Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someome please give an insight on what fomula should be used in excel for this problem? All informartion I have been provided is posted

can someome please give an insight on what fomula should be used in excel for this problem?

All informartion I have been provided is posted in the photos.

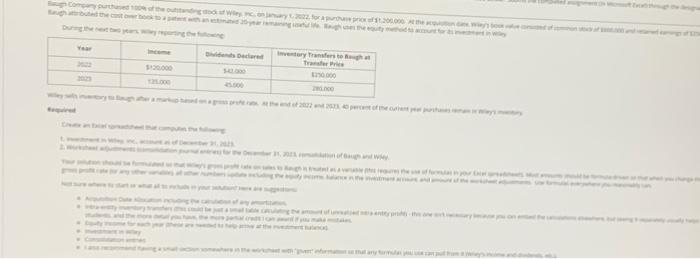

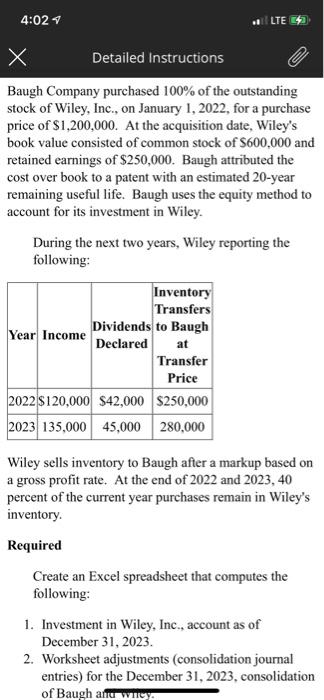

150.000 . 4:02 + LTE 4 Detailed Instructions Baugh Company purchased 100% of the outstanding stock of Wiley, Inc., on January 1, 2022, for a purchase price of $1,200,000. At the acquisition date, Wiley's book value consisted of common stock of S600.000 and retained earnings of $250,000. Baugh attributed the cost over book to a patent with an estimated 20-year remaining useful life. Baugh uses the equity method to account for its investment in Wiley. During the next two years, Wiley reporting the following: Inventory Transfers Year Income Dividends to Baugh Declared at Transfer Price 2022 $120,000 $42,000 $250,000 2023 135,000 45,000 280,000 Wiley sells inventory to Baugh after a markup based on a gross profit rate. At the end of 2022 and 2023, 40 percent of the current year purchases remain in Wiley's inventory Required Create an Excel spreadsheet that computes the following: 1. Investment in Wiley, Inc., account as of December 31, 2023. 2. Worksheet adjustments (consolidation journal entries) for the December 31, 2023, consolidation of Baugh anu wicy of Baugh and Wiley. Your solution should be formulated so that Wiley's gross profit rate on sales to Baugh is treated as a variable (this requires the use of formulas in your Excel spreadsheet!). Most amounts should be formula-driven so that when you change the gross profit rate (or any other variable), all other numbers update including the equity income, balance in the investment account, and amount of the worksheet adjustments. Use formulas everywhere you reasonably can. Not sure where to start or what all to include in your solution? Here are suggestions: Acquisition Date Allocation including the calculation of any amortization. Intra-entity inventory transfers (this could be just a small table calculating the amount of unrealized intra-entity profit) - this one isn't necessary because you can embed the calculations elsewhere, but seeing it separately usually helps students, and the more detail you have, the more partial credit I can award if you make mistakes. Equity Income for each year (these are needed to help arrive at the investment balance). o Investment in Wiley o Consolidation entries o I also recommend having a small section somewhere in the worksheet with "given" information so that any formulas you use can pull from it (Wiley's income and dividends, etc.). 150.000 . 4:02 + LTE 4 Detailed Instructions Baugh Company purchased 100% of the outstanding stock of Wiley, Inc., on January 1, 2022, for a purchase price of $1,200,000. At the acquisition date, Wiley's book value consisted of common stock of S600.000 and retained earnings of $250,000. Baugh attributed the cost over book to a patent with an estimated 20-year remaining useful life. Baugh uses the equity method to account for its investment in Wiley. During the next two years, Wiley reporting the following: Inventory Transfers Year Income Dividends to Baugh Declared at Transfer Price 2022 $120,000 $42,000 $250,000 2023 135,000 45,000 280,000 Wiley sells inventory to Baugh after a markup based on a gross profit rate. At the end of 2022 and 2023, 40 percent of the current year purchases remain in Wiley's inventory Required Create an Excel spreadsheet that computes the following: 1. Investment in Wiley, Inc., account as of December 31, 2023. 2. Worksheet adjustments (consolidation journal entries) for the December 31, 2023, consolidation of Baugh anu wicy of Baugh and Wiley. Your solution should be formulated so that Wiley's gross profit rate on sales to Baugh is treated as a variable (this requires the use of formulas in your Excel spreadsheet!). Most amounts should be formula-driven so that when you change the gross profit rate (or any other variable), all other numbers update including the equity income, balance in the investment account, and amount of the worksheet adjustments. Use formulas everywhere you reasonably can. Not sure where to start or what all to include in your solution? Here are suggestions: Acquisition Date Allocation including the calculation of any amortization. Intra-entity inventory transfers (this could be just a small table calculating the amount of unrealized intra-entity profit) - this one isn't necessary because you can embed the calculations elsewhere, but seeing it separately usually helps students, and the more detail you have, the more partial credit I can award if you make mistakes. Equity Income for each year (these are needed to help arrive at the investment balance). o Investment in Wiley o Consolidation entries o I also recommend having a small section somewhere in the worksheet with "given" information so that any formulas you use can pull from it (Wiley's income and dividends, etc.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started