Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can please help with these question? 3. An investor purchases a call at a price of $3.20. The exercise price is $40.00. If the current

can please help with these question?

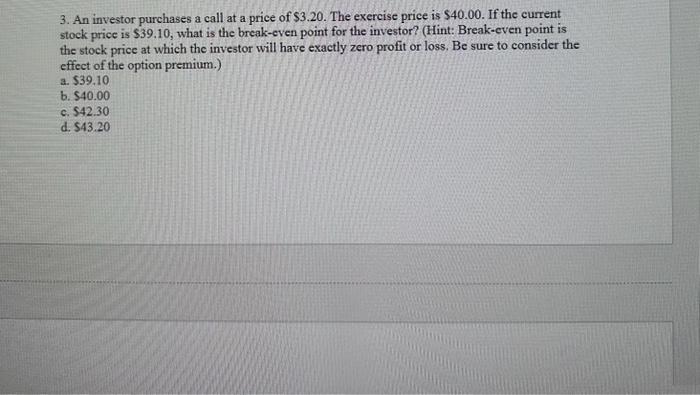

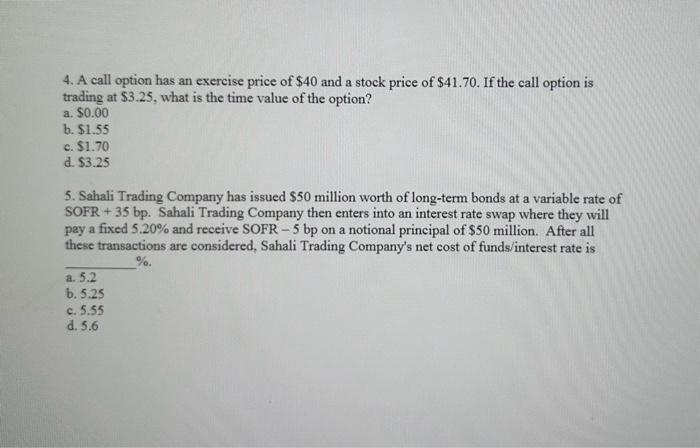

3. An investor purchases a call at a price of $3.20. The exercise price is $40.00. If the current stock price is $39.10, what is the break-even point for the investor? (Hint: Break-even point is the stock price at which the investor will have exactly zero profit or loss. Be sure to consider the effect of the option premium.) a. $39.10 b. $40.00 c. $42.30 d. $43.20 4. A call option has an exercise price of $40 and a stock price of $41.70. If the call option is trading at $3.25, what is the time value of the option? a. $0.00 b. $1.55 c. $1.70 d. $3.25 5. Sahali Trading Company has issued $50 million worth of long-term bonds at a variable rate of SOFR +35 bp. Sahali Trading Company then enters into an interest rate swap where they will pay a fixed 5.20% and receive SOFR -5 bp on a notional principal of $50 million. After all these transactions are considered, Sahali Trading Company's net cost of funds/interest rate is %. a. 5.2 b. 5.25 c. 5.55 d. 5.6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started