Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can help me with this ? Instructions: 1. This assignment is to be done in groups of 3 or 4 the most. You can use

can help me with this ?

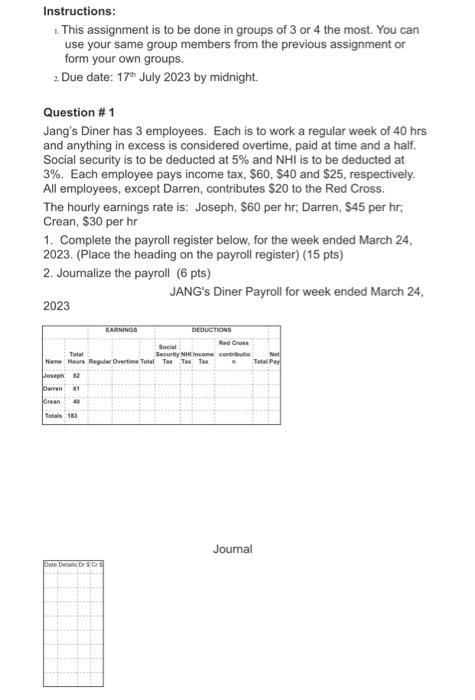

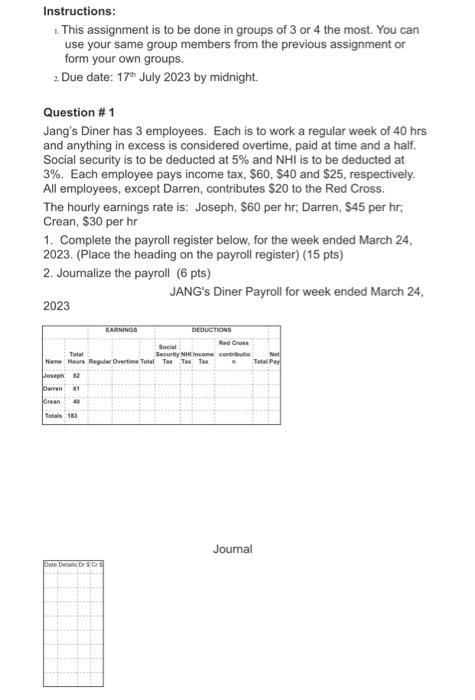

Instructions: 1. This assignment is to be done in groups of 3 or 4 the most. You can use your same group members from the previous assignment or form your own groups. 2. Due date: 17m July 2023 by midnight. Question \#1 Jang's Diner has 3 employees. Each is to work a regular week of 40hrs and anything in excess is considered overtime, paid at time and a half. Social security is to be deducted at 5% and NHI is to be deducted at 3%. Each employee pays income tax, $60,$40 and $25, respectively. All employees, except Darren, contributes $20 to the Red Cross. The hourly earnings rate is: Joseph, $60 per hr; Darren, $45perhr; Crean, $30 per hr 1. Complete the payroll register below, for the week ended March 24, 2023. (Place the heading on the payroll register) (15 pts) 2. Journalize the payroll ( 6 pts) JANG's Diner Payroll for week ended March 24, 2023 Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started