Can someone explain to me how to do this assignment? Or if anyone can answer it.

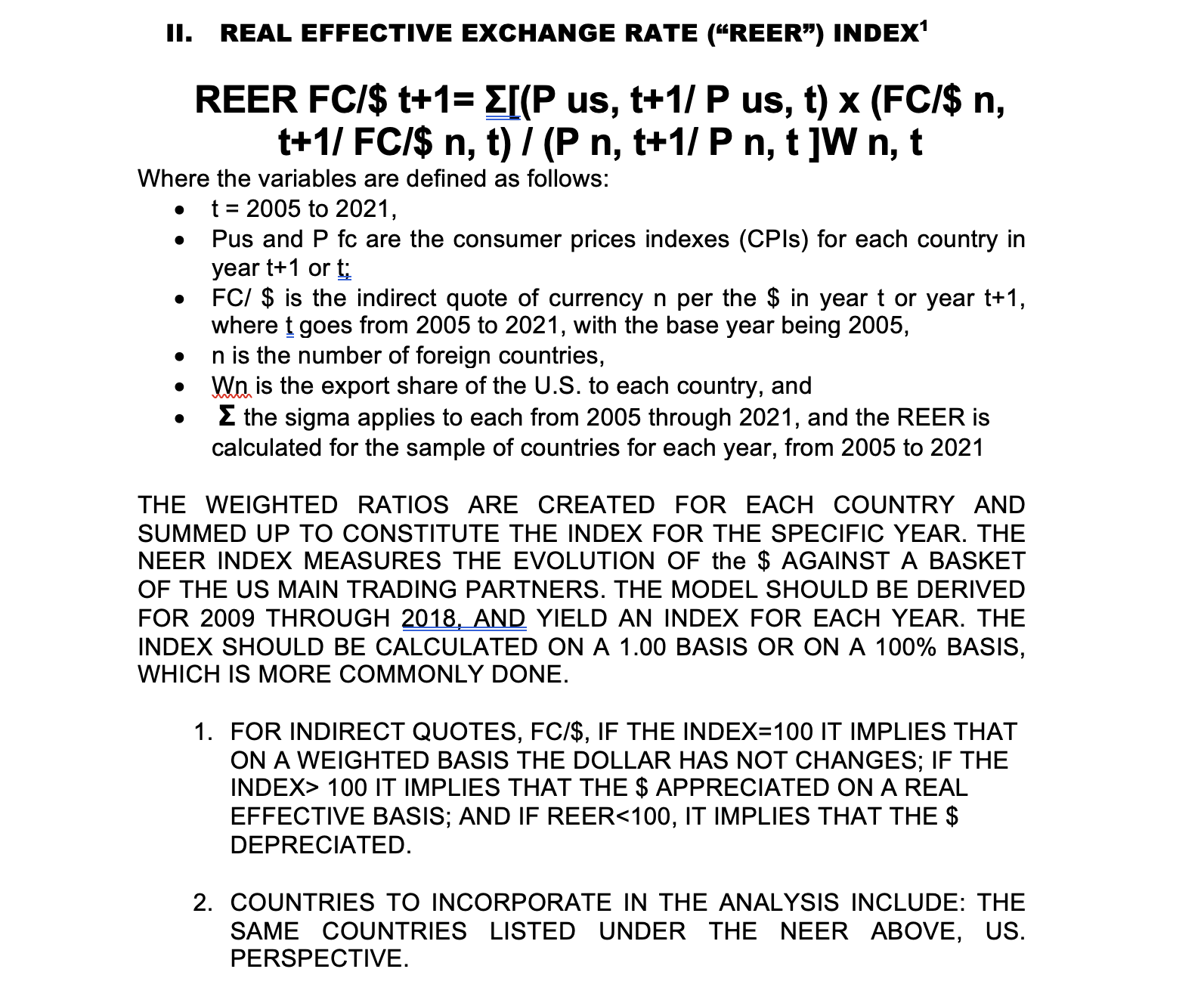

DERIVE THE NEER AND THE REER FOR THE U.S. DOLLAR BY APPLYING THE FOLOWING MODELS. THIS ASSIGNMENT SHOULD BE PERFORMED BY TEAMS OF UP TO 4 STUDENTS (BUT DEFINITELY NOT MORE), HOWEVER INDIVIDUAL WORK IS ACCEPTABLE. THE OBJECTIVE OF THIS ASSIGNMENT IS TO FAMILIARIZE YOU WITH THE APPLICATION OF FINANCIAL MODELS, INTRODUCE YOU TO MARKET DATA SOURCES, AND PROVIDE YOU WITH THE OPPORTUNITY TO INTERPRETE EMPIRICAL FINDINGS. THE ASSIGNMENT SHOULD BE SUBMITTED FOR GRADING ON THE DUE DATE. A COUPLE OF ASSIGNMENTS WOULD BE SELECTED FOR PRESENTATION IN CLASS. I. THE NOMINAL EFFECTIVE EXCHANGE RATE (NEER) INDEX DERIVE THE NEER BY APPLYING THE FOLOWING MODELS, FROM 2005 TO 2021, BY USING YEAR END DATA FROM THE SOURCES CITED BELOW:\# A.U.S. \$ PERSPECTIVE NEER FC/ $,t+1= [FC/$n,t+1/FC/$n,t]Wn,t where the variable are defined as follows: - t goes from 2005 to 2021 (the first year of the analysis is 2006 in comparison to 2005), - FC/$nt is the indirect quote of currency n per the $ in year t, - n is the number of foreign countries (that are listed below), - Wn is the export share (\%) of the U.S. to each country, and - sigma relates to aggregation for country n=1 to N, and each derivation for the N countries is done for each year, from 2005 TO 2021 THE WEIGHTED RATIOS ARE CREATED FOR EACH COUNTRY AND SUMMED UP FOR ALL THE n COUNTRIES TO CONSTITUTE THE INDEX FOR THE SPECIFIC YEAR. THE NEER INDEX MEASURES THE EVOLUTION OF THE \$ FROM THE PERSPECTIVE OF THE U.S. MAIN TRADING PARTNERS (THAT ARE LISTED BELOW). 1. QUOTES ARE INDIRECT, FC/ \$, AND FOR END OF YEAR RATES. 1 2 2. Wn MEASURES THE \% SHARE OF U.S. EXPORT TO COUNTRY n, and Wn=1 3. THE \$ INDEX IS SET AT 100 IN 2008, WHICH IS THE BASE YEAR. THE INDEX MEASURES THE VALUE OF THE \$ FROM A FOREIGN PERSPECTIVE (FOREIGN TERMS). 4. WHEN THE INDEX IS ABOVE 100, IT IMPLIES THAT THE DOLLAR APPRECIATED; AND WHEN IT IS BELOW 100, IT IMPLIES THAT THE \$ DEPRECIATED. WHEN THE INDEX FOR A SPECIFIC YEAR IS 100 IT IMPLIES THAT ON A TRADE WEIGHTED BASIS THE DOLLAR HAS NOT CHANGES, 5. FOR DIRECT QUOTES, \$/FC, IF NEER >100 IT IMPLIES THE $ DEPRECIATED; AND IF NEER $ APPRECIATED 6. COUNTRIES TO INCORPORATE IN THE ANALYSIS INCLUDE: CANADA, MEXICO, BRAZIL, ARGENTINA, JAPAN, GERMANY, FRANCE, UK, TURKEY, CHINA, S. KOREA, SINGAPORE, INDIA, THAILAND, S. AFRICA, NIGERIA, AND RUSSIA. 7. DATA SOURCES: FC/\$ EXCHANGE RATES COULD BE OBTAINED FROM SEVERAL SOURCES, INCLUDING THE IMF, INTERNATIONAL FINANCIAL STATISTICS (ANNUAL OR MONTHLY REPORTS AVAILABLE IN THE LIBRARY OR ON THE WEB), OR FROM ANY OTHER SOURCE, SUCH AS THE FEDERAL RESERVE BULLETIN, US STATISTICAL ABSTRACT, OR WEB BASED SOURCES. (IN PAST ASSIGNMENTS, MANY OF MY STUDENTS DID THEIR RESEARCH ENTIRELY WITH DATA OBTAINED FROM THE WEB) 8. U.S. EXPORT DATA BY GEOGRAPHIC MARKETS COULD BE OBTAINED FROM THE IMF, DIRECTIONS OF TRADE; OR THE BEA, SURVEY OF CURRENT BUSINESS (VARIOUS ISSUES, AVAILABLE IN THE LIBRARY), OR THE US STATISTICAL ABSTRACT, OR FROM THE U.S. PRESIDENT'S ECONOMIC REPORT (ALL OF THE ABOVE SOURCES ARE AVAILABLE ON THE WEB) II. REAL EFFECTIVE EXCHANGE RATE (REER) INDEX REER FC $t+1=(P us, t+1/P us, t)(FC/$n, t+1/FC/$n,t)/(Pn,t+1/Pn,t]Wn,t Where the variables are defined as follows: - t=2005 to 2021 , - Pus and P fc are the consumer prices indexes (CPIs) for each country in year t+1 or t : - FC/$ is the indirect quote of currency n per the $ in year t or year t+1, where t goes from 2005 to 2021 , with the base year being 2005 , - n is the number of foreign countries, - Wn is the export share of the U.S. to each country, and - the sigma applies to each from 2005 through 2021, and the REER is calculated for the sample of countries for each year, from 2005 to 2021 THE WEIGHTED RATIOS ARE CREATED FOR EACH COUNTRY AND SUMMED UP TO CONSTITUTE THE INDEX FOR THE SPECIFIC YEAR. THE NEER INDEX MEASURES THE EVOLUTION OF the \$ AGAINST A BASKET OF THE US MAIN TRADING PARTNERS. THE MODEL SHOULD BE DERIVED FOR 2009 THROUGH 2018, AND YIELD AN INDEX FOR EACH YEAR. THE INDEX SHOULD BE CALCULATED ON A 1.00 BASIS OR ON A 100\% BASIS, WHICH IS MORE COMMONLY DONE. 1. FOR INDIRECT QUOTES, FC/ $, IF THE INDEX =100 IT IMPLIES THAT ON A WEIGHTED BASIS THE DOLLAR HAS NOT CHANGES; IF THE INDEX> 100 IT IMPLIES THAT THE \$ APPRECIATED ON A REAL EFFECTIVE BASIS; AND IF REER$ DEPRECIATED. 2. COUNTRIES TO INCORPORATE IN THE ANALYSIS INCLUDE: THE SAME COUNTRIES LISTED UNDER THE NEER ABOVE, US. PERSPECTIVE. 3. U.S. EXPORT DATA BY GEOGRAPHIC MARKETS COULD BE OBTAINED FROM THE BEA, SURVEY OF CURRENT BUSINESS (VARIOUS ISSUES), OR THE US STATISTICAL ABSTRACT, OR FROM THE PRESIDENT'S ECONOMIC REPORT (ALL OF WHICH ARE AVAILABLE FROM THE WEB) 4. PRICE DATA COULD BE OBTAINED FROM THE IMF (CITED ABOVE), AND SHOULD INCLUDE THE CONSUMER PRICE INDEX (LINE 64 IN EACH COUNTRY DATA PAGE); BUT OTHER PRICE INDEXES COULD BE USED INSTEAD, INCLUDING THE WHOLESALE PRICE INDEX, ETC. 5. DATA SOURCES: FC/\$ EXCHANGE RATES COULD BE OBTAIONED FROM THE IMF, INTERNATIONAL FINANCIAL STATISTICS (ANNUAL OR MONTHLY REPORTS), OR FROM ANY OTHER SOURCE, SUCH AS THE FEDERAL RESERVE BULLETIN, US STATISTICAL ABSTRACT, ETC. (CURRENCY RATES COULD BE RETRIEVED FROM THE WEB, EXCEPT FOR THE IMF DATA) DERIVE THE NEER AND THE REER FOR THE U.S. DOLLAR BY APPLYING THE FOLOWING MODELS. THIS ASSIGNMENT SHOULD BE PERFORMED BY TEAMS OF UP TO 4 STUDENTS (BUT DEFINITELY NOT MORE), HOWEVER INDIVIDUAL WORK IS ACCEPTABLE. THE OBJECTIVE OF THIS ASSIGNMENT IS TO FAMILIARIZE YOU WITH THE APPLICATION OF FINANCIAL MODELS, INTRODUCE YOU TO MARKET DATA SOURCES, AND PROVIDE YOU WITH THE OPPORTUNITY TO INTERPRETE EMPIRICAL FINDINGS. THE ASSIGNMENT SHOULD BE SUBMITTED FOR GRADING ON THE DUE DATE. A COUPLE OF ASSIGNMENTS WOULD BE SELECTED FOR PRESENTATION IN CLASS. I. THE NOMINAL EFFECTIVE EXCHANGE RATE (NEER) INDEX DERIVE THE NEER BY APPLYING THE FOLOWING MODELS, FROM 2005 TO 2021, BY USING YEAR END DATA FROM THE SOURCES CITED BELOW:\# A.U.S. \$ PERSPECTIVE NEER FC/ $,t+1= [FC/$n,t+1/FC/$n,t]Wn,t where the variable are defined as follows: - t goes from 2005 to 2021 (the first year of the analysis is 2006 in comparison to 2005), - FC/$nt is the indirect quote of currency n per the $ in year t, - n is the number of foreign countries (that are listed below), - Wn is the export share (\%) of the U.S. to each country, and - sigma relates to aggregation for country n=1 to N, and each derivation for the N countries is done for each year, from 2005 TO 2021 THE WEIGHTED RATIOS ARE CREATED FOR EACH COUNTRY AND SUMMED UP FOR ALL THE n COUNTRIES TO CONSTITUTE THE INDEX FOR THE SPECIFIC YEAR. THE NEER INDEX MEASURES THE EVOLUTION OF THE \$ FROM THE PERSPECTIVE OF THE U.S. MAIN TRADING PARTNERS (THAT ARE LISTED BELOW). 1. QUOTES ARE INDIRECT, FC/ \$, AND FOR END OF YEAR RATES. 1 2 2. Wn MEASURES THE \% SHARE OF U.S. EXPORT TO COUNTRY n, and Wn=1 3. THE \$ INDEX IS SET AT 100 IN 2008, WHICH IS THE BASE YEAR. THE INDEX MEASURES THE VALUE OF THE \$ FROM A FOREIGN PERSPECTIVE (FOREIGN TERMS). 4. WHEN THE INDEX IS ABOVE 100, IT IMPLIES THAT THE DOLLAR APPRECIATED; AND WHEN IT IS BELOW 100, IT IMPLIES THAT THE \$ DEPRECIATED. WHEN THE INDEX FOR A SPECIFIC YEAR IS 100 IT IMPLIES THAT ON A TRADE WEIGHTED BASIS THE DOLLAR HAS NOT CHANGES, 5. FOR DIRECT QUOTES, \$/FC, IF NEER >100 IT IMPLIES THE $ DEPRECIATED; AND IF NEER $ APPRECIATED 6. COUNTRIES TO INCORPORATE IN THE ANALYSIS INCLUDE: CANADA, MEXICO, BRAZIL, ARGENTINA, JAPAN, GERMANY, FRANCE, UK, TURKEY, CHINA, S. KOREA, SINGAPORE, INDIA, THAILAND, S. AFRICA, NIGERIA, AND RUSSIA. 7. DATA SOURCES: FC/\$ EXCHANGE RATES COULD BE OBTAINED FROM SEVERAL SOURCES, INCLUDING THE IMF, INTERNATIONAL FINANCIAL STATISTICS (ANNUAL OR MONTHLY REPORTS AVAILABLE IN THE LIBRARY OR ON THE WEB), OR FROM ANY OTHER SOURCE, SUCH AS THE FEDERAL RESERVE BULLETIN, US STATISTICAL ABSTRACT, OR WEB BASED SOURCES. (IN PAST ASSIGNMENTS, MANY OF MY STUDENTS DID THEIR RESEARCH ENTIRELY WITH DATA OBTAINED FROM THE WEB) 8. U.S. EXPORT DATA BY GEOGRAPHIC MARKETS COULD BE OBTAINED FROM THE IMF, DIRECTIONS OF TRADE; OR THE BEA, SURVEY OF CURRENT BUSINESS (VARIOUS ISSUES, AVAILABLE IN THE LIBRARY), OR THE US STATISTICAL ABSTRACT, OR FROM THE U.S. PRESIDENT'S ECONOMIC REPORT (ALL OF THE ABOVE SOURCES ARE AVAILABLE ON THE WEB) II. REAL EFFECTIVE EXCHANGE RATE (REER) INDEX REER FC $t+1=(P us, t+1/P us, t)(FC/$n, t+1/FC/$n,t)/(Pn,t+1/Pn,t]Wn,t Where the variables are defined as follows: - t=2005 to 2021 , - Pus and P fc are the consumer prices indexes (CPIs) for each country in year t+1 or t : - FC/$ is the indirect quote of currency n per the $ in year t or year t+1, where t goes from 2005 to 2021 , with the base year being 2005 , - n is the number of foreign countries, - Wn is the export share of the U.S. to each country, and - the sigma applies to each from 2005 through 2021, and the REER is calculated for the sample of countries for each year, from 2005 to 2021 THE WEIGHTED RATIOS ARE CREATED FOR EACH COUNTRY AND SUMMED UP TO CONSTITUTE THE INDEX FOR THE SPECIFIC YEAR. THE NEER INDEX MEASURES THE EVOLUTION OF the \$ AGAINST A BASKET OF THE US MAIN TRADING PARTNERS. THE MODEL SHOULD BE DERIVED FOR 2009 THROUGH 2018, AND YIELD AN INDEX FOR EACH YEAR. THE INDEX SHOULD BE CALCULATED ON A 1.00 BASIS OR ON A 100\% BASIS, WHICH IS MORE COMMONLY DONE. 1. FOR INDIRECT QUOTES, FC/ $, IF THE INDEX =100 IT IMPLIES THAT ON A WEIGHTED BASIS THE DOLLAR HAS NOT CHANGES; IF THE INDEX> 100 IT IMPLIES THAT THE \$ APPRECIATED ON A REAL EFFECTIVE BASIS; AND IF REER$ DEPRECIATED. 2. COUNTRIES TO INCORPORATE IN THE ANALYSIS INCLUDE: THE SAME COUNTRIES LISTED UNDER THE NEER ABOVE, US. PERSPECTIVE. 3. U.S. EXPORT DATA BY GEOGRAPHIC MARKETS COULD BE OBTAINED FROM THE BEA, SURVEY OF CURRENT BUSINESS (VARIOUS ISSUES), OR THE US STATISTICAL ABSTRACT, OR FROM THE PRESIDENT'S ECONOMIC REPORT (ALL OF WHICH ARE AVAILABLE FROM THE WEB) 4. PRICE DATA COULD BE OBTAINED FROM THE IMF (CITED ABOVE), AND SHOULD INCLUDE THE CONSUMER PRICE INDEX (LINE 64 IN EACH COUNTRY DATA PAGE); BUT OTHER PRICE INDEXES COULD BE USED INSTEAD, INCLUDING THE WHOLESALE PRICE INDEX, ETC. 5. DATA SOURCES: FC/\$ EXCHANGE RATES COULD BE OBTAIONED FROM THE IMF, INTERNATIONAL FINANCIAL STATISTICS (ANNUAL OR MONTHLY REPORTS), OR FROM ANY OTHER SOURCE, SUCH AS THE FEDERAL RESERVE BULLETIN, US STATISTICAL ABSTRACT, ETC. (CURRENCY RATES COULD BE RETRIEVED FROM THE WEB, EXCEPT FOR THE IMF DATA)