Answered step by step

Verified Expert Solution

Question

1 Approved Answer

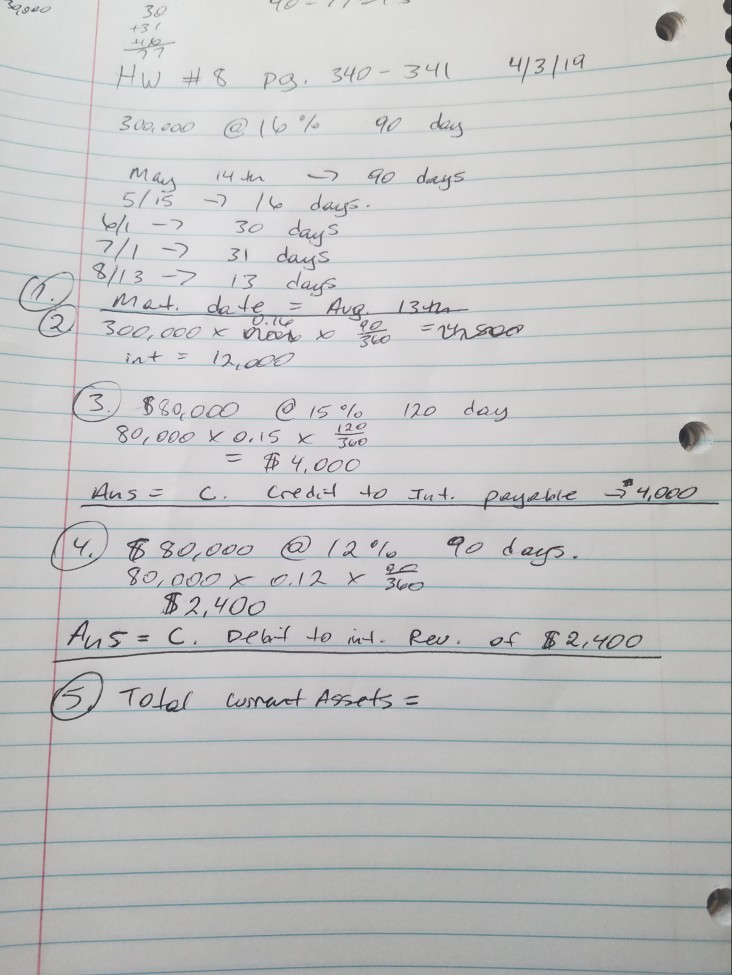

Can somebody check my answers for me? I believe 1, 3, and 4 are correct but I just had a bit of trouble with 2

Can somebody check my answers for me? I believe 1, 3, and 4 are correct but I just had a bit of trouble with 2 and 5.

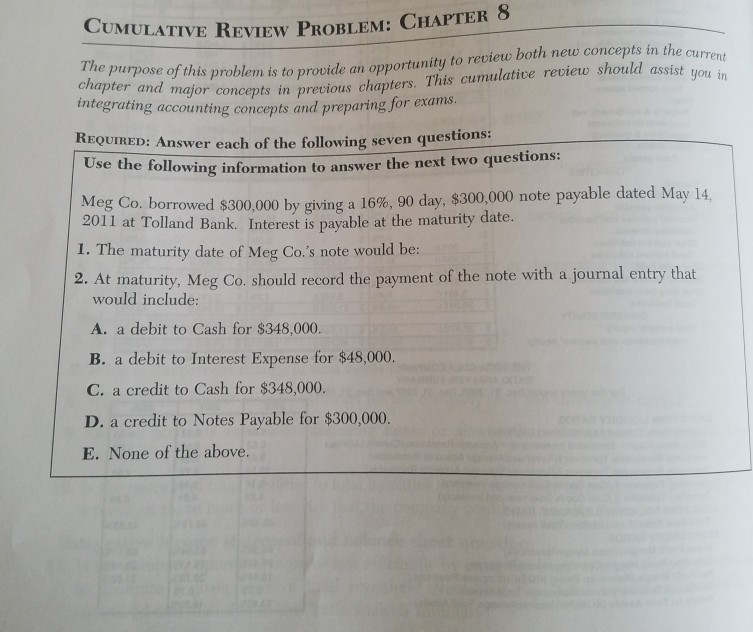

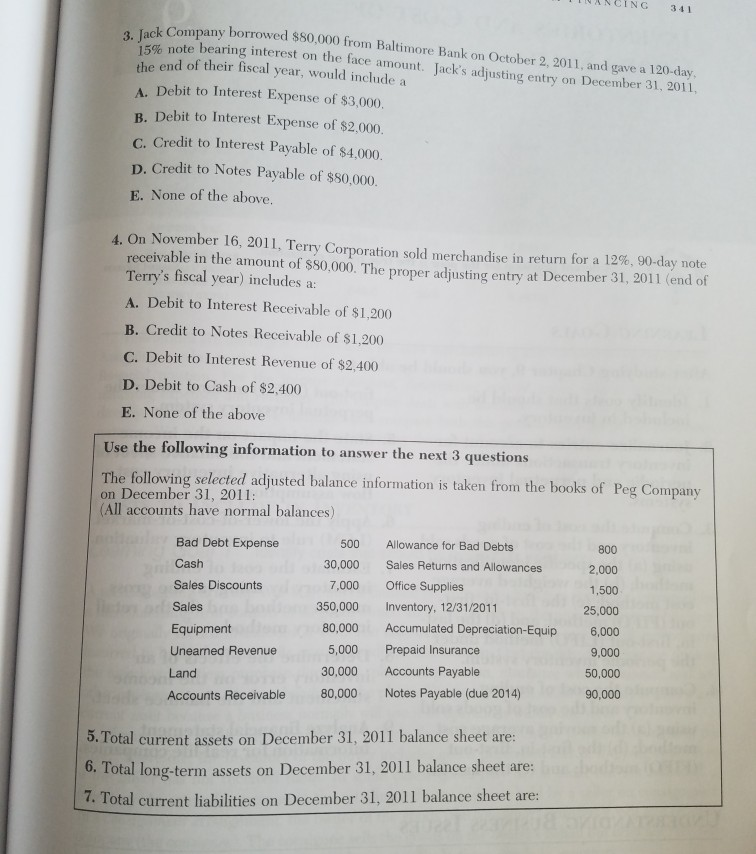

TIVE REVIEW PROBLEM: CHAPTER 8 problem is to provide an opportunity to review both new concepts in t ting concepts and preparing for exams. ajor concepts in precious chapters. This cumulative revie should assist yor Answer each of the following seven questions: olowing information to answer the next two questions: or rowed $300,000 by giving a 16%, 90 day, $300,000 note payable dated May 14, iew should assist you in chapter and major concepts in previous chapters integrating accoun REQUIRED: Meg Co. b 2011 at Tolland Bank. Interest is payable at the maturity date. I. The maturity date of Meg Co.'s note would be: 2. At maturity, Meg Co. should record the payment of the note with a journal entry that would include: A. a debit to Cash for $348,000. B. a debit to Interest Expense for $48,000. C. a credit to Cash for $348,000. D. a credit to Notes Payable for $300,000. E. None of the above ANCING 341 Company borrowed $50,000 from Baltimore Bank on October 2, 2011, and gave a 120-day 3. Jack 15% note earing interest on the face amount ack's adjusting entry on December 31, 2011, the end of their fiscal year, would include a A. Debit to Interest Expense of $3,000. B. Debit to Interest Expense of $2,000 c. Credit to Interest Payable of $4,000. D. Credit to Notes Payable of $80,000. E. None of the above. 4. On November 16, 2011, Terry Corporation sold merchandise in return for a 12%, 90-day note receivable in the amount of $80,000. The proper adjusting entry at December 31, 2011 (end of Terry's fiscal year) includes a: A. Debit to Interest Receivable of $1,200 B. Credit to Notes Receivable of $1,200 C. Debit to Interest Revenue of $2,400 D. Debit to Cash of $2,400 E. None of the above Use the following information to answer the next 3 questions The following selected adjusted balance information is taken from the books of Peg Company on December 31, 2011: (All accounts have normal balances) Bad Debt Expense Cash Sales Discounts Sales Equipment Unearned Revenue Land Accounts Receivable 500 Allowance for Bad Debts 800 2,000 30,000 Sales Returns and Allowances 7,000 Office Supplies 25,000 80,000 Accumulated Depreciation-Equip 6,000 9,000 50,000 90,000 350,000 Inventory, 12/31/2011 5,000 Prepaid Insurance 30,000 Accounts Payable 80,000 Notes Payable (due 2014) 5. Total current assets on December 31, 2011 balance sheet are: 6. Total long-term assets on December 31, 2011 balance sheet are: 7. Total current liabilities on December 31, 2011 balance sheet are: asao 30 t3 ( 7 340-34 sw.ao @) (C) %. %, das 55l day days daus 7/123 8 2,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started