Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can I have some help with A B C & D please 22% in 2023 and is expected to be subject to an income tax

Can I have some help with A B C & D please

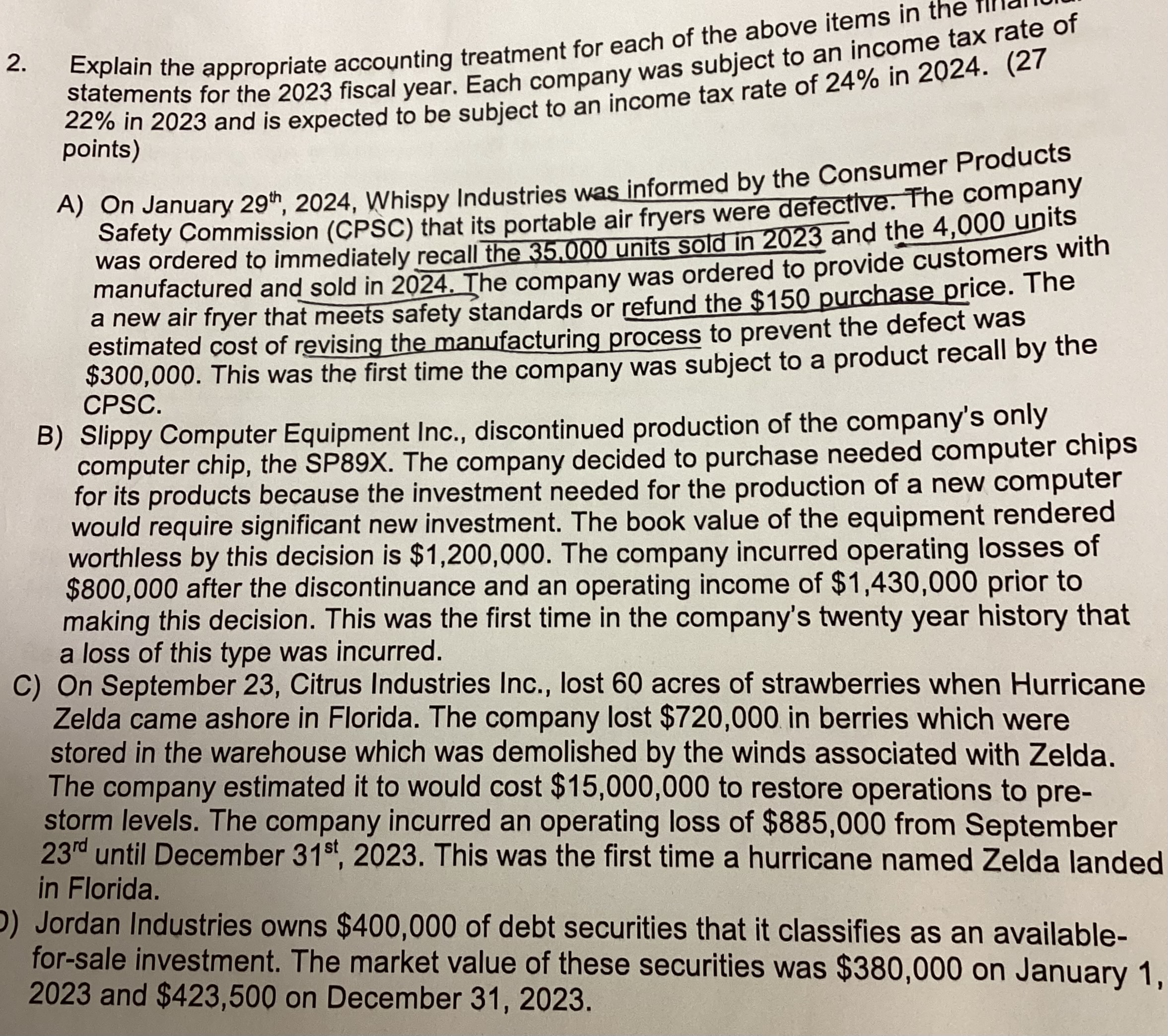

22% in 2023 and is expected to be subject to an income tax rate of 24% in 2024 . points) A) On January 29th,2024, Whispy Industries was informed by the Consumer Products Safety Commission (CPSC) that its portable air fryers were defective. The company was ordered to immediately recall the 35.000 units sold in 2023 and the 4,000 units manufactured and sold in 2024. The company was ordered to provide customers with a new air fryer that meets safety standards or refund the $150 purchase price. The estimated cost of revising the manufacturing process to prevent the defect was $300,000. This was the first time the company was subject to a product recall by the CPSC. B) Slippy Computer Equipment Inc., discontinued production of the company's only computer chip, the SP89X. The company decided to purchase needed computer chips for its products because the investment needed for the production of a new computer would require significant new investment. The book value of the equipment rendered worthless by this decision is $1,200,000. The company incurred operating losses of $800,000 after the discontinuance and an operating income of $1,430,000 prior to making this decision. This was the first time in the company's twenty year history that a loss of this type was incurred. C) On September 23, Citrus Industries Inc., lost 60 acres of strawberries when Hurricane Zelda came ashore in Florida. The company lost $720,000 in berries which were stored in the warehouse which was demolished by the winds associated with Zelda. The company estimated it to would cost $15,000,000 to restore operations to prestorm levels. The company incurred an operating loss of $885,000 from September 23rd until December 31st,2023. This was the first time a hurricane named Zelda landed in Florida. Jordan Industries owns $400,000 of debt securities that it classifies as an avallablefor-sale investment. The market value of these securities was $380,000 on January 1 2023 and $423,500 on December 31, 2023. 22% in 2023 and is expected to be subject to an income tax rate of 24% in 2024 . points) A) On January 29th,2024, Whispy Industries was informed by the Consumer Products Safety Commission (CPSC) that its portable air fryers were defective. The company was ordered to immediately recall the 35.000 units sold in 2023 and the 4,000 units manufactured and sold in 2024. The company was ordered to provide customers with a new air fryer that meets safety standards or refund the $150 purchase price. The estimated cost of revising the manufacturing process to prevent the defect was $300,000. This was the first time the company was subject to a product recall by the CPSC. B) Slippy Computer Equipment Inc., discontinued production of the company's only computer chip, the SP89X. The company decided to purchase needed computer chips for its products because the investment needed for the production of a new computer would require significant new investment. The book value of the equipment rendered worthless by this decision is $1,200,000. The company incurred operating losses of $800,000 after the discontinuance and an operating income of $1,430,000 prior to making this decision. This was the first time in the company's twenty year history that a loss of this type was incurred. C) On September 23, Citrus Industries Inc., lost 60 acres of strawberries when Hurricane Zelda came ashore in Florida. The company lost $720,000 in berries which were stored in the warehouse which was demolished by the winds associated with Zelda. The company estimated it to would cost $15,000,000 to restore operations to prestorm levels. The company incurred an operating loss of $885,000 from September 23rd until December 31st,2023. This was the first time a hurricane named Zelda landed in Florida. Jordan Industries owns $400,000 of debt securities that it classifies as an avallablefor-sale investment. The market value of these securities was $380,000 on January 1 2023 and $423,500 on December 31, 2023

22% in 2023 and is expected to be subject to an income tax rate of 24% in 2024 . points) A) On January 29th,2024, Whispy Industries was informed by the Consumer Products Safety Commission (CPSC) that its portable air fryers were defective. The company was ordered to immediately recall the 35.000 units sold in 2023 and the 4,000 units manufactured and sold in 2024. The company was ordered to provide customers with a new air fryer that meets safety standards or refund the $150 purchase price. The estimated cost of revising the manufacturing process to prevent the defect was $300,000. This was the first time the company was subject to a product recall by the CPSC. B) Slippy Computer Equipment Inc., discontinued production of the company's only computer chip, the SP89X. The company decided to purchase needed computer chips for its products because the investment needed for the production of a new computer would require significant new investment. The book value of the equipment rendered worthless by this decision is $1,200,000. The company incurred operating losses of $800,000 after the discontinuance and an operating income of $1,430,000 prior to making this decision. This was the first time in the company's twenty year history that a loss of this type was incurred. C) On September 23, Citrus Industries Inc., lost 60 acres of strawberries when Hurricane Zelda came ashore in Florida. The company lost $720,000 in berries which were stored in the warehouse which was demolished by the winds associated with Zelda. The company estimated it to would cost $15,000,000 to restore operations to prestorm levels. The company incurred an operating loss of $885,000 from September 23rd until December 31st,2023. This was the first time a hurricane named Zelda landed in Florida. Jordan Industries owns $400,000 of debt securities that it classifies as an avallablefor-sale investment. The market value of these securities was $380,000 on January 1 2023 and $423,500 on December 31, 2023. 22% in 2023 and is expected to be subject to an income tax rate of 24% in 2024 . points) A) On January 29th,2024, Whispy Industries was informed by the Consumer Products Safety Commission (CPSC) that its portable air fryers were defective. The company was ordered to immediately recall the 35.000 units sold in 2023 and the 4,000 units manufactured and sold in 2024. The company was ordered to provide customers with a new air fryer that meets safety standards or refund the $150 purchase price. The estimated cost of revising the manufacturing process to prevent the defect was $300,000. This was the first time the company was subject to a product recall by the CPSC. B) Slippy Computer Equipment Inc., discontinued production of the company's only computer chip, the SP89X. The company decided to purchase needed computer chips for its products because the investment needed for the production of a new computer would require significant new investment. The book value of the equipment rendered worthless by this decision is $1,200,000. The company incurred operating losses of $800,000 after the discontinuance and an operating income of $1,430,000 prior to making this decision. This was the first time in the company's twenty year history that a loss of this type was incurred. C) On September 23, Citrus Industries Inc., lost 60 acres of strawberries when Hurricane Zelda came ashore in Florida. The company lost $720,000 in berries which were stored in the warehouse which was demolished by the winds associated with Zelda. The company estimated it to would cost $15,000,000 to restore operations to prestorm levels. The company incurred an operating loss of $885,000 from September 23rd until December 31st,2023. This was the first time a hurricane named Zelda landed in Florida. Jordan Industries owns $400,000 of debt securities that it classifies as an avallablefor-sale investment. The market value of these securities was $380,000 on January 1 2023 and $423,500 on December 31, 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started