Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone answer this question? En Abu wants to invest either in bond or equity to grow his capital worth RM100,000. As a financial advisor,

can someone answer this question?

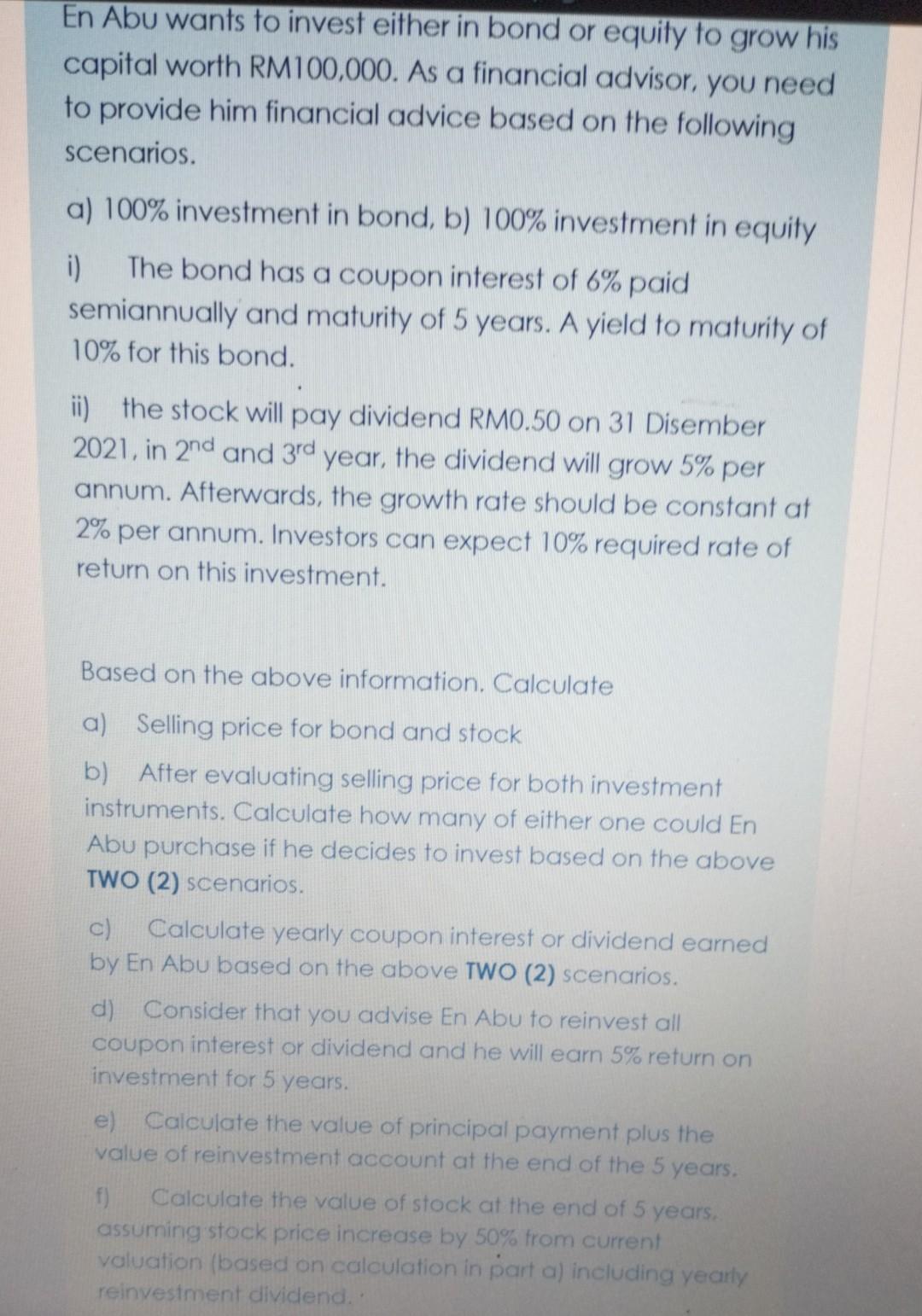

En Abu wants to invest either in bond or equity to grow his capital worth RM100,000. As a financial advisor, you need to provide him financial advice based on the following scenarios. a) 100% investment in bond, b) 100% investment in equity i) The bond has a coupon interest of 6% paid semiannually and maturity of 5 years. A yield to maturity of 10% for this bond. ii) the stock will pay dividend RM0.50 on 31 Disember 2021. in 2nd and 3rd year, the dividend will grow 5% per annum. Afterwards, the growth rate should be constant at 2% per annum. Investors can expect 10% required rate of return on this investment. Based on the above information, Calculate a) Selling price for bond and stock b) After evaluating selling price for both investment instruments. Calculate how many of either one could En Abu purchase if he decides to invest based on the above TWO (2) scenarios. c) Calculate yearly coupon interest or dividend earned by En Abu based on the above TWO (2) scenarios. d) Consider that you advise En Abu to reinvest all coupon interest or dividend and he will earn 5% return on investment for 5 years. e) Calculate the value of principal payment plus the value of reinvestment account at the end of the 5 years. f) Calculate the value of stock at the end of 5 years. assuming stock price increase by 50% from current valuation (based on calculation in part a) including yearly reinvestment dividendStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started