Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me determine the responses I co0uld not figure out on my own with regards to this question? Garcia, Inc. uses a job-order

Can someone help me determine the responses I co0uld not figure out on my own with regards to this question?

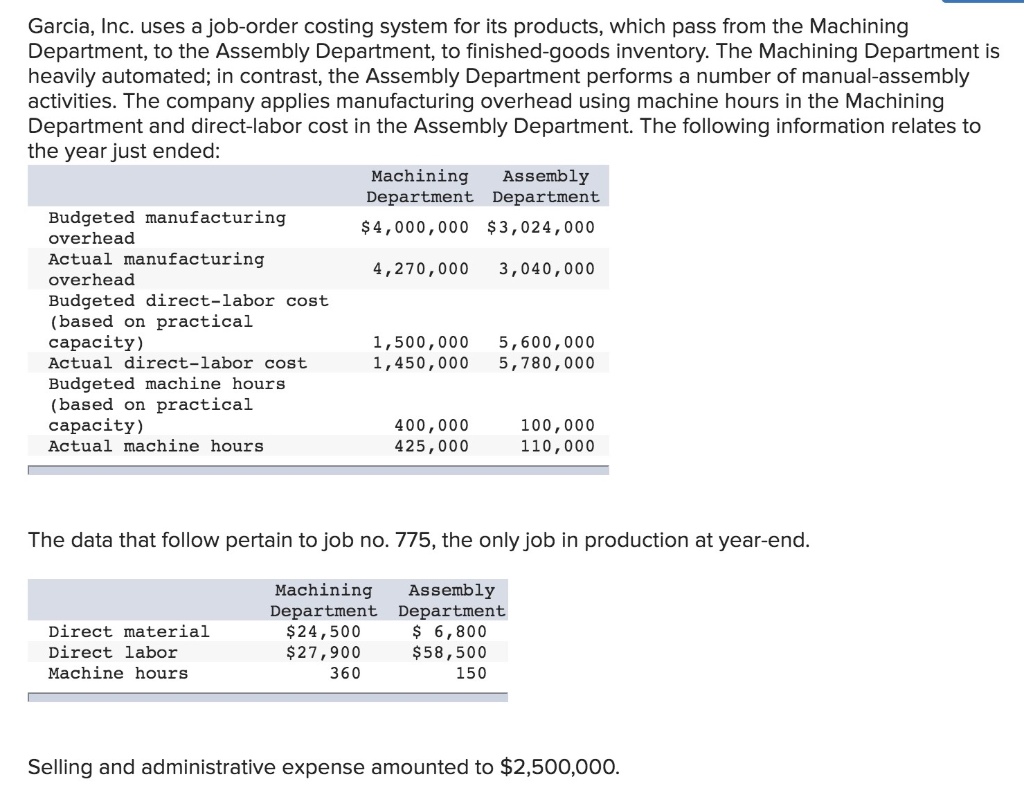

Garcia, Inc. uses a job-order costing system for its products, which pass from the Machining Department, to the Assembly Department, to finished-goods inventory. The Machining Department is heavily automated; in contrast, the Assembly Department performs a number of manual-assembly activities. The company applies manufacturing overhead using machine hours in the Machining Department and direct-labor cost in the Assembly Department. The following information relates to the year just ended: Machining Assembly Department Department Budgeted manufacturing overhead $4,000,000 $3,024,000 Actual manufacturing 4,270,000 3,040,000 overhead Budgeted direct-labor cost (based on practical capacity) 1,500,000 5,600,000 Actual direct-labor cost 1,450,000 5,780,000 Budgeted machine hours (based on practical capacity) 400,000 100,000 Actual machine hours 425,000 110,000 The data that follow pertain to job no. 775, the only job in production at year-end. Direct material Direct labor Machine hours Machining Assembly Department Department $24,500 $ 6,800 $ 27,900 $58,500 360 150 Selling and administrative expense amounted to $2,500,000. 3. Determine whether overhead was under- or overapplied during the year in the Machining Department. 4. Determine whether overhead was under- or overapplied during the year in the Assembly Department. 6. How much overhead would have been charged to the company's Work-in-Process account during the year? Work-in-processStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started