CAN ANYONE PLS CHECK IF MY ANSWERS ARE CORRECT AND IF NOT WILL YOU PLEASE EXPLAIN TO ME HOW TO GET THA RIGHT ANSWER THANK YOU

1)

2)

3)

4)

5)

6)

7)

8)

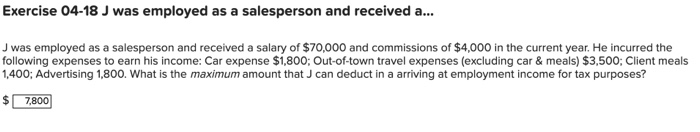

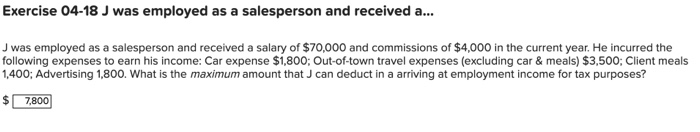

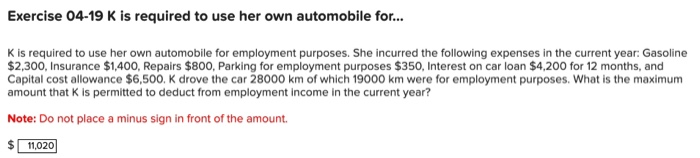

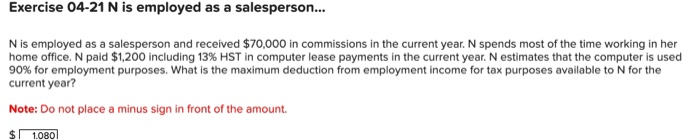

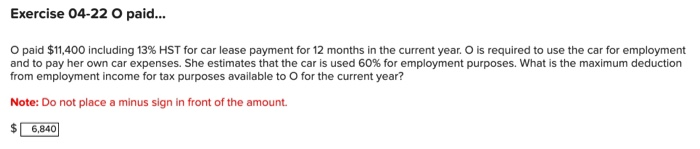

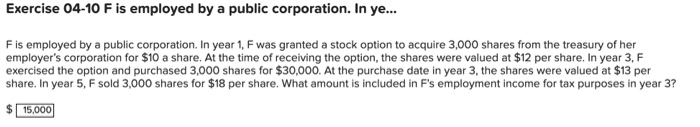

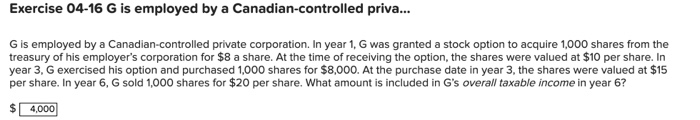

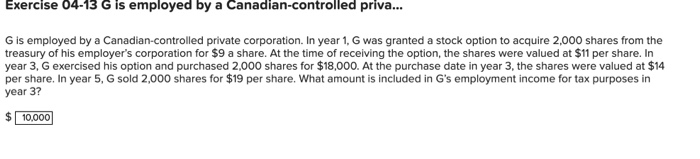

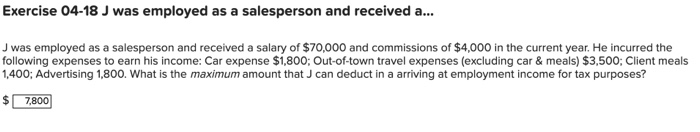

Exercise 04-18 J was employed as a salesperson and received a... J was employed as a salesperson and received a salary of $70,000 and commissions of $4,000 in the current year. He incurred the following expenses to earn his income: Car expense $1,800: Out-of-town travel expenses (excluding car & meals) $3,500: Client meals 1,400; Advertising 1,800. What is the maximum amount that can deduct in a arriving at employment income for tax purposes? 7,800 Exercise 04-19 K is required to use her own automobile for... K is required to use her own automobile for employment purposes. She incurred the following expenses in the current year: Gasoline $2,300, Insurance $1,400, Repairs $800, Parking for employment purposes $350, Interest on car loan $4,200 for 12 months, and Capital cost allowance $6,500. K drove the car 28000 km of which 19000 km were for employment purposes. What is the maximum amount that is permitted to deduct from employment income in the current year? Note: Do not place a minus sign in front of the amount 11,020 Exercise 04-20 M is employed as a marketing analyst and req... M is employed as a marketing analyst and required by his employment contract to maintain a home office. His office occupies 10% of the total space in his home. He works 4 days a week in his home office and travels the remaining 1 working days. He incurs the following expenses: New desk $1,000, telephone landline monthly basic rate (10% of total) $150; Internet (10% of total) $380; Utilities (10% of total) $400; House insurance (10% of total) $130; Mortgage interest (10% of total) $700; Property taxes (10% of total) $680; Maintenance (10% of total) $80. What is the maximum deduction from employment income for tax purposes available to M in the current year? 480 Exercise 04-21 N is employed as a salesperson... N is employed as a salesperson and received $70,000 in commissions in the current year. N spends most of the time working in her home office. N paid $1,200 including 13% HST in computer lease payments in the current year. N estimates that the computer is used 90% for employment purposes. What is the maximum deduction from employment income for tax purposes available to N for the current year? Note: Do not place a minus sign in front of the amount $ 1.080 Exercise 04-22 O paid... O paid $11,400 including 13% HST for car lease payment for 12 months in the current year. O is required to use the car for employment and to pay her own car expenses. She estimates that the car is used 60% for employment purposes. What is the maximum deduction from employment income for tax purposes available to o for the current year? Note: Do not place a minus sign in front of the amount 6,840 Exercise 04-10 F is employed by a public corporation. In ye... F is employed by a public corporation. In year 1, F was granted a stock option to acquire 3,000 shares from the treasury of her employer's corporation for $10 a share. At the time of receiving the option, the shares were valued at $12 per share. In year 3, F exercised the option and purchased 3,000 shares for $30,000. At the purchase date in year 3, the shares were valued at $13 per share. In year 5, F sold 3,000 shares for $18 per share. What amount is included in F's employment income for tax purposes in year 3? $ 15,000 Exercise 04-16 G is employed by a Canadian-controlled priva... Gis employed by a Canadian-controlled private corporation. In year 1, G was granted a stock option to acquire 1,000 shares from the treasury of his employer's corporation for $8 a share. At the time of receiving the option, the shares were valued at $10 per share. In year 3, G exercised his option and purchased 1,000 shares for $8,000. At the purchase date in year 3, the shares were valued at $15 per share. In year 6, G sold 1,000 shares for $20 per share. What amount is included in G's overall taxable income in year 6? 4,000 Exercise 04-13 G is employed by a Canadian-controlled priva... G is employed by a Canadian-controlled private corporation. In year 1G was granted a stock option to acquire 2,000 shares from the treasury of his employer's corporation for $9 a share. At the time of receiving the option, the shares were valued at $11 per share. In year 3, G exercised his option and purchased 2,000 shares for $18,000. At the purchase date in year 3, the shares were valued at $14 per share. In year 5, G sold 2,000 shares for $19 per share. What amount is included in G's employment income for tax purposes in year 3? 10,000