Answered step by step

Verified Expert Solution

Question

1 Approved Answer

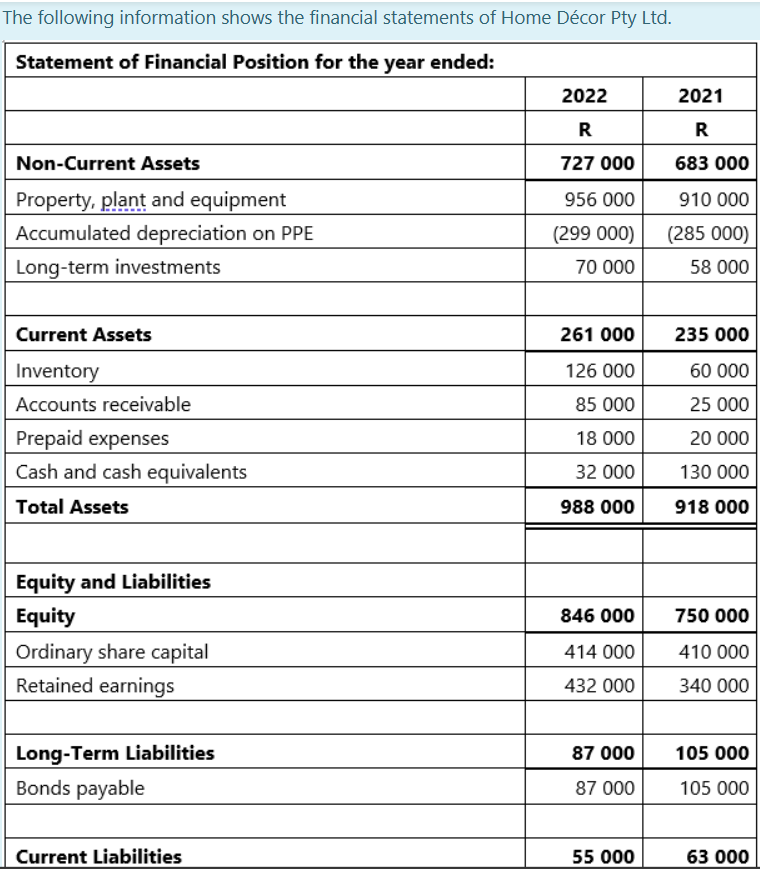

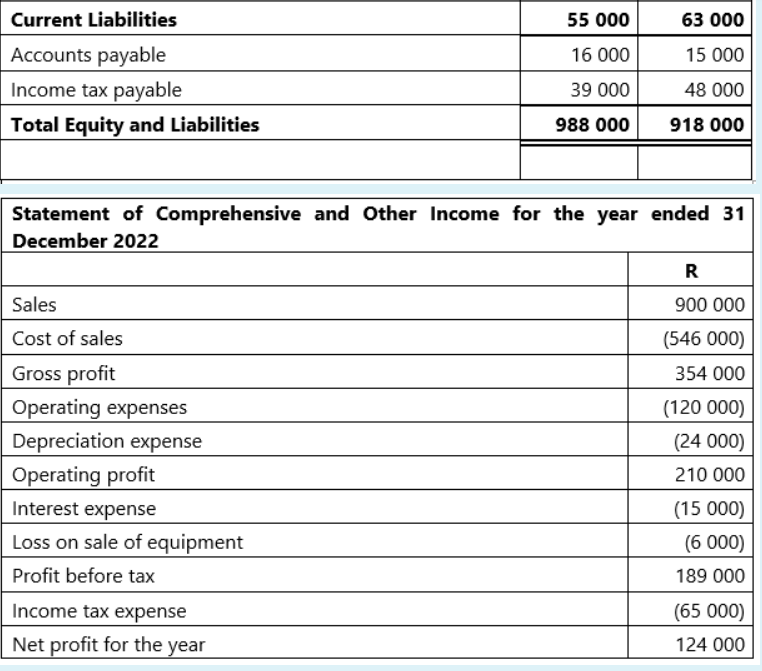

can i please get help The following information shows the financial statements of Home Dcor Pty Ltd. begin{tabular}{|c|c|c|} hline multicolumn{3}{|c|}{ Statement of Financial Position for

can i please get help

The following information shows the financial statements of Home Dcor Pty Ltd. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Statement of Financial Position for the year ended: } \\ \hline & 2022 & 2021 \\ \hline & R & R \\ \hline Non-Current Assets & 727000 & 683000 \\ \hline Property, plant and equipment & 956000 & 910000 \\ \hline Accumulated depreciation on PPE & (299000) & (285000) \\ \hline Long-term investments & 70000 & 58000 \\ \hline Current Assets & 261000 & 235000 \\ \hline Inventory & 126000 & 60000 \\ \hline Accounts receivable & 85000 & 25000 \\ \hline Prepaid expenses & 18000 & 20000 \\ \hline Cash and cash equivalents & 32000 & 130000 \\ \hline Total Assets & 988000 & 918000 \\ \hline \multicolumn{3}{|l|}{ Equity and Liabilities } \\ \hline Equity & 846000 & 750000 \\ \hline Ordinary share capital & 414000 & 410000 \\ \hline Retained earnings & 432000 & 340000 \\ \hline Long-Term Liabilities & 87000 & 105000 \\ \hline Bonds payable & 87000 & 105000 \\ \hline Current Liabilities & 55000 & 63000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Current Liabilities & 55000 & 63000 \\ \hline Accounts payable & 16000 & 15000 \\ \hline Income tax payable & 39000 & 48000 \\ \hline Total Equity and Liabilities & 988000 & 918000 \\ \hline \multicolumn{3}{|c|}{\begin{tabular}{l} Statement of Comprehensive and Other Income for the year ended 31 \\ December 2022 \end{tabular}} \\ \hline & & R \\ \hline Sales & & 900000 \\ \hline Cost of sales & & (546000) \\ \hline Gross profit & & 354000 \\ \hline Operating expenses & & (120000) \\ \hline Depreciation expense & & (24000) \\ \hline Operating profit & & 210000 \\ \hline Interest expense & & (15000) \\ \hline Loss on sale of equipment & & (6000) \\ \hline Profit before tax & & 189000 \\ \hline Income tax expense & & (65000) \\ \hline Net profit for the year & & 124000 \\ \hline \end{tabular} Additional information: i) Sold equipment with a book value of R11 000 (R21,000 cost - R10,000 accumulated depreciation) for R5 000 cash. ii) Purchased equipment for R67 000 cash. iii) Declared and paid R32 000 in cash dividends. Require: Use the information provided to prepare the statement of cash flows using the indirect method. (25) The following information shows the financial statements of Home Dcor Pty Ltd. \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Statement of Financial Position for the year ended: } \\ \hline & 2022 & 2021 \\ \hline & R & R \\ \hline Non-Current Assets & 727000 & 683000 \\ \hline Property, plant and equipment & 956000 & 910000 \\ \hline Accumulated depreciation on PPE & (299000) & (285000) \\ \hline Long-term investments & 70000 & 58000 \\ \hline Current Assets & 261000 & 235000 \\ \hline Inventory & 126000 & 60000 \\ \hline Accounts receivable & 85000 & 25000 \\ \hline Prepaid expenses & 18000 & 20000 \\ \hline Cash and cash equivalents & 32000 & 130000 \\ \hline Total Assets & 988000 & 918000 \\ \hline \multicolumn{3}{|l|}{ Equity and Liabilities } \\ \hline Equity & 846000 & 750000 \\ \hline Ordinary share capital & 414000 & 410000 \\ \hline Retained earnings & 432000 & 340000 \\ \hline Long-Term Liabilities & 87000 & 105000 \\ \hline Bonds payable & 87000 & 105000 \\ \hline Current Liabilities & 55000 & 63000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Current Liabilities & 55000 & 63000 \\ \hline Accounts payable & 16000 & 15000 \\ \hline Income tax payable & 39000 & 48000 \\ \hline Total Equity and Liabilities & 988000 & 918000 \\ \hline \multicolumn{3}{|c|}{\begin{tabular}{l} Statement of Comprehensive and Other Income for the year ended 31 \\ December 2022 \end{tabular}} \\ \hline & & R \\ \hline Sales & & 900000 \\ \hline Cost of sales & & (546000) \\ \hline Gross profit & & 354000 \\ \hline Operating expenses & & (120000) \\ \hline Depreciation expense & & (24000) \\ \hline Operating profit & & 210000 \\ \hline Interest expense & & (15000) \\ \hline Loss on sale of equipment & & (6000) \\ \hline Profit before tax & & 189000 \\ \hline Income tax expense & & (65000) \\ \hline Net profit for the year & & 124000 \\ \hline \end{tabular} Additional information: i) Sold equipment with a book value of R11 000 (R21,000 cost - R10,000 accumulated depreciation) for R5 000 cash. ii) Purchased equipment for R67 000 cash. iii) Declared and paid R32 000 in cash dividends. Require: Use the information provided to prepare the statement of cash flows using the indirect method. (25)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started