Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can i get help with these journal entries? It was the end of the fiscal year, and Helen was evaluating her company's MOH. Since her

Can i get help with these journal entries?

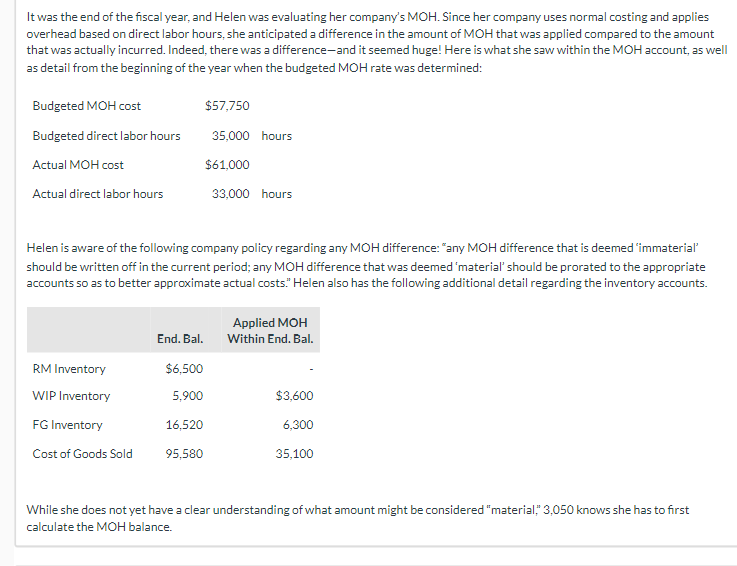

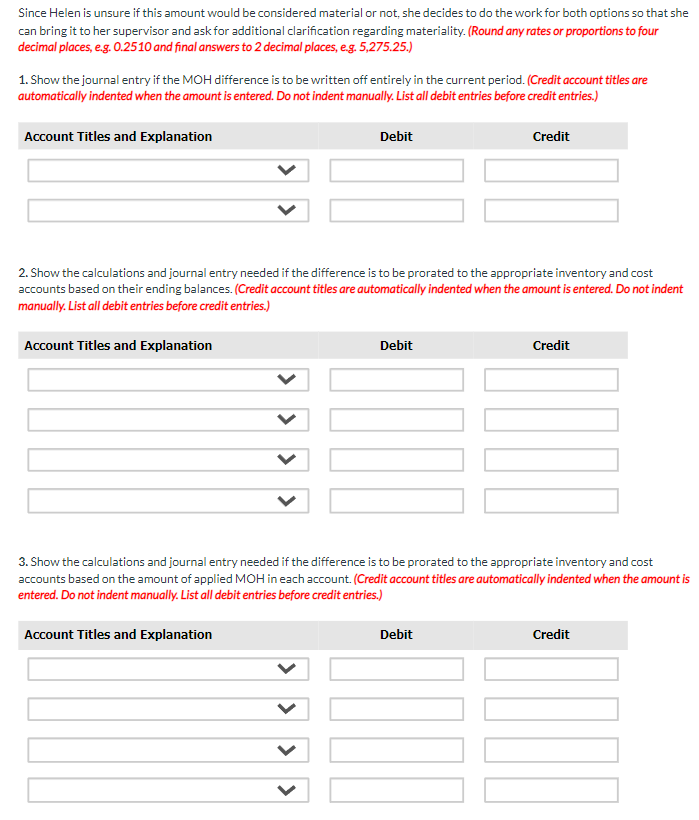

It was the end of the fiscal year, and Helen was evaluating her company's MOH. Since her company uses normal costing and applies overhead based on direct labor hours, she anticipated a difference in the amount of MOH that was applied compared to the amount that was actually incurred. Indeed, there was a difference-and it seemed huge! Here is what she saw within the MOH account, as well as detail from the beginning of the year when the budgeted MOH rate was determined: Helen is aware of the following company policy regarding any MOH difference: "any MOH difference that is deemed 'immaterial' should be written off in the current period; any MOH difference that was deemed 'material' should be prorated to the appropriate accounts 50 as to better approximate actual costs." Helen also has the following additional detail regarding the inventory accounts. While she does not yet have a clear understanding of what amount might be considered "material," 3,050 knows she has to first calculate the MOH balance. Since Helen is unsure if this amount would be considered material or not, she decides to do the work for both options so that she can bring it to her supervisor and ask for additional clarification regarding materiality. (Round any rates or proportions to four decimal places, e.g. 0.2510 and final answers to 2 decimal places, e.g. 5,275.25.) 1. Show the journal entry if the MOH difference is to be written off entirely in the current period. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) 2. Show the calculations and journal entry needed if the difference is to be prorated to the appropriate inventory and cost accounts based on their ending balances. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) 3. Show the calculations and journal entry needed if the difference is to be prorated to the appropriate inventory and cost accounts based on the amount of applied MOH in each account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started