Can anyone help me with this project on the company "Starbucks"?

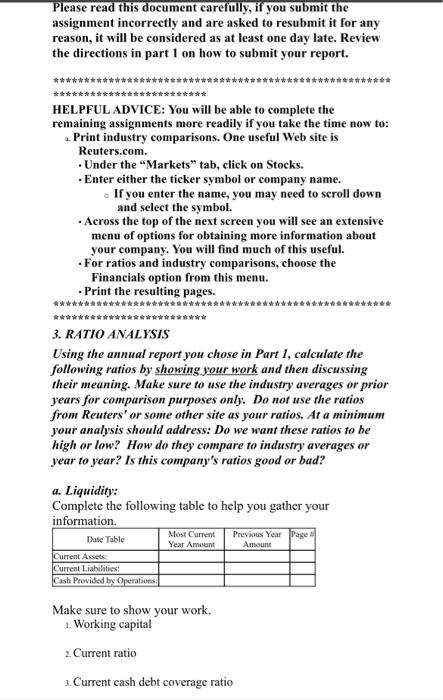

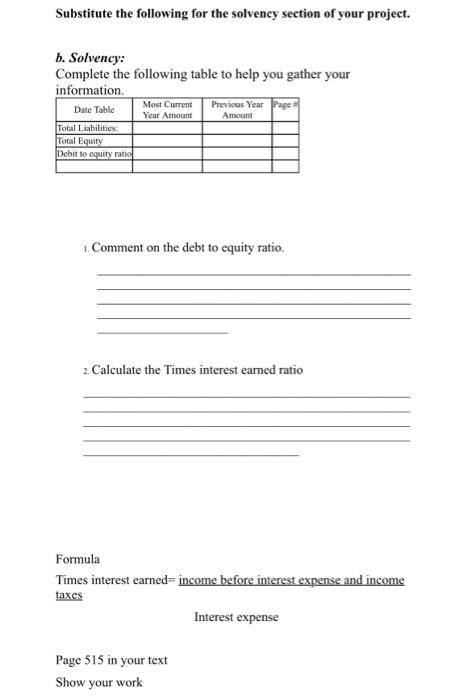

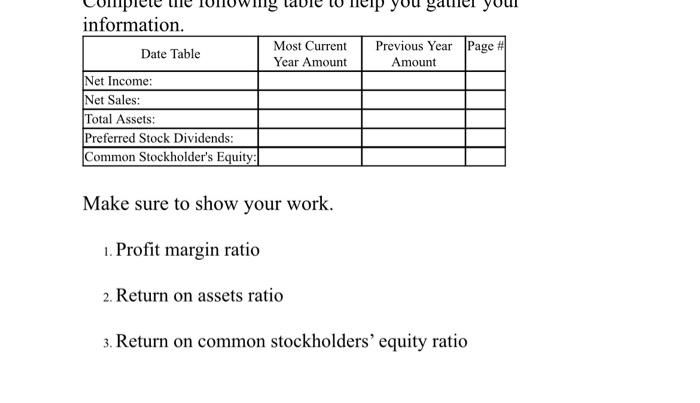

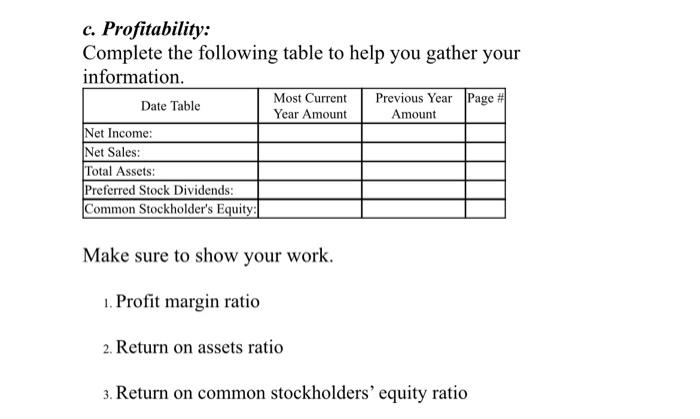

Please read this document carefully, if you submit the assignment incorrectly and are asked to resubmit it for any reason, it will be considered as at least one day late. Review the directions in part 1 on how to submit your report. HELPFUL ADVICE: You will be able to complete the remaining assignments more readily if you take the time now to: . Print industry comparisons. One useful Web site is Reuters.com. - Under the "Markets" tab, click on Stocks. - Enter either the ticker symbol or company name. - If you enter the name, you may need to seroll down and select the symbol. - Across the top of the next sereen you will see an extensive menu of options for obtaining more information about your company. You will find much of this useful. - For ratios and industry comparisons, choose the Financials option from this menu. - Print the resulting pages. 3. RATIO ANALYSIS Using the annual report you chose in Part 1 , calculate the following ratios by showing your work and then discussing their meaning. Make sure to use the industry averages or prior years for comparison purposes only. Do not use the ratios from Reuters' or some other site as your ratios. At a minimum your analysis should address: Do we want these ratios to be high or low? How do they compare to industry averages or year to year? Is this company's ratios good or bad? a. Liquidity: Complete the following table to help you gather your information. Make sure to show your work. 1. Working capital 2. Current ratio 3. Current cash debt coverage ratio Substitute the following for the solvency section of your project. b. Solvency: Complete the following table to help you gather your information. 1. Comment on the debt to equity ratio. 2. Calculate the Times interest earned ratio Formula Times interest earned = income before interest expense and income taxes Interest expense Page 515 in your text Show your work information. Make sure to show your work. 1. Profit margin ratio 2. Return on assets ratio 3. Return on common stockholders' equity ratio c. Profitability: Complete the following table to help you gather your information. Make sure to show your work. 1. Profit margin ratio 2. Return on assets ratio 3. Return on common stockholders' equity ratio Please read this document carefully, if you submit the assignment incorrectly and are asked to resubmit it for any reason, it will be considered as at least one day late. Review the directions in part 1 on how to submit your report. HELPFUL ADVICE: You will be able to complete the remaining assignments more readily if you take the time now to: . Print industry comparisons. One useful Web site is Reuters.com. - Under the "Markets" tab, click on Stocks. - Enter either the ticker symbol or company name. - If you enter the name, you may need to seroll down and select the symbol. - Across the top of the next sereen you will see an extensive menu of options for obtaining more information about your company. You will find much of this useful. - For ratios and industry comparisons, choose the Financials option from this menu. - Print the resulting pages. 3. RATIO ANALYSIS Using the annual report you chose in Part 1 , calculate the following ratios by showing your work and then discussing their meaning. Make sure to use the industry averages or prior years for comparison purposes only. Do not use the ratios from Reuters' or some other site as your ratios. At a minimum your analysis should address: Do we want these ratios to be high or low? How do they compare to industry averages or year to year? Is this company's ratios good or bad? a. Liquidity: Complete the following table to help you gather your information. Make sure to show your work. 1. Working capital 2. Current ratio 3. Current cash debt coverage ratio Substitute the following for the solvency section of your project. b. Solvency: Complete the following table to help you gather your information. 1. Comment on the debt to equity ratio. 2. Calculate the Times interest earned ratio Formula Times interest earned = income before interest expense and income taxes Interest expense Page 515 in your text Show your work information. Make sure to show your work. 1. Profit margin ratio 2. Return on assets ratio 3. Return on common stockholders' equity ratio c. Profitability: Complete the following table to help you gather your information. Make sure to show your work. 1. Profit margin ratio 2. Return on assets ratio 3. Return on common stockholders' equity ratio