Question: Study the following scenario and answer the question that follows: Edgo Ltd The managers of Edgo Ltd, a clothing retailer with fifty stores throughout

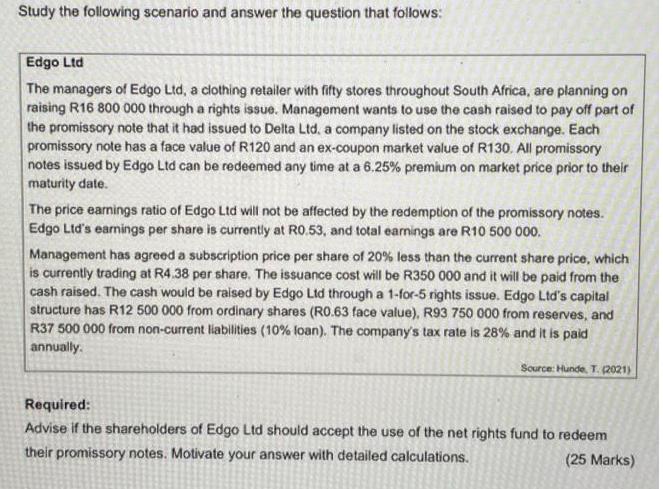

Study the following scenario and answer the question that follows: Edgo Ltd The managers of Edgo Ltd, a clothing retailer with fifty stores throughout South Africa, are planning on raising R16 800 000 through a rights issue. Management wants to use the cash raised to pay off part of the promissory note that it had issued to Delta Ltd. a company listed on the stock exchange. Each promissory note has a face value of R120 and an ex-coupon market value of R130. All promissory notes issued by Edgo Ltd can be redeemed any time at a 6.25% premium on market price prior to their maturity date. The price earnings ratio of Edgo Ltd will not be affected by the redemption of the promissory notes. Edgo Ltd's earnings per share is currently at R0.53, and total earnings are R10 500 000. Management has agreed a subscription price per share of 20% less than the current share price, which is currently trading at R4.38 per share. The issuance cost will be R350 000 and it will be paid from the cash raised. The cash would be raised by Edgo Ltd through a 1-for-5 rights issue. Edgo Ltd's capital structure has R12 500 000 from ordinary shares (R0.63 face value), R93 750 000 from reserves, and R37 500 000 from non-current liabilities (10% loan). The company's tax rate is 28% and it is paid annually. Source: Hunde, T. (2021) Required: Advise if the shareholders of Edgo Ltd should accept the use of the net rights fund to redeem their promissory notes. Motivate your answer with detailed calculations. (25 Marks)

Step by Step Solution

3.61 Rating (148 Votes )

There are 3 Steps involved in it

The shareholders of Ed go L id should accept the use of the net rights ... View full answer

Get step-by-step solutions from verified subject matter experts