Can I get help with these question? Ill thumbs up if correct :). Thanks so much beforehand.

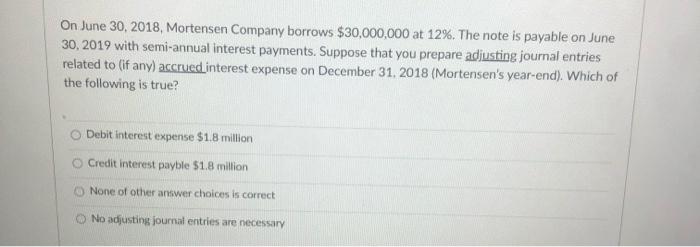

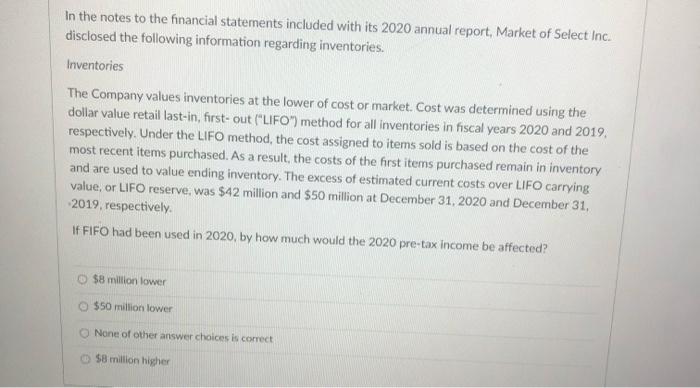

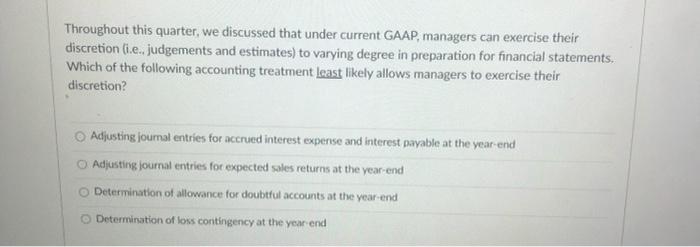

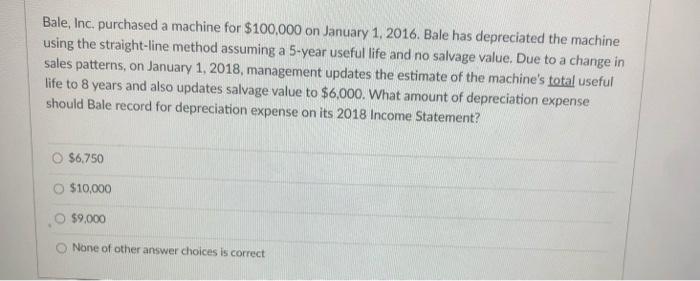

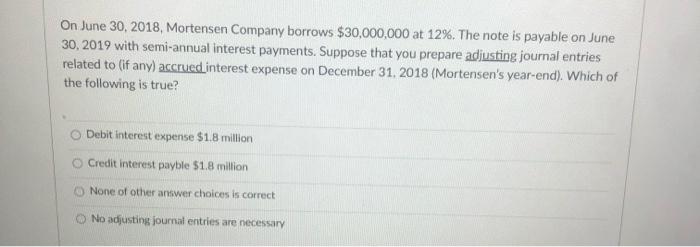

In the notes to the financial statements included with its 2020 annual report, Market of Select Inc. disclosed the following information regarding inventories. Inventories The Company values inventories at the lower of cost or market. Cost was determined using the dollar value retail last-in, first-out ("LIFO) method for all inventories in fiscal years 2020 and 2019, respectively. Under the LIFO method, the cost assigned to items sold is based on the cost of the most recent items purchased. As a result, the costs of the first items purchased remain in inventory and are used to value ending inventory. The excess of estimated current costs over LIFO carrying value, or LIFO reserve, was $42 million and $50 million at December 31, 2020 and December 31, 2019, respectively If FIFO had been used in 2020, by how much would the 2020 pre-tax income be affected? $8 million lower $50 million lower None of other answer choices is correct $8 million higher Throughout this quarter, we discussed that under current GAAP, managers can exercise their discretion i.e.. judgements and estimates) to varying degree in preparation for financial statements, Which of the following accounting treatment least likely allows managers to exercise their discretion? Adjusting joumal entries for accrued interest expense and interest payable at the year-end Adjusting journal entries for expected sales returns at the year-end Determination of allowance for doubtful accounts at the year-end Determination of loss contingency at the year end Bale, Inc. purchased a machine for $100,000 on January 1, 2016. Bale has depreciated the machine using the straight-line method assuming a 5-year useful life and no salvage value. Due to a change in sales patterns, on January 1, 2018, management updates the estimate of the machine's total useful life to 8 years and also updates salvage value to $6,000. What amount of depreciation expense should Bale record for depreciation expense on its 2018 Income Statement? O $6.750 O $10,000 $9.000 None of other answer choices is correct On June 30, 2018, Mortensen Company borrows $30,000,000 at 12%. The note is payable on June 30, 2019 with semi-annual interest payments. Suppose that you prepare adjusting journal entries related to (if any) accrued interest expense on December 31, 2018 (Mortensen's year-end). Which of the following is true? Debit interest expense $1.8 million Credit interest payble $1.8 million None of other answer choices is correct No adjusting journal entries are necessary

Can I get help with these question? Ill thumbs up if correct :). Thanks so much beforehand.

Can I get help with these question? Ill thumbs up if correct :). Thanks so much beforehand.