Can I get some help with the wrong ones.

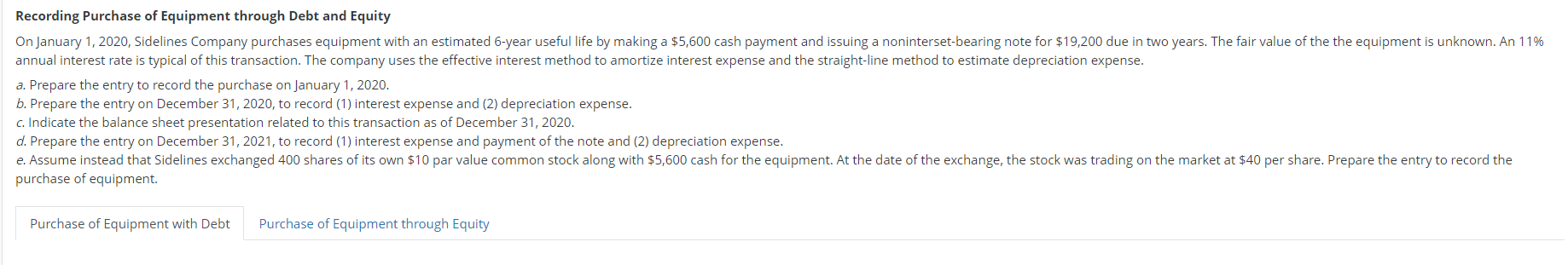

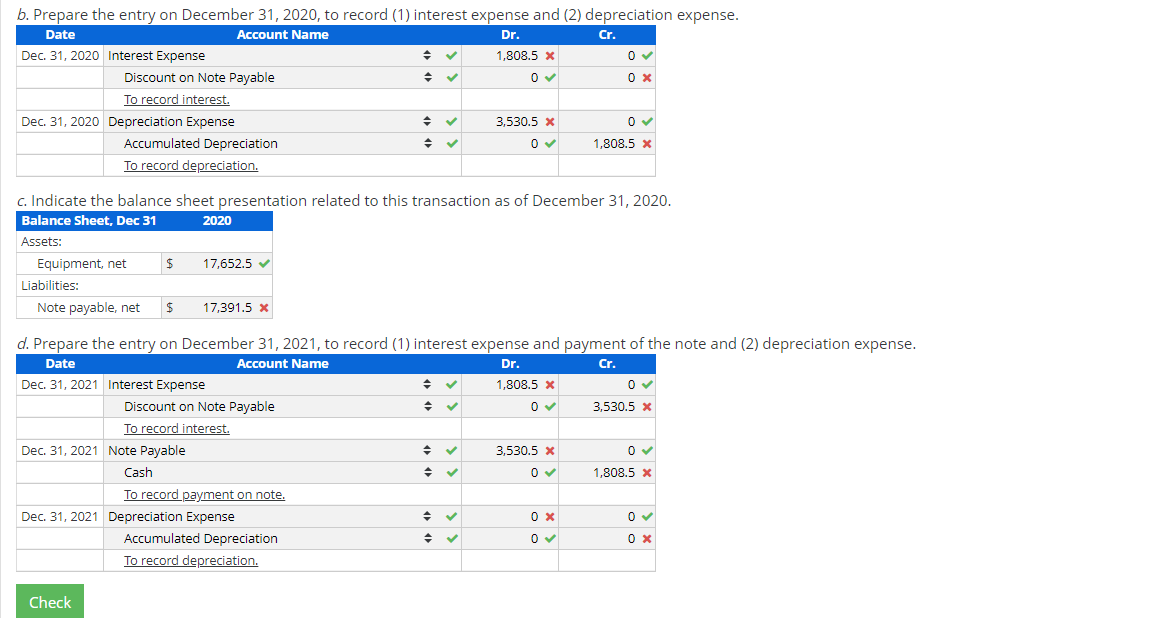

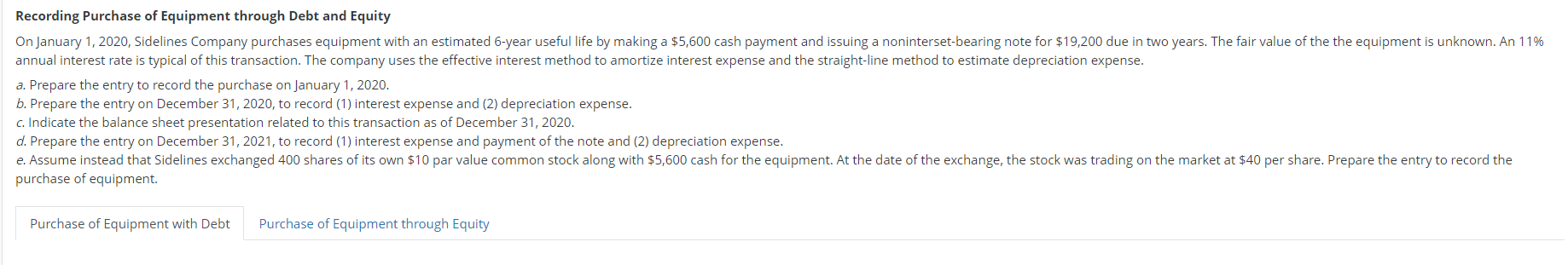

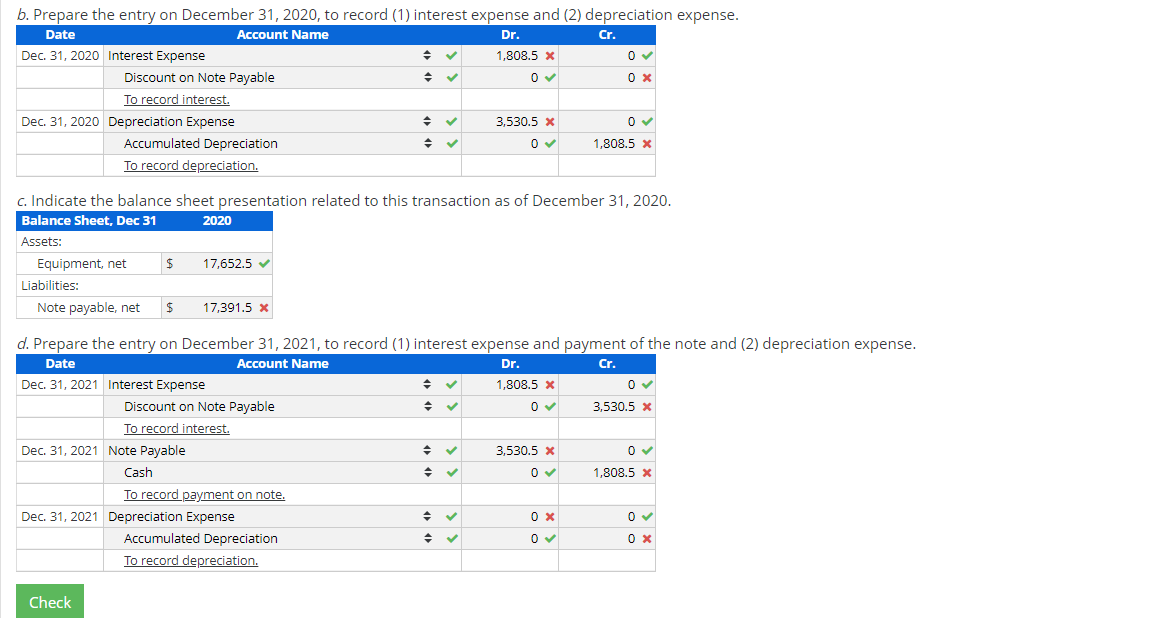

Recording Purchase of Equipment through Debt and Equity On January 1, 2020, Sidelines Company purchases equipment with an estimated 6-year useful life by making a $5,600 cash payment and issuing a noninterset-bearing note for $19,200 due in two years. The fair value of the the equipment is unknown. An 11% annual interest rate is typical of this transaction. The company uses the effective interest method to amortize interest expense and the straight-line method to estimate depreciation expense. a. Prepare the entry to record the purchase on January 1, 2020. b. Prepare the entry on December 31, 2020, to record (1) interest expense and (2) depreciation expense. c. Indicate the balance sheet presentation related to this transaction as of December 31, 2020. d. Prepare the entry on December 31, 2021, to record (1) interest expense and payment of the note and (2) depreciation expense. e. Assume instead that Sidelines exchanged 400 shares of its own $10 par value common stock along with $5,600 cash for the equipment. At the date of the exchange, the stock was trading on the market at $40 per share. Prepare the entry to record the purchase of equipment. Purchase of Equipment with Debt Purchase of Equipment through Equity cr. b. Prepare the entry on December 31, 2020, to record (1) interest expense and (2) depreciation expense. Date Account Name Dr. Dec 31, 2020 Interest Expense 1,808.5 X o Discount on Note Payable 0 0 x To record interest. Dec 31, 2020 Depreciation Expense + 3,530.5 x Accumulated Depreciation 1,808.5 x To record depreciation. c. Indicate the balance sheet presentation related to this transaction as of December 31, 2020. Balance Sheet, Dec 31 2020 Assets: Equipment, net $ 17,652.5 Liabilities: Note payable, net $ 17,391.5 x d. Prepare the entry on December 31, 2021, to record (1) interest expense and payment of the note and (2) depreciation expense. Date Account Name Dr. Cr. Dec 31, 2021 Interest Expense 1,808.5 x 0 Discount on Note Payable 0 3,530.5 x To record interest. Dec 31, 2021 Note Payable 3,530.5 x 0 Cash 1,808.5 x To record payment on note. Dec 31, 2021 Depreciation Expense OX 0 Accumulated Depreciation 0 OX To record depreciation. . Check