Question: can anyone solve this please? me what you are de met e Lay X Copy font Cheer Wapet Mega Cente am Normal * Conditional For

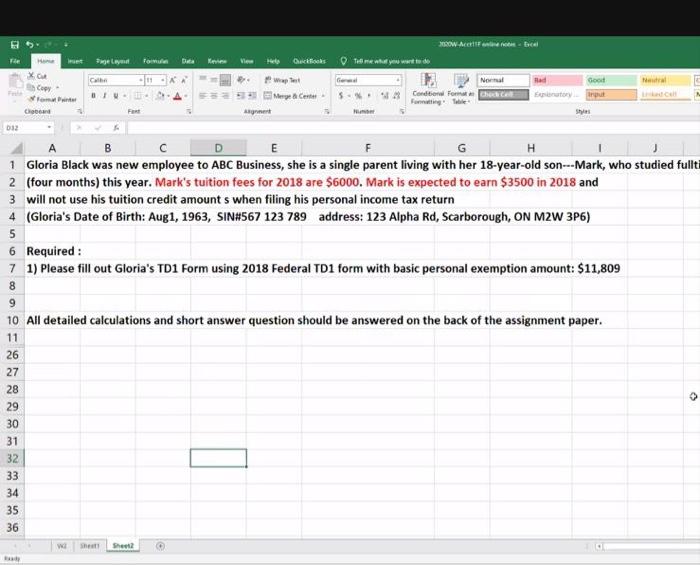

me what you are de met e Lay X Copy font Cheer Wapet Mega Cente am Normal * Conditional For Bad Good Story Shu 032 B E 1 Gloria Black was new employee to ABC Business, she is a single parent living with her 18-year-old son---Mark, who studied fullt 2 (four months) this year. Mark's tuition fees for 2018 are $6000. Mark is expected to earn $3500 in 2018 and 3 will not use his tuition credit amounts when filing his personal income tax return 4 (Gloria's Date of Birth: Aug1, 1963, SIN#567 123 789 address: 123 Alpha Rd, Scarborough, ON M2W 3P6) 5 6 Required: 7 1) Please fill out Gloria's TD1 Form using 2018 Federal TD1 form with basic personal exemption amount: $11,809 8 9 10 All detailed calculations and short answer question should be answered on the back of the assignment paper. v 11 26 27 28 29 30 31 32 33 34 35 36 Sheet me what you are de met e Lay X Copy font Cheer Wapet Mega Cente am Normal * Conditional For Bad Good Story Shu 032 B E 1 Gloria Black was new employee to ABC Business, she is a single parent living with her 18-year-old son---Mark, who studied fullt 2 (four months) this year. Mark's tuition fees for 2018 are $6000. Mark is expected to earn $3500 in 2018 and 3 will not use his tuition credit amounts when filing his personal income tax return 4 (Gloria's Date of Birth: Aug1, 1963, SIN#567 123 789 address: 123 Alpha Rd, Scarborough, ON M2W 3P6) 5 6 Required: 7 1) Please fill out Gloria's TD1 Form using 2018 Federal TD1 form with basic personal exemption amount: $11,809 8 9 10 All detailed calculations and short answer question should be answered on the back of the assignment paper. v 11 26 27 28 29 30 31 32 33 34 35 36 Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts