Can someone help me answer part 1 balance sheet accounts, 2, 3 and 4 then create a balance sheet from the data

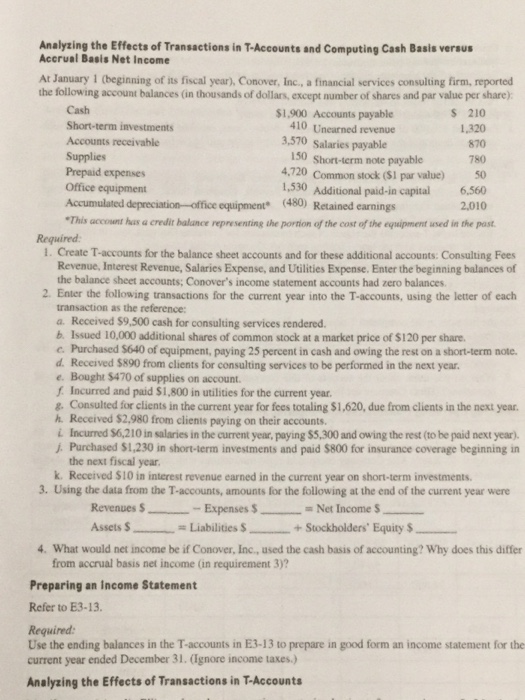

Analyzing the Effects of Transactions in T-Accounts and Computing Cash Basis versus Accrual Basis Net Income At January 1 (beginning of its fiscal year), Conover, Inc.,a financial services consulting firm, reported the following account balances (in thousands of dollars, except number of shares and par value per share) Cash S 210 1,320 870 780 $1,900 Accounts payable Short-term investments 410 Unearned revenue 3,570 Salaries payable Accounts receivable Supplies 150 Short-term note payable Prepaid expenses 4.720 Common stock (S1 par value) s0 Office equipment Accumulated depreciation-office equipment 1,530 Additional paid-in capital 6,560 2,010 (480) Retained earnings This account has a credit balance representing the portion of the cost of the equipment used in the past Required 1. Create T-accounts for the balance sheet accounts and for these additional accounts: Consulting Fees Revenue, Interest Revenue, Salaries Expense, and Utilities Expense. Enter the beginning balances of the balance sheet accounts; Conover's income statement accounts had zero balances 2. Enter the following transactions for the current year into the T-accounts, using the letter of each transaction as the reference: a. Received $9,500 cash for consulting services rendered b. Issued 10,000 additional shares of common stock at a market price of $120 per share e. Purchased S640 of equipment, paying 25 percent in cash and owing the rest on a short-term note d. Received $890 from clients for consulting services to be performed in the next year e. Bought S$470 of supplies on account. f Incurred and paid $1,800 in utilities for the current year g Consulted for clients in the current year for fees totaling $1,620, due from clients in the next year. h. Received $2,980 from clients paying on their accounts i Incurned S6,210 in salaries in the current year, paying $5,300 and owing the rest (to be paid next year). j Purchased $1,230 in short-term investments and paid $800 for insurance coverage beginning in the next fiscal year k. Received $10 in interest revenue earned in the current year on short-term investments. 3. Using the data from the T-accounts, amounts for the following at the end of the current year were Revenues $ Assets $ Expenses Liabilities $ Net Income $ + Stockholders' Equity $ $ 4. What would net income be if Conover, Inc., used the cash basis of accounting? Why does this differ from accrual basis net income (in requirement 3)? Preparing an income Statement Refer to E3-13 Required Use the ending balances in the T-accounts in E3-13 to prepare in good form an income statement for the current year ended December 31. Ignore income taxes.) Analyzing the Effects of Transactions in T-Accounts