Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can anyone hep me with these 4 tax accounting questions? thank you 15. As a general rule, shareholders calculate gains and losses on liquidations based

can anyone hep me with these 4 tax accounting questions? thank you

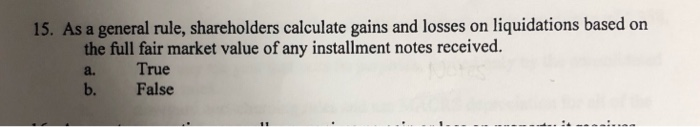

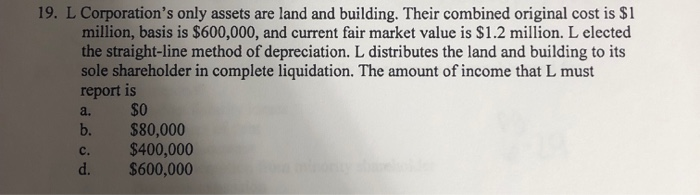

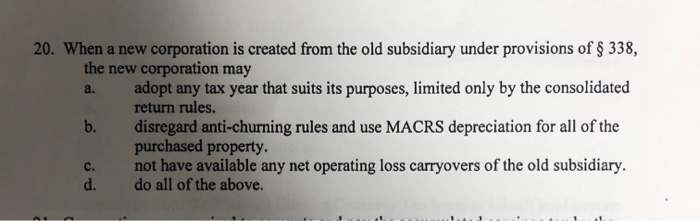

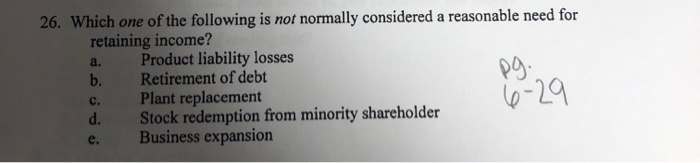

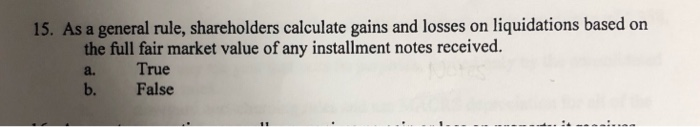

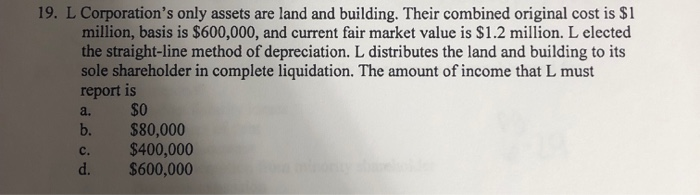

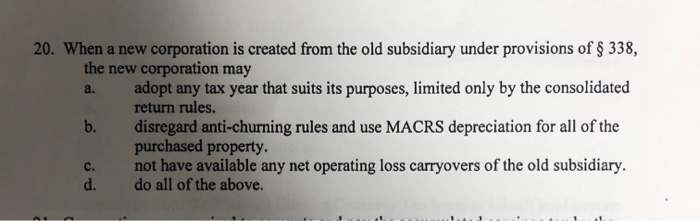

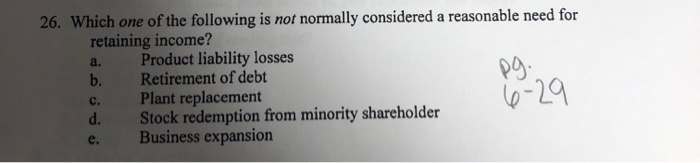

15. As a general rule, shareholders calculate gains and losses on liquidations based on the full fair market value of any installment notes received. a. True b. False 19. L Corporation's only assets are land and building. Their combined original cost is $1 million, basis is $600,000, and current fair market value is $1.2 million. L elected the straight-line method of depreciation. L distributes the land and building to its sole shareholder in complete liquidation. The amount of income that L must report is a. $O b. $80,000 c. $400,000 d. $600,000 20. When a new corporation is created from the old subsidiary under provisions of 338, the new corporation may a. adopt any tax year that suits its purposes, limited only by the consolidated b. disregard anti-churning rules and use MACRS depreciation for all of the c. not have available any net operating loss carryovers of the old subsidiary. return rules. purchased property do all of the above. d. 26. Which one of the following is not normally considered a reasonable need for retaining income? a. Product liability losses b. Retirement of debt c. Plant replacement d. Stock redemption from minority shareholder e. Business expansion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started