Answered step by step

Verified Expert Solution

Question

1 Approved Answer

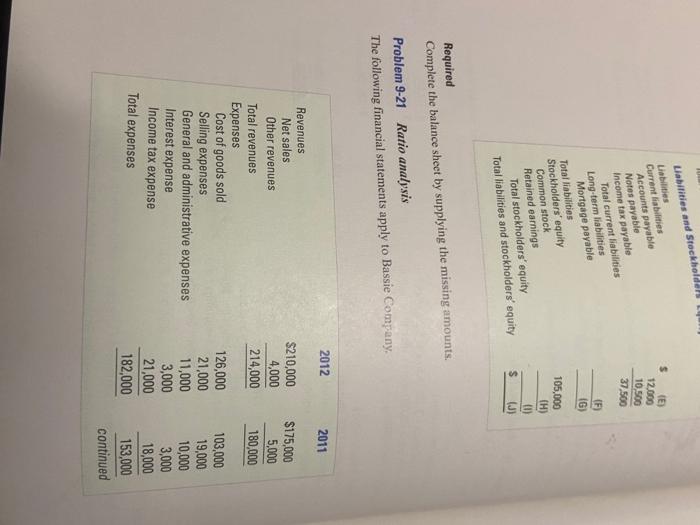

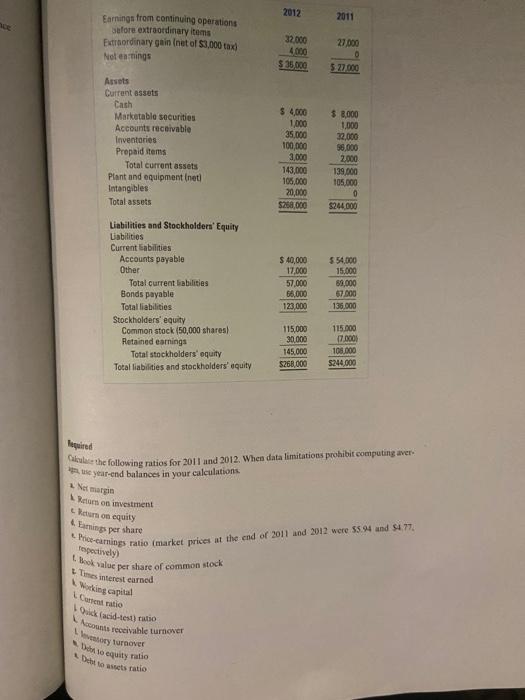

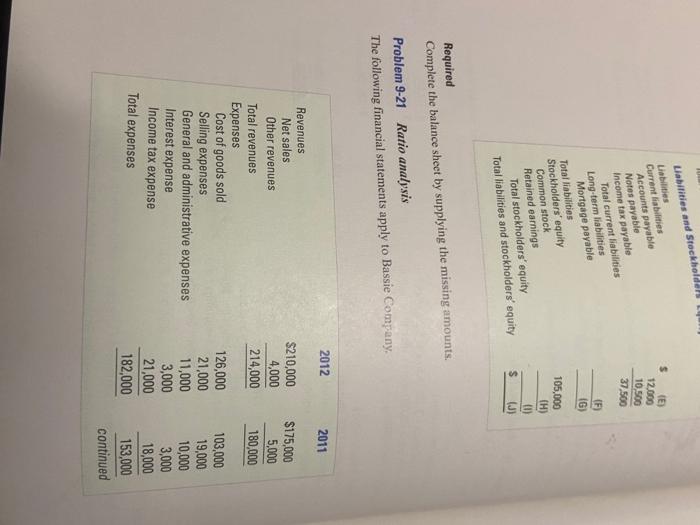

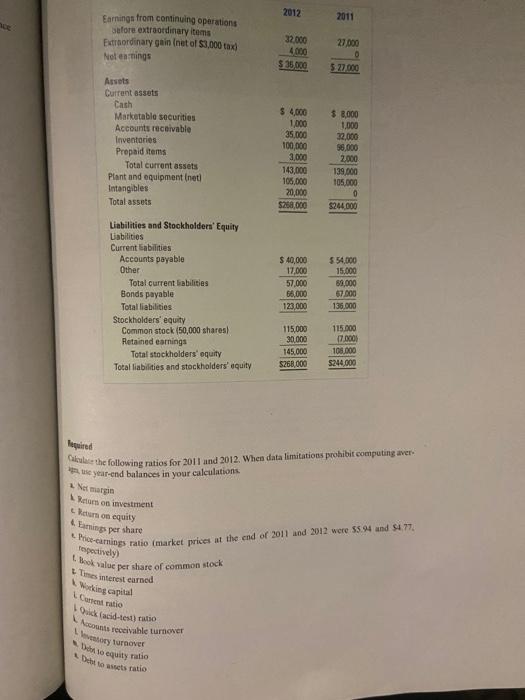

Can someone answer 9-21 in order? The bottom half of the first and the whole second page js the problem that I need assistance with

Can someone answer 9-21 in order? The bottom half of the first and the whole second page js the problem that I need assistance with

TE) 12.000 10,500 37,500 Liabilities and Stockholder till Liabilities Current liabilities Accounts payable Notes payable Income tax payable Total current liabilities Long-term liabilities Mortgage payable Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity (F) IG) 105,000 (H) (0) $ (J) Required Complete the balance sheet by supplying the missing amounts. Problem 9-21 Ratio analysis The following financial statements apply to Bassie Company, 2012 2011 $210,000 4,000 214,000 $175,000 5,000 180,000 Revenues Net sales Other revenues Total revenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense 126,000 21,000 11,000 3,000 21,000 182,000 103,000 19,000 10,000 3,000 18,000 153,000 continued Total expenses 2012 2011 he Earnings from continuing operations Safore extraordinary items Extraordinary gain (net of $3,000 tax Not eatings 27 000 32.000 4000 $ 35.000 5.27000 Assets Current assets Cash Marketable securities Accounts receivable Inventaries Prepaid items Total current assets Plant and equipment ineti Intangibles Total assets $ 4.000 1,000 35.000 100.000 3.000 143,000 105,000 20,000 $268.000 $ 8.000 1.000 32,000 $6,000 2.000 139,000 105.000 0 $244.000 Liabilities and Stockholders' Equity Liabilities Current Cabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities Stockholders' equity Common stock (50,000 shares) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 40,000 17.000 57.000 36.000 123,000 $ 54,000 15,000 89,000 67.000 136.000 115,000 30,000 145.000 $26.000 115.000 17.000 108.000 5244,000 Mauired) Cake the following ratios for 2011 and 2012. When data limitations prohibit computing aver e year-end balances in your calculations Ne margin Ram on investment L. Return on equity Lamnings per share Price-camins ratio market prices at the end of 2011 aod 2012 were 55.94 and $4.77 respectively) book salue per share of common stock Times interest earned Waking capital Contato Quick acid-test) to Accounts receivable turnover Lloy turnover Do equity ratio Dicts ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started