Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can i please get a detailed explanation on how this question is answered and show the calculations!!!! with all the formulas 3. On January 01,

can i please get a detailed explanation on how this question is answered and show the calculations!!!! with all the formulas

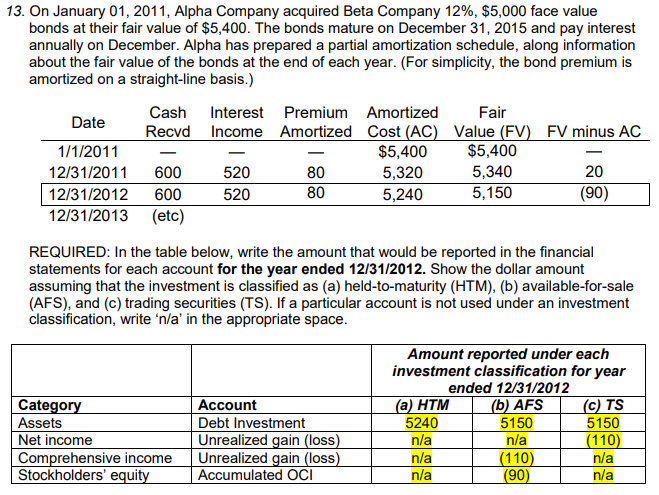

3. On January 01, 2011, Alpha Company acquired Beta Company 12%,$5,000 face value bonds at their fair value of $5,400. The bonds mature on December 31,2015 and pay interest annually on December. Alpha has prepared a partial amortization schedule, along information about the fair value of the bonds at the end of each year. (For simplicity, the bond premium is amortized on a straight-line basis.) REQUIRED: In the table below, write the amount that would be reported in the financial statements for each account for the year ended 12/31/2012. Show the dollar amount assuming that the investment is classified as (a) held-to-maturity (HTM), (b) available-for-sale (AFS), and (c) trading securities (TS). If a particular account is not used under an investment classification, write 'n/a' in the appropriate space. 3. On January 01, 2011, Alpha Company acquired Beta Company 12%,$5,000 face value bonds at their fair value of $5,400. The bonds mature on December 31,2015 and pay interest annually on December. Alpha has prepared a partial amortization schedule, along information about the fair value of the bonds at the end of each year. (For simplicity, the bond premium is amortized on a straight-line basis.) REQUIRED: In the table below, write the amount that would be reported in the financial statements for each account for the year ended 12/31/2012. Show the dollar amount assuming that the investment is classified as (a) held-to-maturity (HTM), (b) available-for-sale (AFS), and (c) trading securities (TS). If a particular account is not used under an investment classification, write 'n/a' in the appropriate spaceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started