Answered step by step

Verified Expert Solution

Question

1 Approved Answer

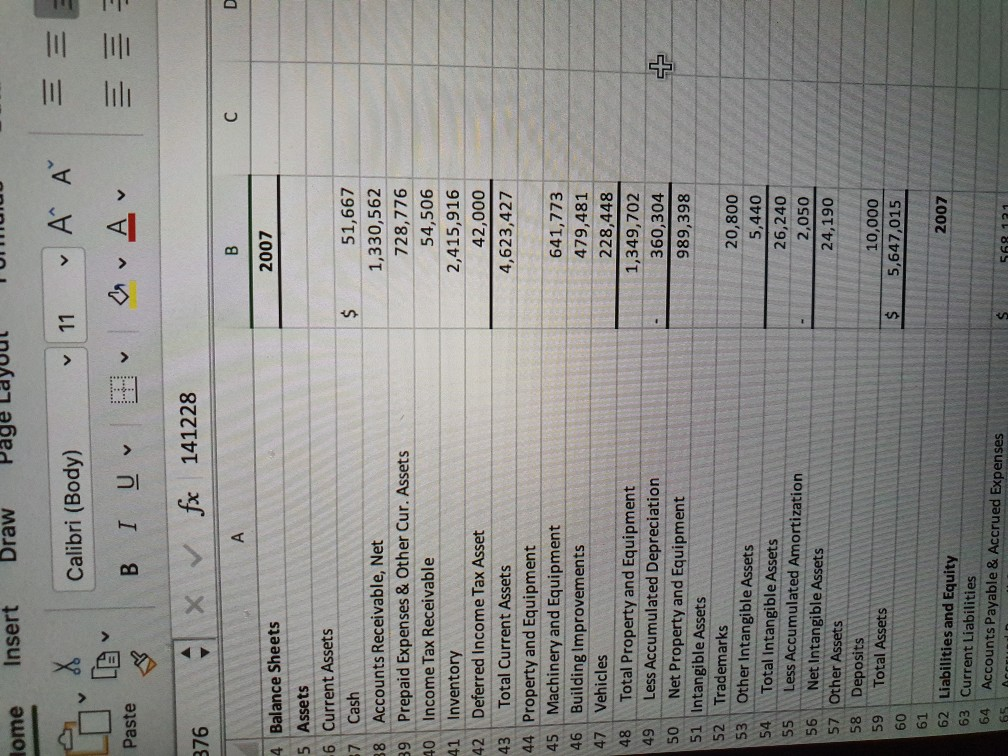

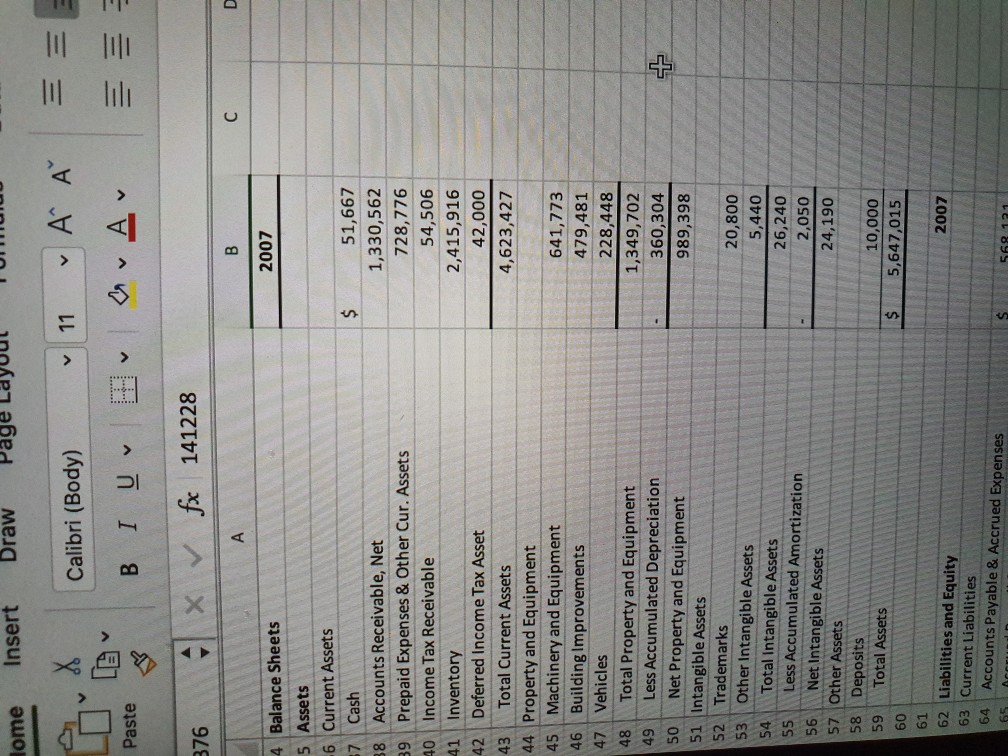

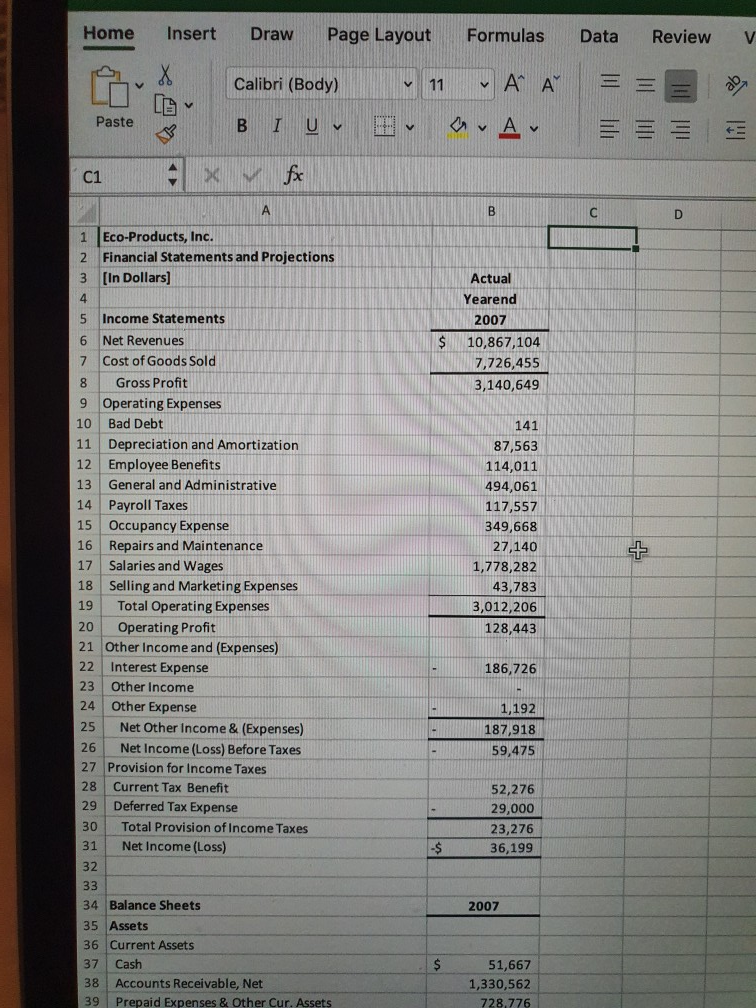

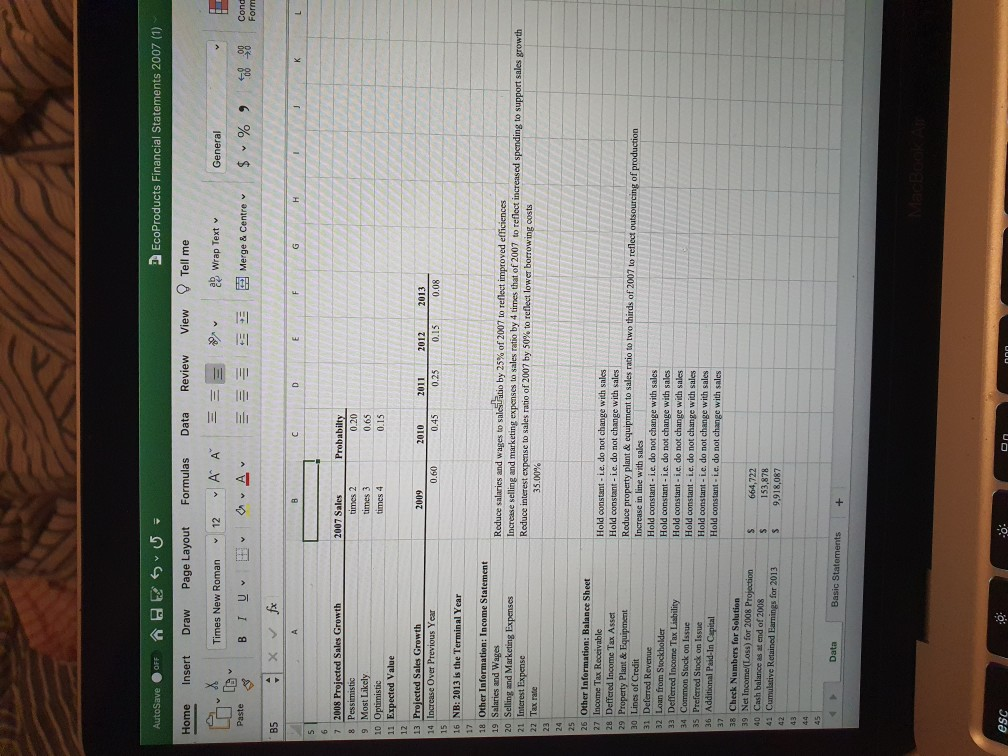

can anyone show me the process how the value of purchase of plant equipment and intangible assets .... where it come from balanced sheet and

can anyone show me the process how the value of purchase of plant equipment and intangible assets .... where it come from balanced sheet and income.. how to calculate

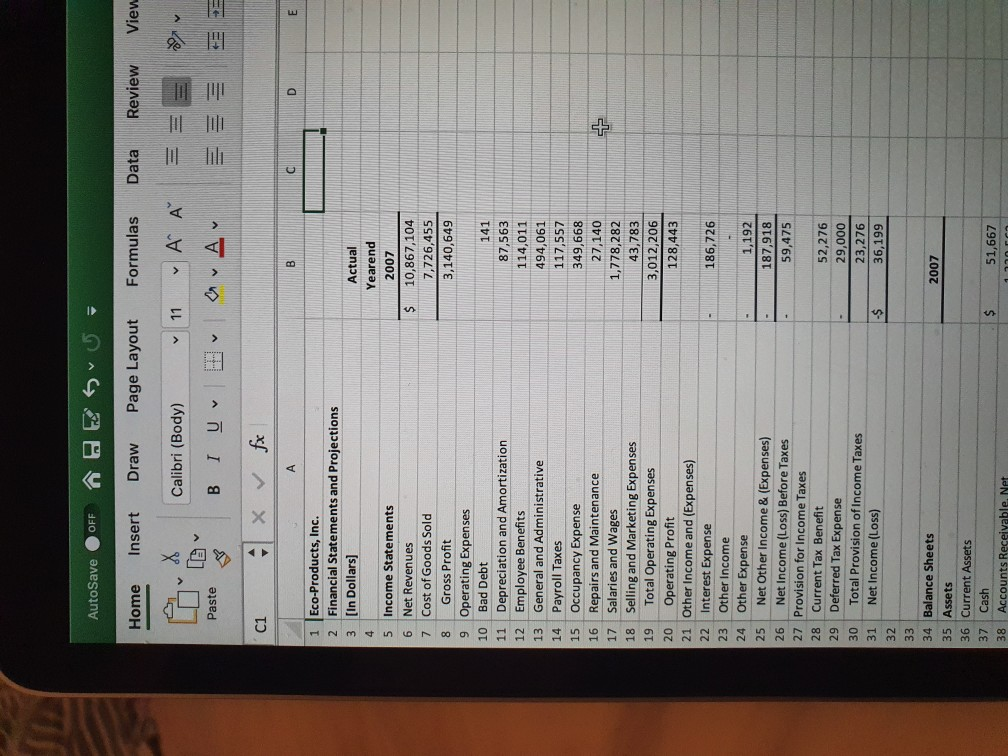

Home Insert Draw TULUI Pages A = BY Paste Calibri (Body) 11 A BI U va A fx 141228 B 376 4 C D 2007 51,667 1,330,562 728,776 54,506 2,415,916 42,000 4,623,427 641,773 4 Balance Sheets 5 Assets -6 Current Assets 37 Cash 88 Accounts Receivable, Net 39 Prepaid Expenses & Other Cur. Assets 40 Income Tax Receivable 41 Inventory 42 Deferred Income Tax Asset 43 Total Current Assets 44 Property and Equipment 45 Machinery and Equipment 46 Building Improvements 47 Vehicles 48 Total Property and Equipment 49 Less Accumulated Depreciation Net Property and Equipment 51 Intangible Assets Trademarks Other Intangible Assets Total Intangible Assets Less Accumulated Amortization 56 Net Intangible Assets 57 Other Assets Deposits Total Assets 479,481 228,448 1,349,702 360,304 989,398 50 20,800 5,440 26,240 2,050 24,190 $ 10,000 5,647,015 2007 62 Liabilities and Equity 63 Current Liabilities 64 Accounts Payable & Accrued Expenses 65 A 568 121 AutoSave OFF GES Home Insert Draw Page Layout Formulas Data Review View Calibri (Body) 11 AA CA Paste BIU 33 C1 C D E 1 2 3 Eco-Products, Inc. Financial Statements and Projections [In Dollars] $ Actual Yearend 2007 10,867,104 7,726,455 3,140,649 5 Income Statements 6 Net Revenues 7 Cost of Goods Sold 8 Gross Profit Operating Expenses 10 Bad Debt Depreciation and Amortization 12 Employee Benefits 13 General and Administrative 14 Payroll Taxes 15 Occupancy Expense 16 Repairs and Maintenance 17 Salaries and Wages 18 Selling and Marketing Expenses 19 Total Operating Expenses 20 Operating Profit Other Income and (Expenses) Interest Expense Other Income 24 Other Expense Net Other Income & (Expenses) Net Income (Loss) Before Taxes Provision for Income Taxes Current Tax Benefit Deferred Tax Expense Total Provision of Income Taxes Net Income (Loss) 141 87,563 114,011 494,061 117,557 349,668 27,140 1,778,282 43,783 3,012,206 128,443 186,726 1,192 187,918 59,475 52,276 29,000 23,276 36,199 -$ 2007 Balance Sheets Assets 36 Current Assets 37 Cash 38 Accounts Receivable. Net 51,667 Home Insert Draw Page Layout Formulas Data Review V Paste Calibri (Body) v 11 A A 58 BI U POA - fx 1 Eco-Products, Inc. 2 Financial Statements and Projections 3 [In Dollars) on WN Actual Yearend 2007 10,867,104 7,726,455 3,140,649 $ 5 Income Statements Net Revenues 7 Cost of Goods Sold 8 Gross Profit 9 Operating Expenses 10 Bad Debt 11 Depreciation and Amortization 12 Employee Benefits 13 General and Administrative 14 Payroll Taxes 15 Occupancy Expense 16 Repairs and Maintenance 17 Salaries and Wages 18 Selling and Marketing Expenses 19 Total Operating Expenses 20 Operating Profit 21 Other Income and (Expenses) 22 Interest Expense 23 Other Income 24 Other Expense Net Other Income & (Expenses) 26 Net Income (Loss) Before Taxes 27 Provision for Income Taxes 28 Current Tax Benefit 29 Deferred Tax Expense Total Provision of Income Taxes Net Income (Loss) 141 87,563 114,011 494,061 117,557 349,668 27,140 1,778,282 43,783 3,012,206 128,443 186,726 1,192 187,918 59,475 52,276 29,000 23,276 36,199 30 -$ 2007 34 Balance Sheets 35 Assets 36 Current Assets 37 Cash 38 Accounts Receivable, Net 39 Prepaid Expenses & Other Cur. Assets 51,667 1,330,562 728.776 AutoSave OFF BES5= EcoProducts Financial Statements 2007 (1) Home Insert Draw Page Layout Formulas Data Review View Tell me A = = General 12 O A A 23 Wrap Text Merge & Centre $ % & Conce Paste B5 Times New Roman BI U B fx A x 8 C D L 7 2008 Projected Sales Growth 8 Pessimistic 9 Most Likely 10 Optimistic 11 Expected Value 2007 Sales times 2 times 3 times 4 Probabilty 0.20 0.65 0.15 13 Projected Sales Growth 14 Increase Over Previous Year 2009 2010 0.45 2011 0.25 2012 0.15 0.60 2013 0.08 16 NB: 2013 is the Terminal Year 18 Other Information: Income Statement 19 Salaries and Wages 20 Selling and Marketing Expenses 21 Interest Expense 22 Tax rate Reduce salaries and wages to sale to by 25% of 2007 to reflect improved efficiences Increase selling and marketing expenses to sales ratio by 4 times that of 2007 to reflect increased spending to support sales growth Reduce interest expense to sales ratio of 2007 by 50% to reflect lower borrowing costs 35.00% 26 Other Information: Balance Sheet 27 Income Tax Receivable 28 Deffered Income Tax Asset 29 Property Plant & Equipment 20 Lines of Credit 31 Deferred Revenue 32 Loan from Stockholder 33 Defferred Income Tax Liability 34 Common Stock on Issue 35 Preferred Stock on Issue 36 Additional Paid-In Capital Hold constant - i.e. do not change with sales Hold constant - i.e. do not change with sales Reduce property plant & equipment to sales ratio to two thirds of 2007 to reflect outsourcing of production Increase in line with sales Hold constant - i.e. do not change with sales Hold constant - i.e. do not change with sales Hold constant - i.e, do not change with sales Hold constant - i.e. do not change with sales Hold constant - i.e. do not change with sales Hold constant. i.c, do not change with sales Check Numbers for Solution 39 Net Income/(Loss) for 2008 Projection 40 Cash balance as at end of 2008 41 Cumulative Retained Earnings for 2013 664,722 153,878 9,918,087 $ Data Basic Statements esc Home Insert Draw TULUI Pages A = BY Paste Calibri (Body) 11 A BI U va A fx 141228 B 376 4 C D 2007 51,667 1,330,562 728,776 54,506 2,415,916 42,000 4,623,427 641,773 4 Balance Sheets 5 Assets -6 Current Assets 37 Cash 88 Accounts Receivable, Net 39 Prepaid Expenses & Other Cur. Assets 40 Income Tax Receivable 41 Inventory 42 Deferred Income Tax Asset 43 Total Current Assets 44 Property and Equipment 45 Machinery and Equipment 46 Building Improvements 47 Vehicles 48 Total Property and Equipment 49 Less Accumulated Depreciation Net Property and Equipment 51 Intangible Assets Trademarks Other Intangible Assets Total Intangible Assets Less Accumulated Amortization 56 Net Intangible Assets 57 Other Assets Deposits Total Assets 479,481 228,448 1,349,702 360,304 989,398 50 20,800 5,440 26,240 2,050 24,190 $ 10,000 5,647,015 2007 62 Liabilities and Equity 63 Current Liabilities 64 Accounts Payable & Accrued Expenses 65 A 568 121 AutoSave OFF GES Home Insert Draw Page Layout Formulas Data Review View Calibri (Body) 11 AA CA Paste BIU 33 C1 C D E 1 2 3 Eco-Products, Inc. Financial Statements and Projections [In Dollars] $ Actual Yearend 2007 10,867,104 7,726,455 3,140,649 5 Income Statements 6 Net Revenues 7 Cost of Goods Sold 8 Gross Profit Operating Expenses 10 Bad Debt Depreciation and Amortization 12 Employee Benefits 13 General and Administrative 14 Payroll Taxes 15 Occupancy Expense 16 Repairs and Maintenance 17 Salaries and Wages 18 Selling and Marketing Expenses 19 Total Operating Expenses 20 Operating Profit Other Income and (Expenses) Interest Expense Other Income 24 Other Expense Net Other Income & (Expenses) Net Income (Loss) Before Taxes Provision for Income Taxes Current Tax Benefit Deferred Tax Expense Total Provision of Income Taxes Net Income (Loss) 141 87,563 114,011 494,061 117,557 349,668 27,140 1,778,282 43,783 3,012,206 128,443 186,726 1,192 187,918 59,475 52,276 29,000 23,276 36,199 -$ 2007 Balance Sheets Assets 36 Current Assets 37 Cash 38 Accounts Receivable. Net 51,667 Home Insert Draw Page Layout Formulas Data Review V Paste Calibri (Body) v 11 A A 58 BI U POA - fx 1 Eco-Products, Inc. 2 Financial Statements and Projections 3 [In Dollars) on WN Actual Yearend 2007 10,867,104 7,726,455 3,140,649 $ 5 Income Statements Net Revenues 7 Cost of Goods Sold 8 Gross Profit 9 Operating Expenses 10 Bad Debt 11 Depreciation and Amortization 12 Employee Benefits 13 General and Administrative 14 Payroll Taxes 15 Occupancy Expense 16 Repairs and Maintenance 17 Salaries and Wages 18 Selling and Marketing Expenses 19 Total Operating Expenses 20 Operating Profit 21 Other Income and (Expenses) 22 Interest Expense 23 Other Income 24 Other Expense Net Other Income & (Expenses) 26 Net Income (Loss) Before Taxes 27 Provision for Income Taxes 28 Current Tax Benefit 29 Deferred Tax Expense Total Provision of Income Taxes Net Income (Loss) 141 87,563 114,011 494,061 117,557 349,668 27,140 1,778,282 43,783 3,012,206 128,443 186,726 1,192 187,918 59,475 52,276 29,000 23,276 36,199 30 -$ 2007 34 Balance Sheets 35 Assets 36 Current Assets 37 Cash 38 Accounts Receivable, Net 39 Prepaid Expenses & Other Cur. Assets 51,667 1,330,562 728.776 AutoSave OFF BES5= EcoProducts Financial Statements 2007 (1) Home Insert Draw Page Layout Formulas Data Review View Tell me A = = General 12 O A A 23 Wrap Text Merge & Centre $ % & Conce Paste B5 Times New Roman BI U B fx A x 8 C D L 7 2008 Projected Sales Growth 8 Pessimistic 9 Most Likely 10 Optimistic 11 Expected Value 2007 Sales times 2 times 3 times 4 Probabilty 0.20 0.65 0.15 13 Projected Sales Growth 14 Increase Over Previous Year 2009 2010 0.45 2011 0.25 2012 0.15 0.60 2013 0.08 16 NB: 2013 is the Terminal Year 18 Other Information: Income Statement 19 Salaries and Wages 20 Selling and Marketing Expenses 21 Interest Expense 22 Tax rate Reduce salaries and wages to sale to by 25% of 2007 to reflect improved efficiences Increase selling and marketing expenses to sales ratio by 4 times that of 2007 to reflect increased spending to support sales growth Reduce interest expense to sales ratio of 2007 by 50% to reflect lower borrowing costs 35.00% 26 Other Information: Balance Sheet 27 Income Tax Receivable 28 Deffered Income Tax Asset 29 Property Plant & Equipment 20 Lines of Credit 31 Deferred Revenue 32 Loan from Stockholder 33 Defferred Income Tax Liability 34 Common Stock on Issue 35 Preferred Stock on Issue 36 Additional Paid-In Capital Hold constant - i.e. do not change with sales Hold constant - i.e. do not change with sales Reduce property plant & equipment to sales ratio to two thirds of 2007 to reflect outsourcing of production Increase in line with sales Hold constant - i.e. do not change with sales Hold constant - i.e. do not change with sales Hold constant - i.e, do not change with sales Hold constant - i.e. do not change with sales Hold constant - i.e. do not change with sales Hold constant. i.c, do not change with sales Check Numbers for Solution 39 Net Income/(Loss) for 2008 Projection 40 Cash balance as at end of 2008 41 Cumulative Retained Earnings for 2013 664,722 153,878 9,918,087 $ Data Basic Statements escStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started