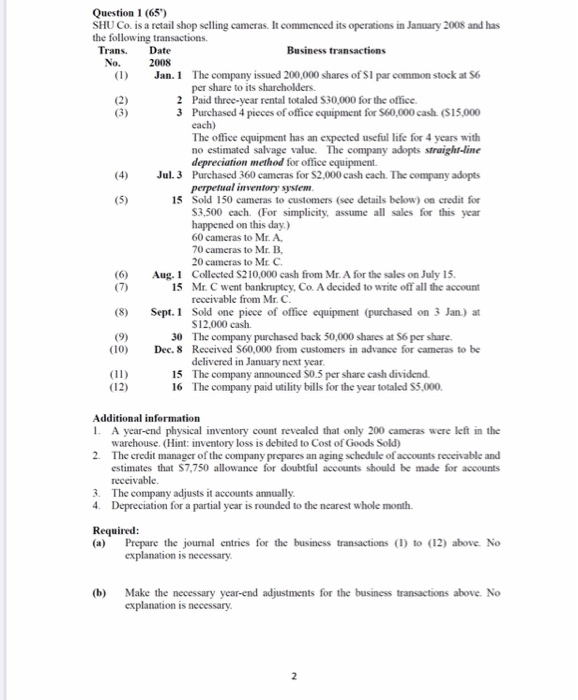

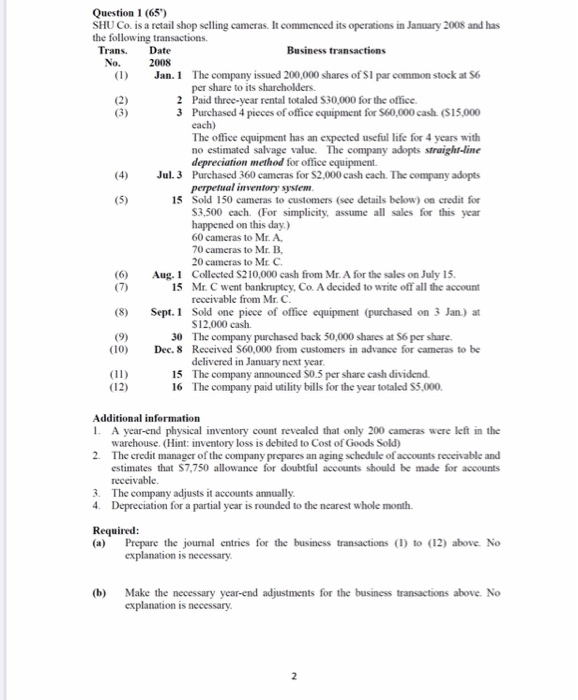

can somebody solve this 2 question please

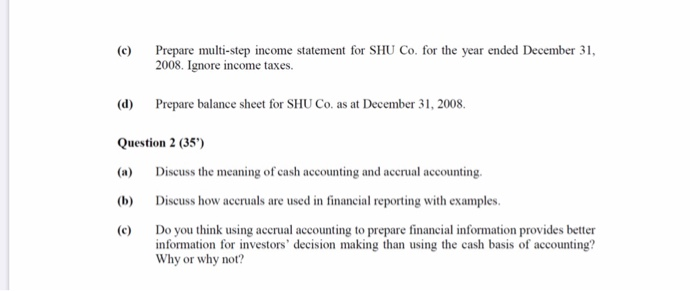

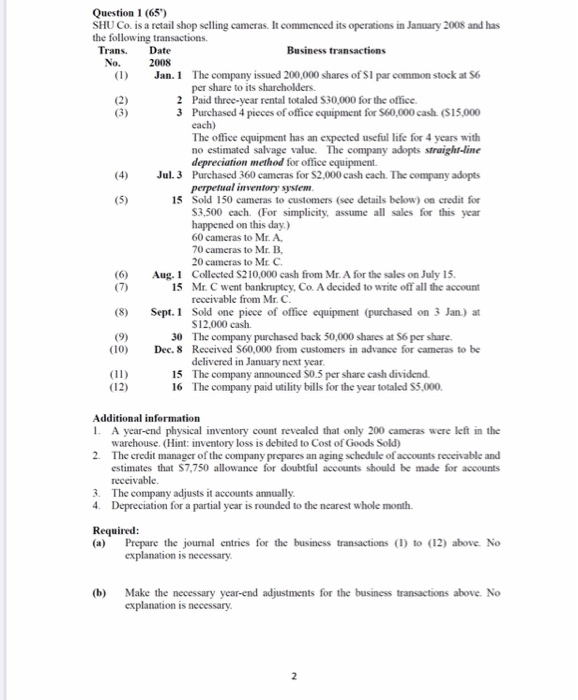

Question 1 (65") SHU Co. is a retail shop selling cameras. It commenced its operations in January 2008 and has the following transactions. Trans. Date Business transactions No. 2008 (1) Jan. 1 The company issued 200,000 shares of Sl par common stock at S6 per share to its shareholders. (2) 2 Paid three-year rental totaled S30,000 for the office. 3 Purchased 4 pieces of office equipment for 560,000 cash. (15,000 each) The office equipment has an expected useful life for 4 years with no estimated salvage value. The company adopts straight-line depreciation method for office equipment. Jul. 3 Purchased 360 cameras for S2,000 cash each. The company adopts perpetual inventory system 15 Sold 150 cameras to customers (see details below) on credit for $3,500 cach. (For simplicity, assume all sales for this year happened on this day.) 60 cameras to Mr. A 70 cameras to Mr. B. 20 cameras to Mr.C. Aug. 1 Collected S210,000 cash from Mr. A for the sales on July 15. (7) 15 Mr. C went bankruptcy, Co. A decided to write off all the account receivable from Mr. C. (8) Sept. 1 Sold one piece of office equipment (purchased on 3 Jan.) at $12,000 cash. (9) 30 The company purchased back 50,000 shares at S6 per share. (10) Dec. 8 Received $60,000 from customers in advance for cameras to be delivered in January next year. 15 The company announced S0.5 per share cash dividend. (12) 16 The company paid utility bills for the year totaled $5,000. Additional information 1. A year-end physical inventory count revealed that only 200 cameras were left in the warehouse. (Hint: inventory loss is debited to Cost of Goods Sold) 2. The credit manager of the company prepares an aging schedule of accounts receivable and estimates that $7,750 allowance for doubtful accounts should be made for accounts receivable 3. The company adjusts it accounts annually. 4. Depreciation for a partial year is rounded to the nearest whole month. Required: (a) Prepare the journal entries for the business transactions (1) to (12) above. No explanation is necessary (6) Make the necessary year-end adjustments for the business transactions above. No explanation is necessary 2 (c) Prepare multi-step income statement for SHU Co. for the year ended December 31, 2008. Ignore income taxes. (d) Prepare balance sheet for SHU Co. as at December 31, 2008. Question 2 (35) (a) Discuss the meaning of cash accounting and accrual accounting. (b) Discuss how accruals are used in financial reporting with examples. Do you think using accrual accounting to prepare financial information provides better information for investors' decision making than using the cash basis of accounting? Why or why not? (c)