Answered step by step

Verified Expert Solution

Question

1 Approved Answer

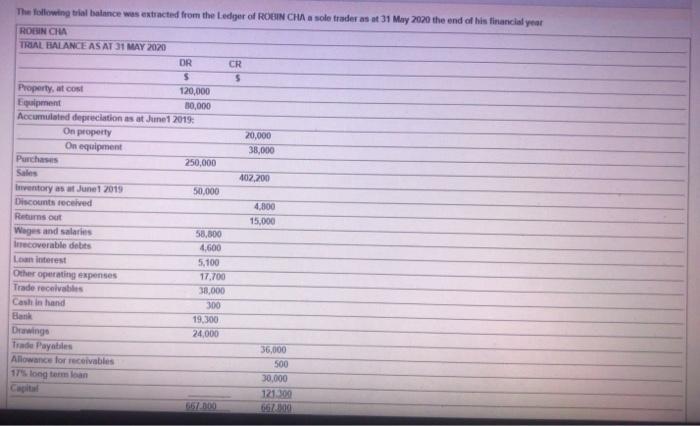

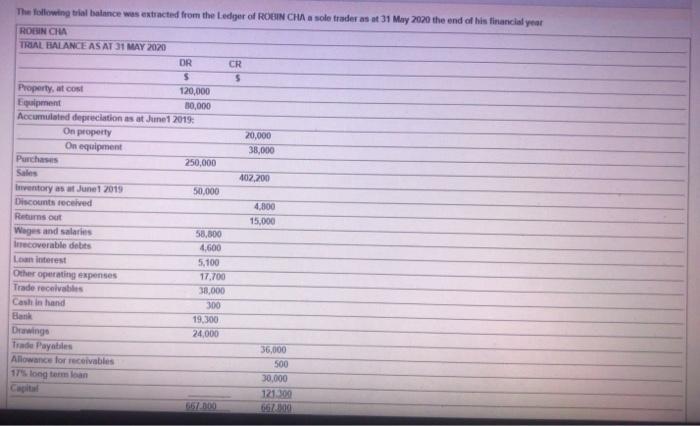

can someone help me please. The following trial balance was extracted from the Ledger of ROBIN CHA a sole trader as at 31 May 2020

can someone help me please.

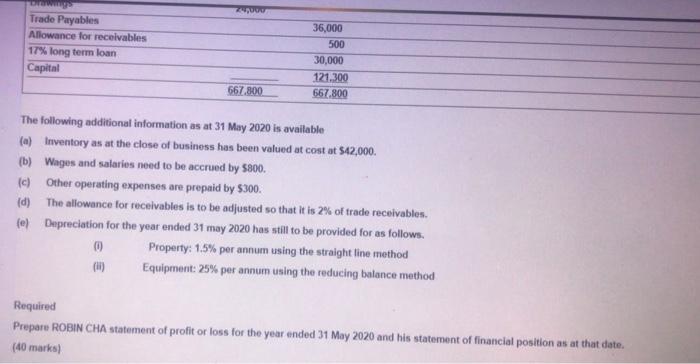

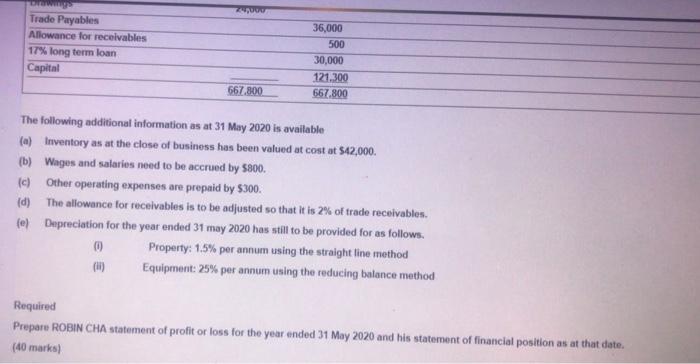

The following trial balance was extracted from the Ledger of ROBIN CHA a sole trader as at 31 May 2020 the end of his financial year ROSINCHA TRAL BALANCE AS AT 31 MAY 2020 DR CR s s Property, at cost 120,000 Equipment 10,000 Accumulated depreciation as at June 2019 On property 20,000 On equipment 38,000 Purchases 250.000 Sales 402,200 Inventory at June 2019 50,000 Discounts received 4.800 Returns out 15,000 Wages and salaries 58,800 Inrecoverable debits 4,600 La interest 5,100 Other operating expenses 17.700 Trade receivables 38.000 Cash in hand 300 Bank 19,300 Drawings 24,000 Trade Payatiles 36,000 Allowance for receivables 500 11 long term loan 30,000 121.300 66/ Trade Payables Allowance for receivables 17% long term loan Capital 36,000 500 30,000 121.300 667.800 667.800 The following additional information as at 31 May 2020 is available (a) Inventory as at the close of business has been valued at cost at $42,000. (b) Wages and salarios need to be accrued by $800. Ich Other operating expenses are prepaid by $300. (d) The allowance for receivables is to be adjusted so that it is 2% of trade receivables. (e Depreciation for the year ended 31 may 2020 has still to be provided for as follows. Property: 1.5% per annum using the straight line method (H) Equipment: 25% per annum using the reducing balance method Required Prepare ROBIN CHA statement of profit or loss for the year ended 31 May 2020 and his statement of financial position as at that date. (40 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the statement of profit or loss and the statement of financial position well follow these steps Step 1 Adjustments 1 Inventory Adjustment C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started