Answered step by step

Verified Expert Solution

Question

1 Approved Answer

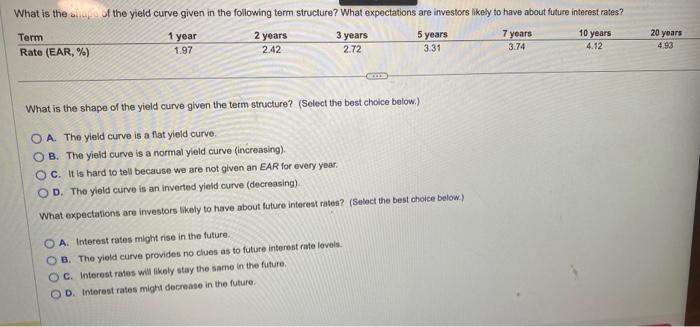

can i get help with this please? What is the shape of the yield curve given the term structure? (Select the best choice below.) A.

can i get help with this please?

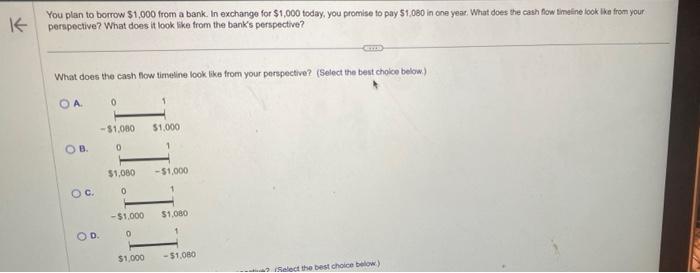

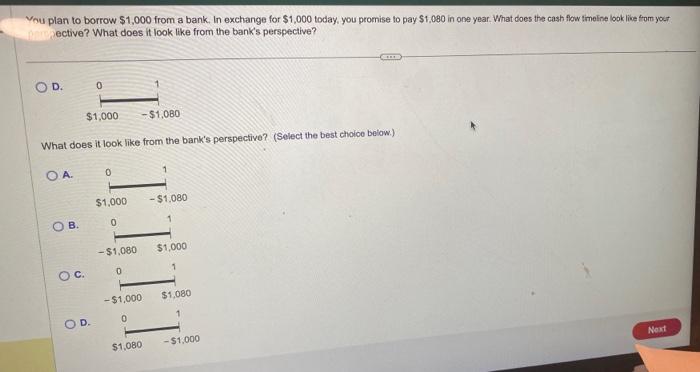

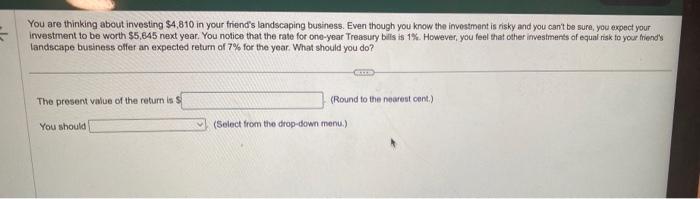

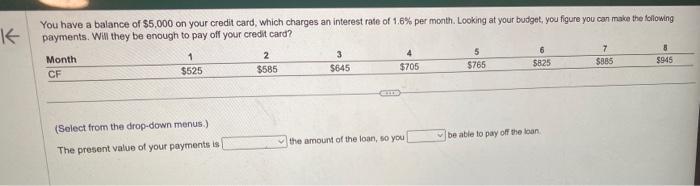

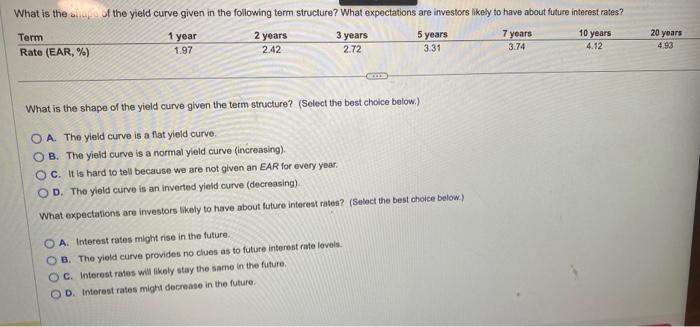

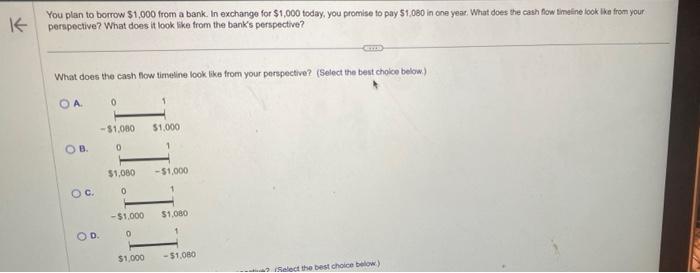

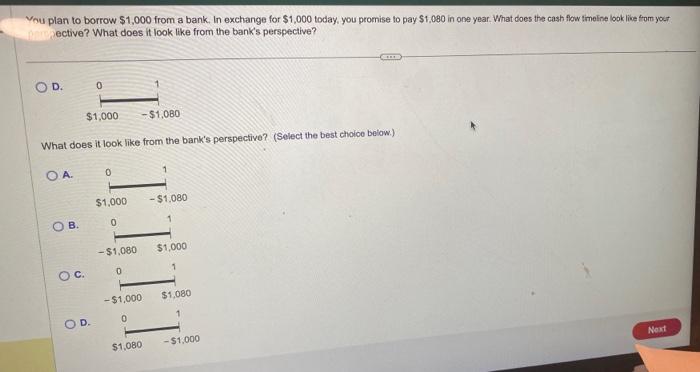

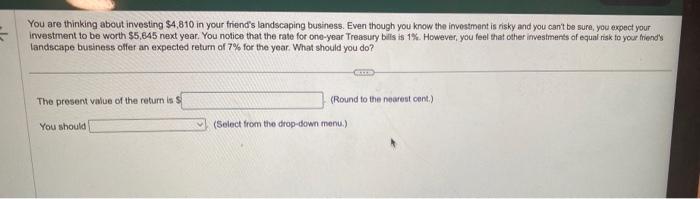

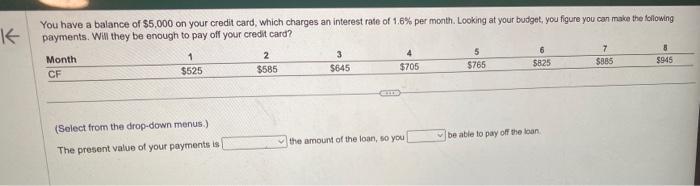

What is the shape of the yield curve given the term structure? (Select the best choice below.) A. The yield curve is a flat yield curve, B. The yield curve is a normal yield curve (increasing). C. It is hard to tell because we are not given an EAR for every year. D. The yield curve is an inverted yield curve (decreasing). What expectations are investors likely to have about future interest rates? (Salect the best choice below) A. Interest rates might rise in the future. B. The yield curve provides no clues as to future interest rate levels: C. Interest rates will likely stay the same in the future. D. Interest rates might decrease in the future. You plan to borrow $1,000 from a bank. In exchange for $1,000 today, you promise to pay $1,080 in one yeac. What does the cash fow tindine look like from your: perspective? What does it look like from the bank's perspective? What does the cash flow tirveline look like from your parspective? (Select the best choice below.) isu plan to borrow $1,000 from a bank. In exchange for $1,000 today, you promise to pay $1,080 in one year. What does the cash flow timeine look like tom yout ective? What does it look like from the bank's perspective? D. What does it look like from the bank's perspective? (Select the best choioe betow.) B. c. D. You are thinking about investing \$4,810 in your friend's landscaping business. Even though you know the investment is risky and you cant be sure, you expect your investment to be worth $5,645 next year. You notice that the rate for orie-year Treasury bils is 1%. However, you feel that other irmestments of equal risk to your triend's landiscape business offer an expected return of 7% for the year. What should you do? The present value of the return is : (Round to the nearest cent.) You should (Select from the drop-down menu.) You have a balance of $5,000 on your credit card, which charges an interest rate of 1.6% per month. Looking at your budget, you figure you car make the following payments. Wis they be enough to pay off your credit card? (Select from the drop-down menus.) The present value of your payments is the amount of the loan, so you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started