Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me doing the part 1 and 2 according to financial planning cycle ? Complete the assignment posted by your instructor. Your lecture

can someone help me doing the part 1 and 2 according to financial planning cycle ?

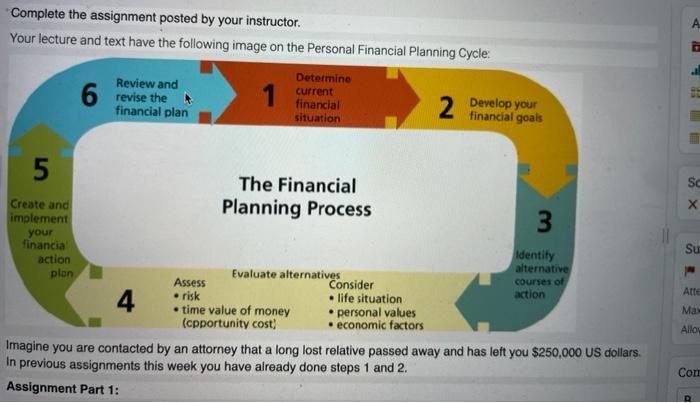

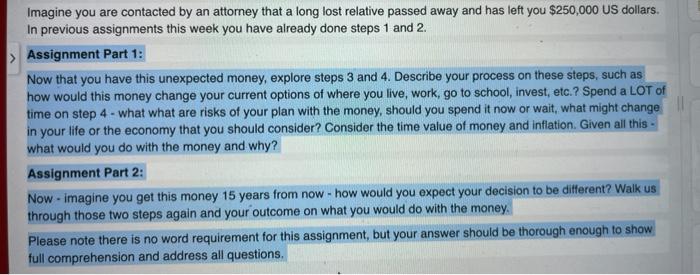

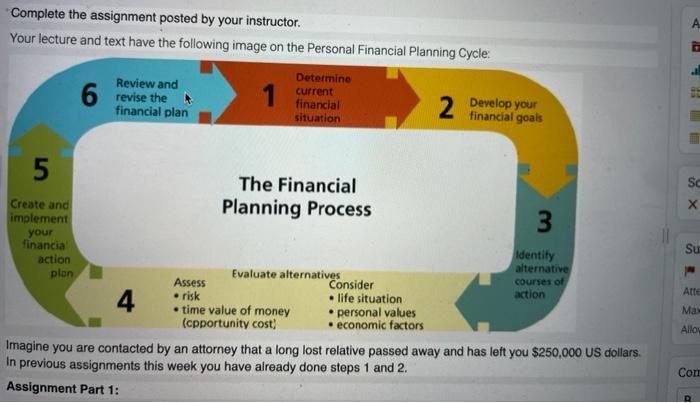

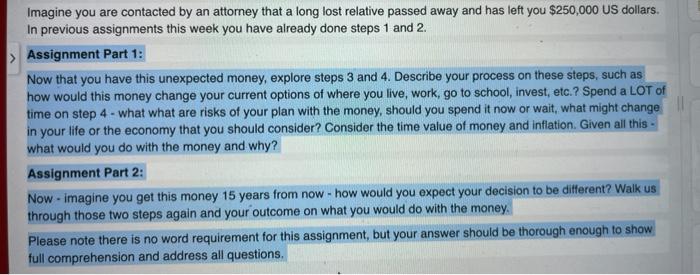

Complete the assignment posted by your instructor. Your lecture and text have the following image on the Personal Financial Planning Cycle A Determine 6 revise the financial plan 1 current financial situation 2 Develop your financial goals Sc Su 5 The Financial Create and Planning Process implement 3 your financia Identity action alternative plon Evaluate alternatives Assess courses of Consider risk action 4 life situation time value of money personal values (cpportunity cost) economic factors Imagine you are contacted by an attorney that a long lost relative passed away and has left you $250,000 US dollars. In previous assignments this week you have already done steps 1 and 2. Assignment Part 1: Atte Mas Alloy Con Imagine you are contacted by an attorney that a long lost relative passed away and has left you $250,000 US dollars. In previous assignments this week you have already done steps 1 and 2. > Assignment Part 1: Now that you have this unexpected money, explore steps 3 and 4. Describe your process on these steps, such as how would this money change your current options of where you live, work, go to school, invest, etc.? Spend a LOT of time on step 4 - what what are risks of your plan with the money, should you spend it now or wait, what might change in your life or the economy that you should consider? Consider the time value of money and inflation. Given all this - what would you do with the money and why? Assignment Part 2: Now - imagine you get this money 15 years from now - how would you expect your decision to be different? Walk us through those two steps again and your outcome on what you would do with the money, Please note there is no word requirement for this assignment, but your answer should be thorough enough to show full comprehension and address all questions, Complete the assignment posted by your instructor. Your lecture and text have the following image on the Personal Financial Planning Cycle A Determine 6 revise the financial plan 1 current financial situation 2 Develop your financial goals Sc Su 5 The Financial Create and Planning Process implement 3 your financia Identity action alternative plon Evaluate alternatives Assess courses of Consider risk action 4 life situation time value of money personal values (cpportunity cost) economic factors Imagine you are contacted by an attorney that a long lost relative passed away and has left you $250,000 US dollars. In previous assignments this week you have already done steps 1 and 2. Assignment Part 1: Atte Mas Alloy Con Imagine you are contacted by an attorney that a long lost relative passed away and has left you $250,000 US dollars. In previous assignments this week you have already done steps 1 and 2. > Assignment Part 1: Now that you have this unexpected money, explore steps 3 and 4. Describe your process on these steps, such as how would this money change your current options of where you live, work, go to school, invest, etc.? Spend a LOT of time on step 4 - what what are risks of your plan with the money, should you spend it now or wait, what might change in your life or the economy that you should consider? Consider the time value of money and inflation. Given all this - what would you do with the money and why? Assignment Part 2: Now - imagine you get this money 15 years from now - how would you expect your decision to be different? Walk us through those two steps again and your outcome on what you would do with the money, Please note there is no word requirement for this assignment, but your answer should be thorough enough to show full comprehension and address all questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started