Can Someone go through this problem and explain to me how you get these answers?

Can Someone go through this problem and explain to me how you get these answers?

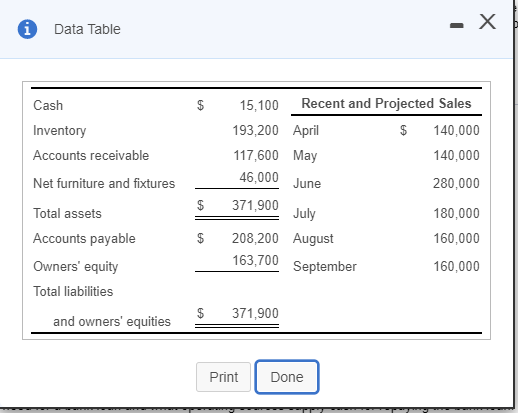

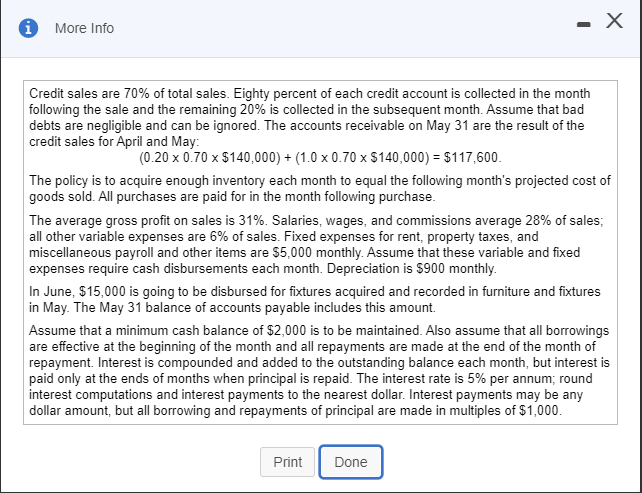

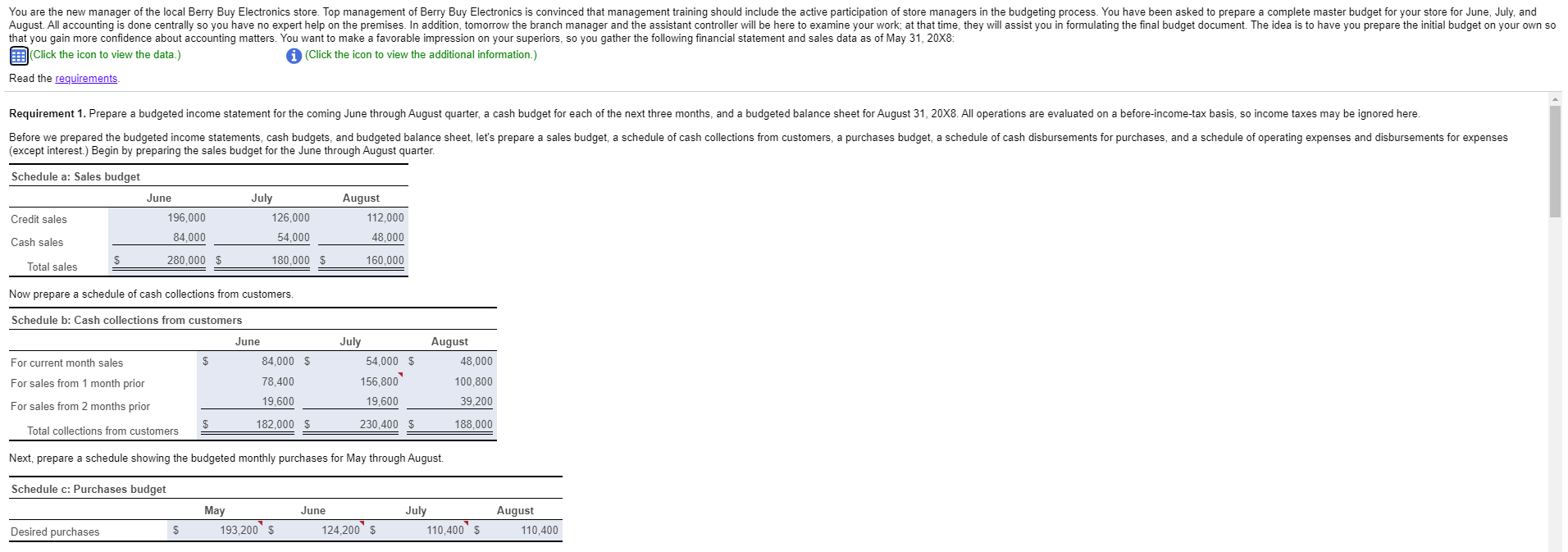

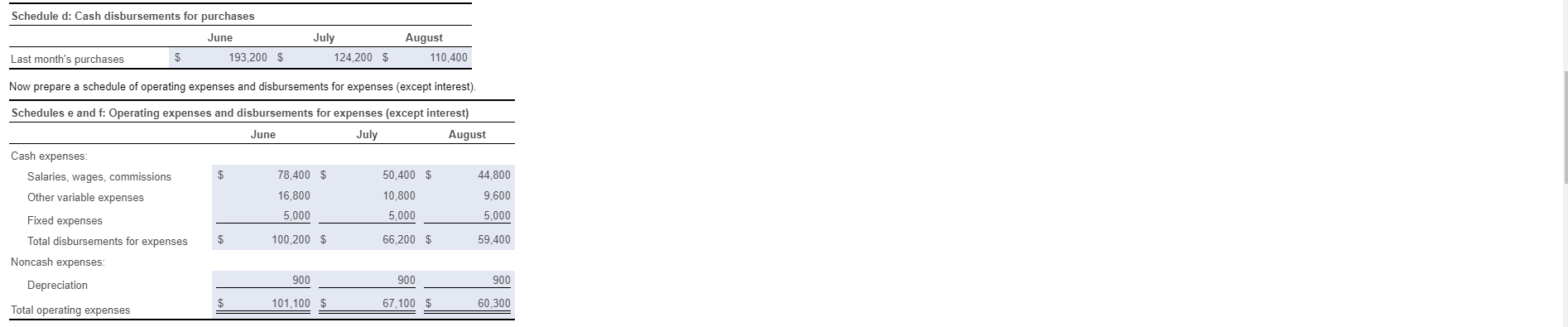

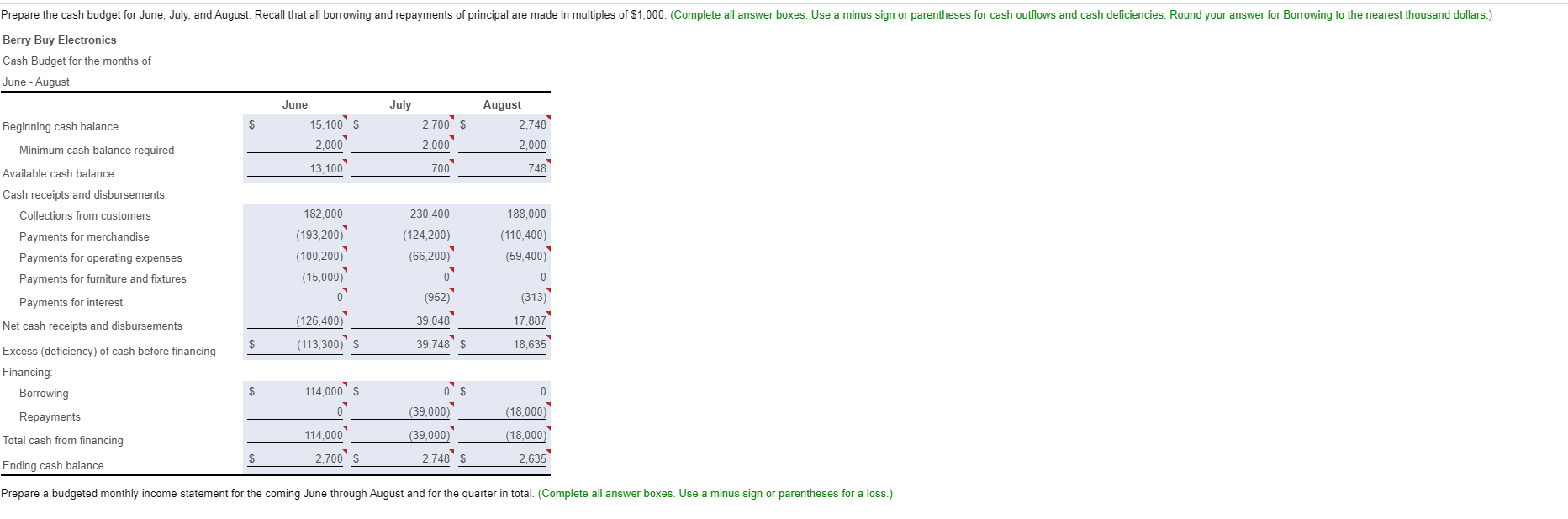

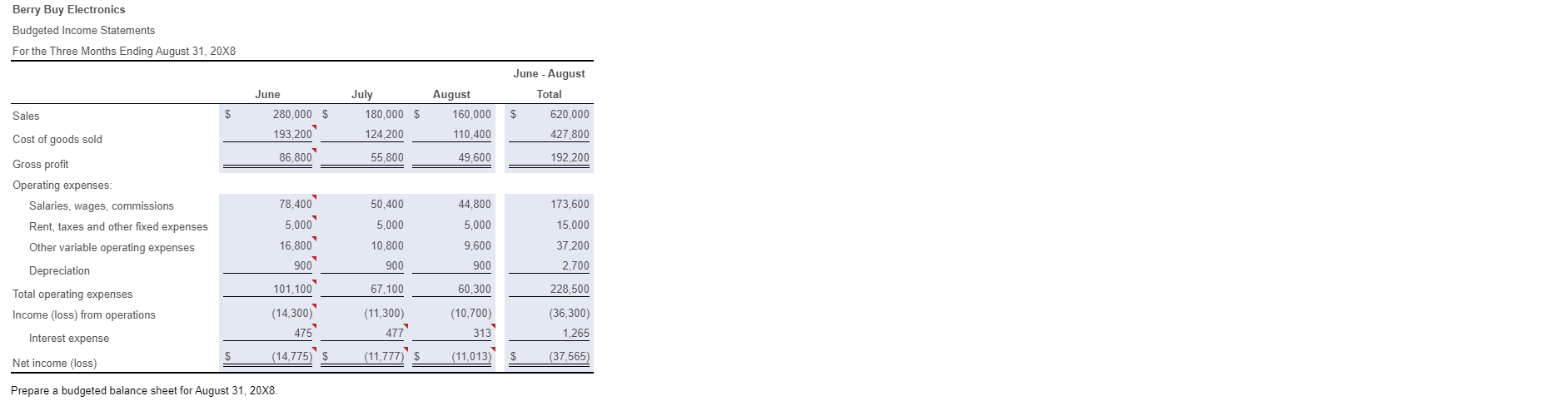

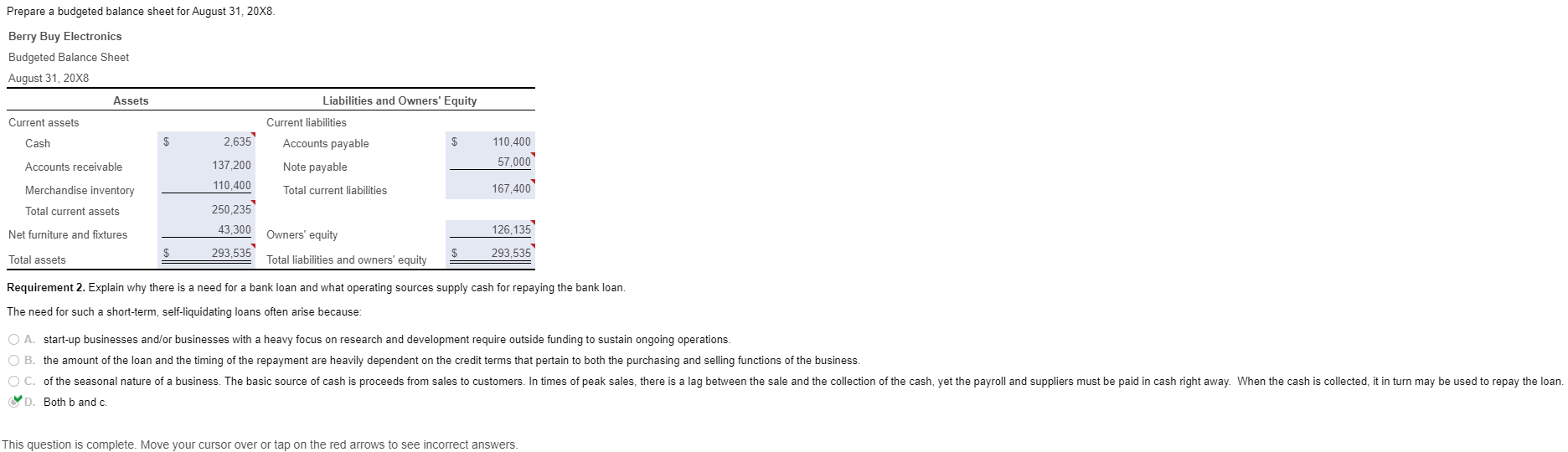

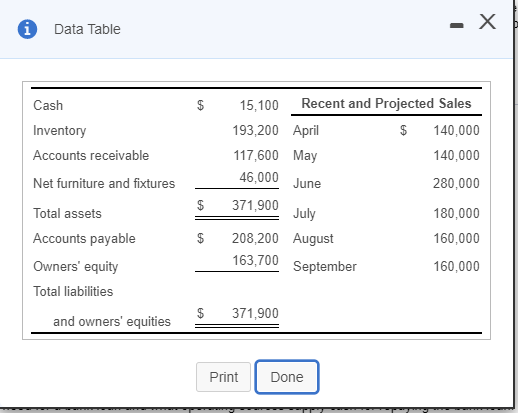

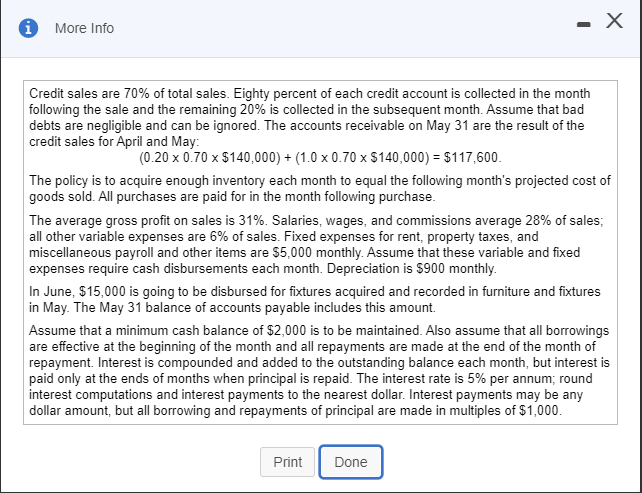

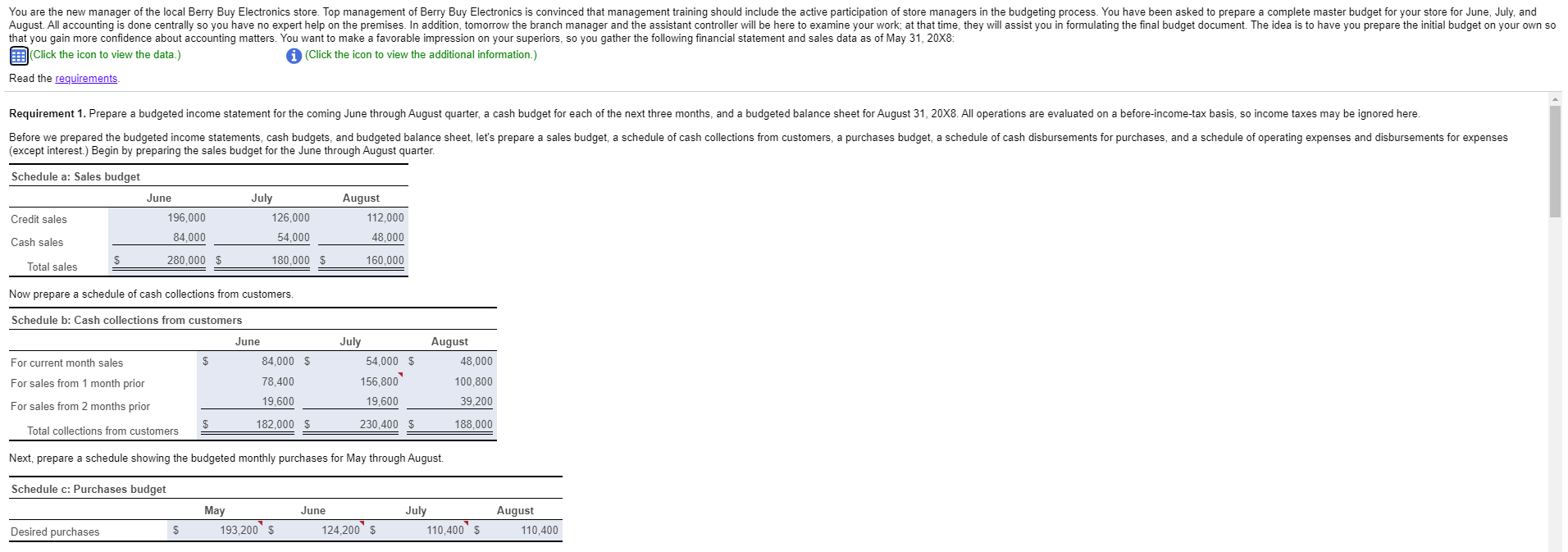

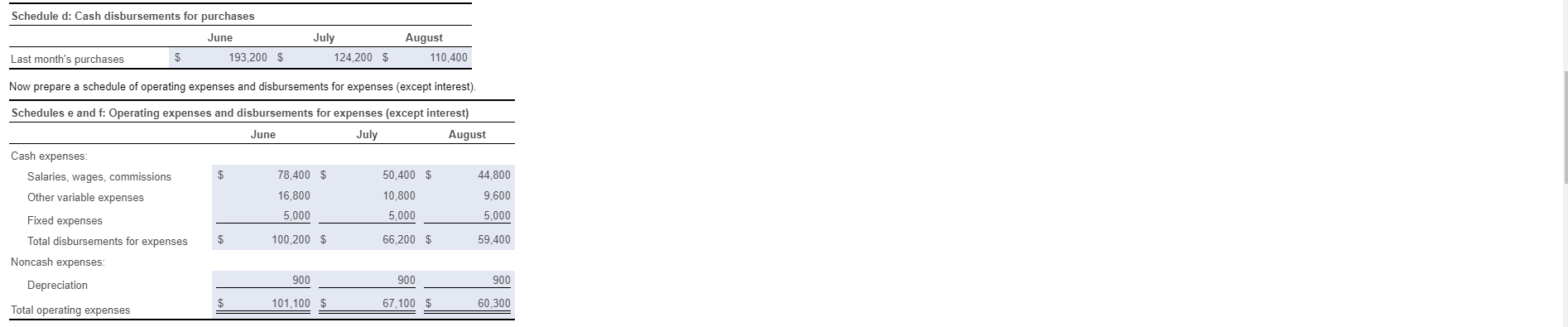

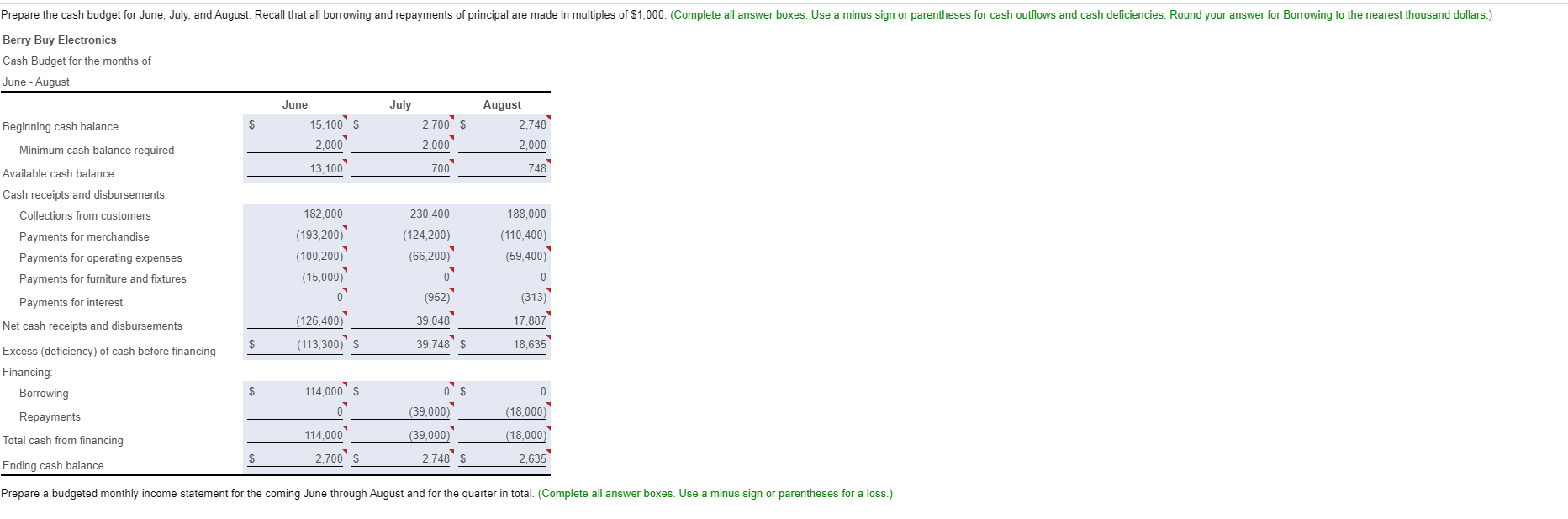

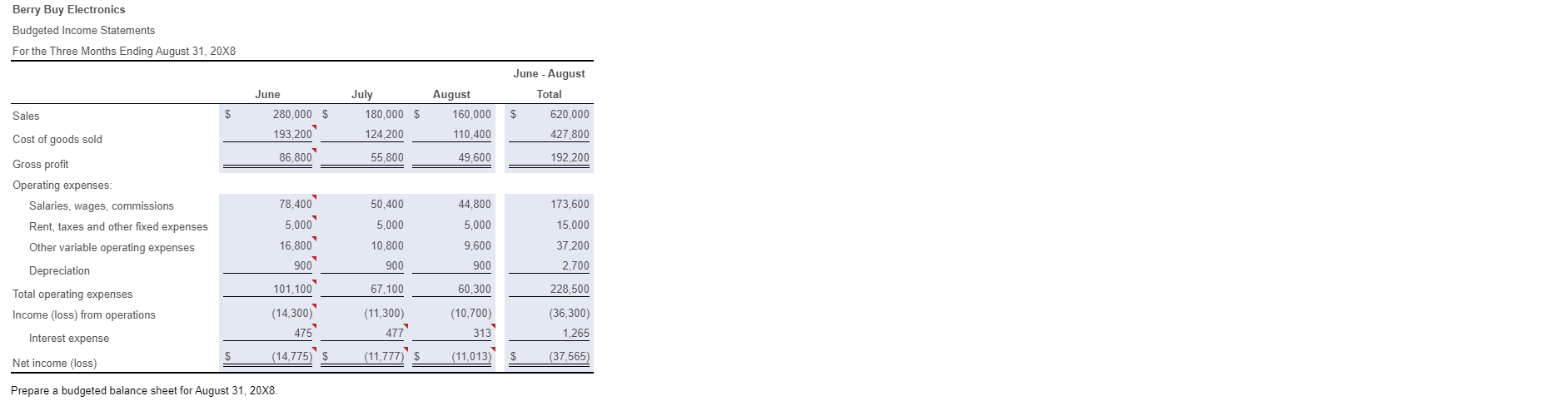

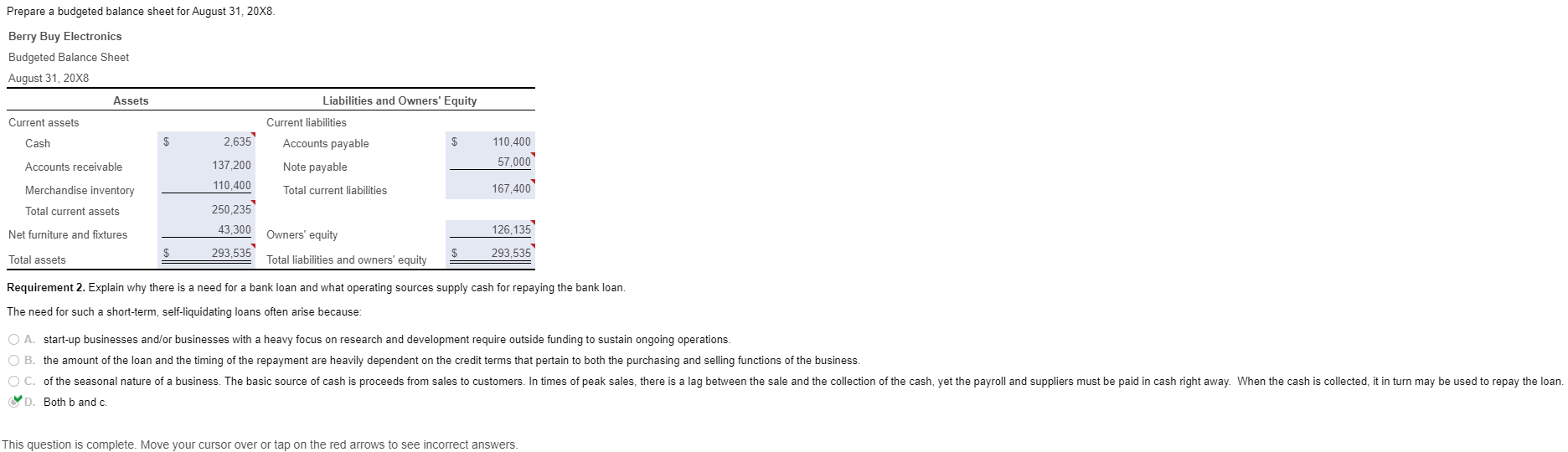

- X Data Table Cash 46.000 June Inventory Accounts receivable Net furniture and fixtures Total assets Accounts payable Owners' equity Total liabilities 15,100 Recent and Projected Sales 193,200 April $ 140,000 117,600 May 140,000 280,000 371,900 July 180,000 208,200 August 160,000 163,700 September 160,000 $ 371,900 and owners' equities Print Done - X More Info Credit sales are 70% of total sales. Eighty percent of each credit account is collected in the month following the sale and the remaining 20% is collected in the subsequent month. Assume that bad debts are negligible and can be ignored. The accounts receivable on May 31 are the result of the credit sales for April and May: (0.20 x 0.70 x $140,000) + (1.0 x 0.70 x $140,000) = $117,600 The policy is to acquire enough inventory each month to equal the following month's projected cost of goods sold. All purchases are paid for in the month following purchase. The average gross profit on sales is 31%. Salaries, wages, and commissions average 28% of sales; all other variable expenses are 6% of sales. Fixed expenses for rent, property taxes, and miscellaneous payroll and other items are $5,000 monthly. Assume that these variable and fixed expenses require cash disbursements each month. Depreciation is $900 monthly. In June $15,000 is going to be disbursed for fixtures acquired and recorded in furniture and fixtures in May. The May 31 balance of accounts payable includes this amount. Assume that a minimum cash balance of $2,000 is to be maintained. Also assume that all borrowings are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Interest is compounded and added to the outstanding balance each month, but interest is paid only at the ends of months when principal is repaid. The interest rate is 5% per annum; round interest computations and interest payments to the nearest dollar. Interest payments may be any dollar amount, but all borrowing and repayments of principal are made in multiples of $1,000 Print Done You are the new manager of the local Berry Buy Electronics store. Top management of Berry Buy Electronics is convinced that management training should include the active participation of store managers in the budgeting process. You have been asked to prepare a complete master budget for your store for June, July, and August. All accounting is done centrally so you have no expert help on the premises. In addition, tomorrow the branch manager and the assistant controller will be here to examine your work, at that time, they will assist you in formulating the final budget document. The idea is to have you prepare the initial budget on your own so that you gain more confidence about accounting matters. You want to make a favorable impression on your superiors, so you gather the following financial statement and sales data as of May 31, 20X8: (Click the icon to view the data.) (Click the icon to view the additional information.) Read the requirements. Requirement 1. Prepare a budgeted income statement for the coming June through August quarter, a cash budget for each of the next three months, and a budgeted balance sheet for August 31, 20X8. All operations are evaluated on a before-income tax basis, so income taxes may be ignored here. Before we prepared the budgeted income statements, cash budgets, and budgeted balance sheet, let's prepare a sales budget, a schedule of cash collections from customers, a purchases budget, a schedule of cash disbursements for purchases, and a schedule of operating expenses and disbursements for expenses (except interest.) Begin by preparing the sales budget for the June through August quarter. Schedule a: Sales budget June Credit sales 196,000 84.000 Cash sales $ 280,000 $ Total sales July 126,000 54,000 August 112,000 48,000 180,000 $ 160.000 Now prepare a schedule of cash collections from customers. Schedule b: Cash collections from customers June For current month sales For sales from 1 month prior For sales from 2 months prior 84,000 $ 78,400 19.600 July 54,000 $ 156,800 19,600 August 48,000 100,800 39,200 $ 182,000 $ 230,400 $ 188,000 Total collections from customers Next, prepare a schedule showing the budgeted monthly purchases for May through August Schedule c: Purchases budget May 193,200 $ June 124,200 $ July 110,400 $ August 110,400 Desired purchases $ Schedule d: Cash disbursements for purchases June July August Last month's purchases 193,200 $ 124,200 $ 110,400 Now prepare a schedule of operating expenses and disbursements for expenses (except interest). Schedules e and f: Operating expenses and disbursements for expenses (except interest) June July August Cash expenses: Salaries, wages, commissions $ 78,400 $ 50,400 $ 44,800 Other variable expenses 16,800 10,800 9,600 5,000 5,000 5,000 Fixed expenses Total disbursements for expenses 100,200 $ 66,200 $ 59,400 Noncash expenses 900 900 900 Depreciation $ 101,100 $ 67,100 $ 60.300 Total operating expenses Prepare the cash budget for June, July, and August. Recall that all borrowing and repayments of principal are made in multiples of $1,000. (Complete all answer boxes. Use a minus sign or parentheses for cash outflows and cash deficiencies. Round your answer for Borrowing to the nearest thousand dollars.) Berry Buy Electronics Cash Budget for the months of June - August June July August Beginning cash balance $ 15,100 $ 2,700 $ 2,748 Minimum cash balance required 2,000 2,000 2.000 Available cash balance 13,100 700 748 Cash receipts and disbursements: Collections from customers 182.000 230,400 188,000 Payments for merchandise (193,200) (124,200) (110,400) Payments for operating expenses (100,200 (66,200) (59,400) Payments for furniture and fixtures (15,000) 0 0 Payments for interest (313) Net cash receipts and disbursements (126,400) 39,048 17,887 $ (113,300 $ 39,748 $ 18,635 Excess (deficiency) of cash before financing Financing Borrowing $ 114,000 $ 0 $ 0 Repayments 0 (39,000) (18,000) Total cash from financing 114.000 (39,000) (18,000) 2,700 2,748 2,635 Ending cash balance (952) Prepare a budgeted monthly income statement for the coming June through August and for the quarter in total. (Complete all answer boxes. Use a minus sign or parentheses for a loss.) Berry Buy Electronics Budgeted Income Statements For the Three Months Ending August 31, 20X8 June 280,000 $ 193,200 86,800 Sales July 180,000 $ 124,200 June - August Total $ 620,000 427,800 August 160,000 110.400 Cost of goods sold 55,800 49,600 192.200 50,400 44,800 Gross profit Operating expenses: Salaries, wages, commissions Rent, taxes and other fixed expenses Other variable operating expenses Depreciation 5,000 78,400 5,000 16,800 900 5,000 9,600 173,600 15,000 37,200 2,700 10,800 900 900 67,100 60,300 228,500 Total operating expenses Income (loss) from operations Interest expense 101,100 (14,300) 475 (14,775) $ (11,300) 477 (10,700) 313 (36,300) 1,265 Net income (loss) (11,777) $ (11,013) (37,565) Prepare a budgeted balance sheet for August 31, 20X8. Prepare a budgeted balance sheet for August 31, 20X8. Berry Buy Electronics Budgeted Balance Sheet August 31, 20X8 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 2,635 Accounts payable $ 110.400 57.000 Accounts receivable Note payable 137,200 110,400 Merchandise inventory Total current liabilities 167,400 Total current assets 250,235 43,300 Net furniture and fixtures Owners' equity 126,135 $ 293,535 $ 293,535 Total assets Total liabilities and owners' equity Requirement 2. Explain why there is a need for a bank loan and what operating sources supply cash for repaying the bank loan. The need for such a short-term, self-liquidating loans often arise because: O A. start-up businesses and/or businesses with a heavy focus on research and development require outside funding to sustain ongoing operations. O B. the amount of the loan and the timing of the repayment are heavily dependent on the credit terms that pertain to both the purchasing and selling functions of the business. O C. of the seasonal nature of a business. The basic source of cash is proceeds from sales to customers. In times of peak sales, there is a lag between the sale and the collection of the cash, yet the payroll and suppliers must be paid in cash right away. When the cash is collected, it in turn may be used to repay the loan. D. Both b and c. This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers

Can Someone go through this problem and explain to me how you get these answers?

Can Someone go through this problem and explain to me how you get these answers?