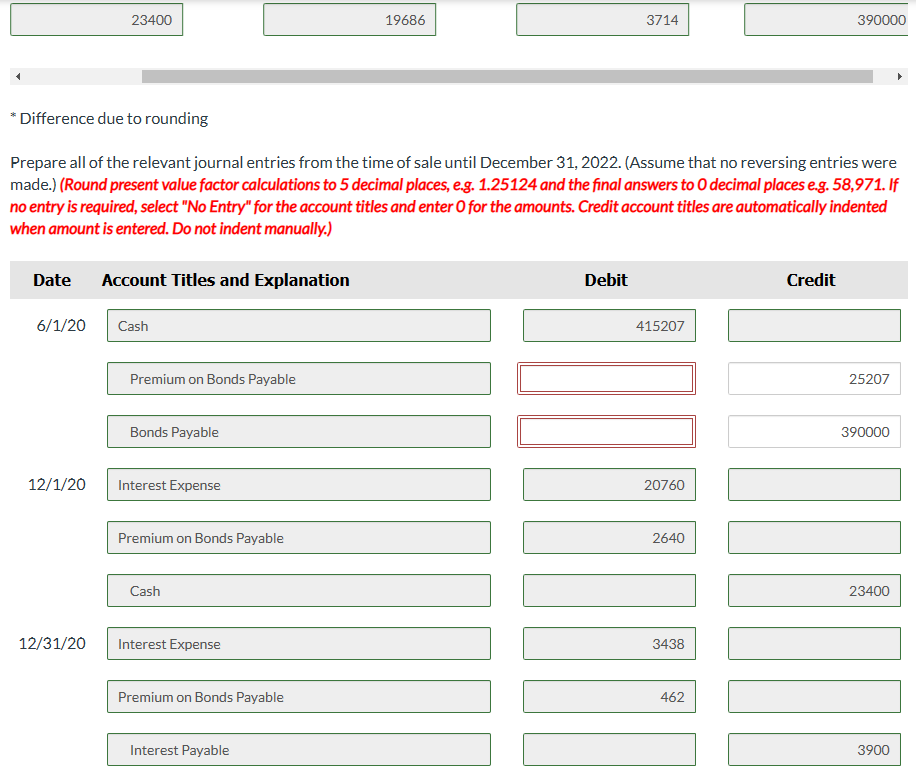

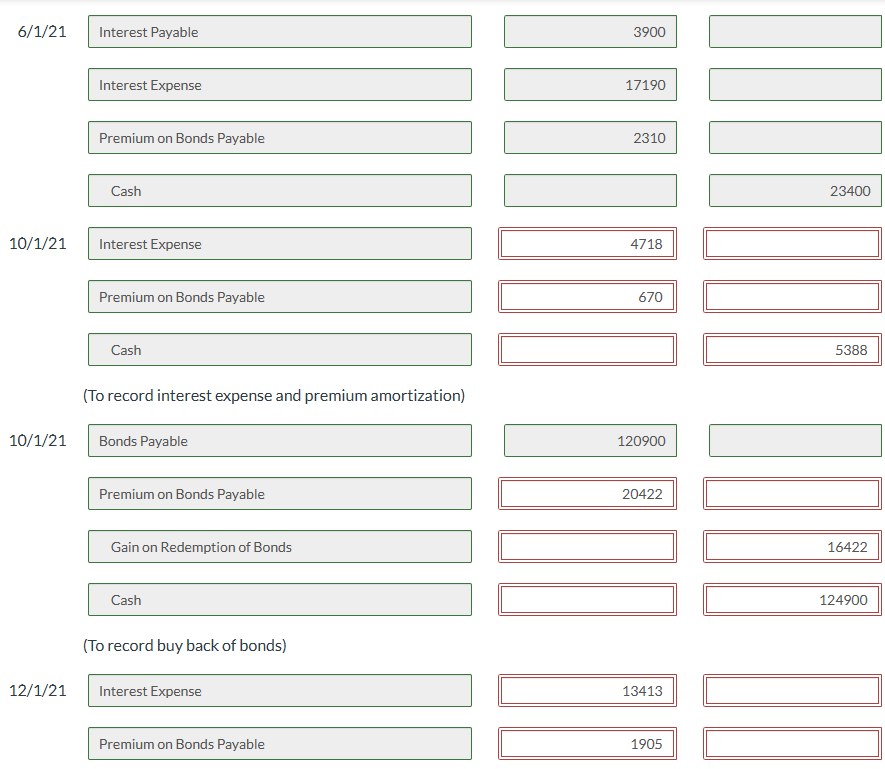

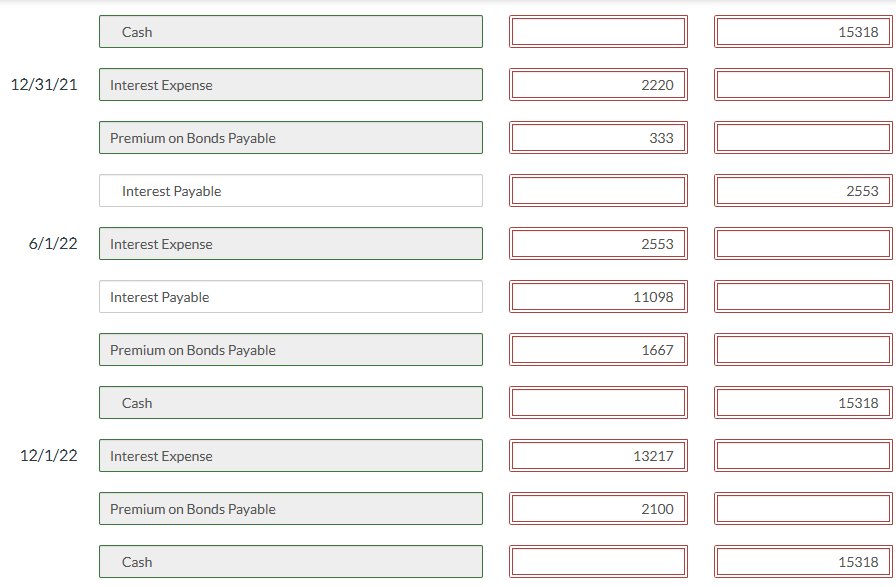

Vaughn Co. sells $390,000 of 12% bonds on June 1,2020 . The bonds pay interest on December 1 and June 1 . The due date of the bonds is June 1, 2024. The bonds yield 10%. On October 1,2021 , Vaughn buys back $120,900 worth of bonds for $124,900 (includes accrued interest). Give entries through December 1, 2022. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548.) * Difference due to rounding Prepare all of the relevant journal entries from the time of sale until December 31, 2022. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) 6/1/21 Interest Payable 3900 Interest Expense 17190 Premium on Bonds Payable 2310 Cash 23400 10/1/21 Interest Expense \begin{tabular}{|l|} \hline 4718 \\ \hline \end{tabular} Premium on Bonds Payable \begin{tabular}{|l||} \hline 670 \\ \hline \end{tabular} (To record interest expense and premium amortization) 10/1/21 Bonds Payable 120900 Premium on Bonds Payable \begin{tabular}{|l||} \hline 20422 \\ \hline \hline \end{tabular} Gain on Redemption of Bonds Cash \begin{tabular}{||r|} \hline \hline 124900 \\ \hline \hline \end{tabular} (To record buy back of bonds) 12/1/21 Interest Expense \begin{tabular}{|l|} \hline 13413 \\ \hline \end{tabular} Premium on Bonds Payable \begin{tabular}{|r|} \hline 1905 \\ \hline \end{tabular} Cash \begin{tabular}{|r|} \hline 15318 \\ \hline \end{tabular} 12/31/21 Interest Expense \begin{tabular}{|l|} \hline 2220 \\ \hline \end{tabular} Premium on Bonds Payable \begin{tabular}{|l|} \hline 333 \\ \hline \end{tabular} Interest Payable \begin{tabular}{|r|} \hline 2553 \\ \hline \end{tabular} 6/1/22 Interest Expense \begin{tabular}{|r||} \hline 2553 \\ \hline \end{tabular} Interest Payable \begin{tabular}{|r|} \hline 11098 \\ \hline \end{tabular} Premium on Bonds Payable \begin{tabular}{|r|} \hline 15318 \\ \hline \end{tabular} 12/1/22 Interest Expense \begin{tabular}{|l|} \hline 13217 \\ \hline \end{tabular} Premium on Bonds Payable \begin{tabular}{|r|} \hline 2100 \\ \hline \end{tabular} Cash