can someone help me pleasee?

I really appreciate your help

is this better? its readable on mine

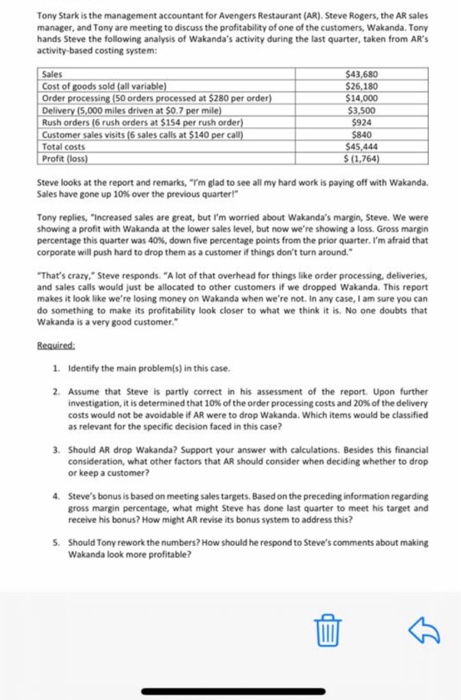

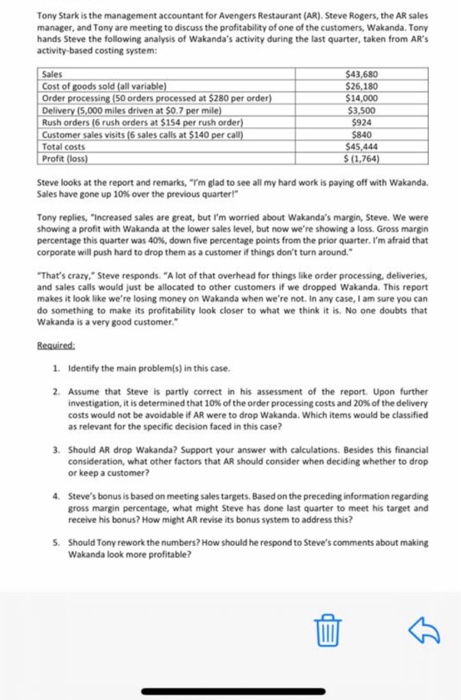

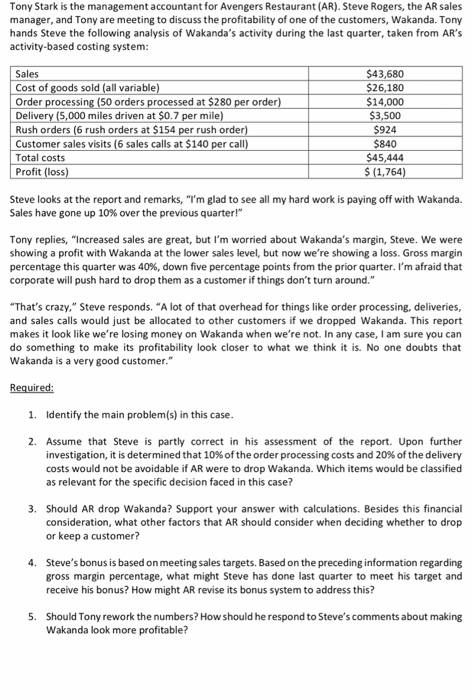

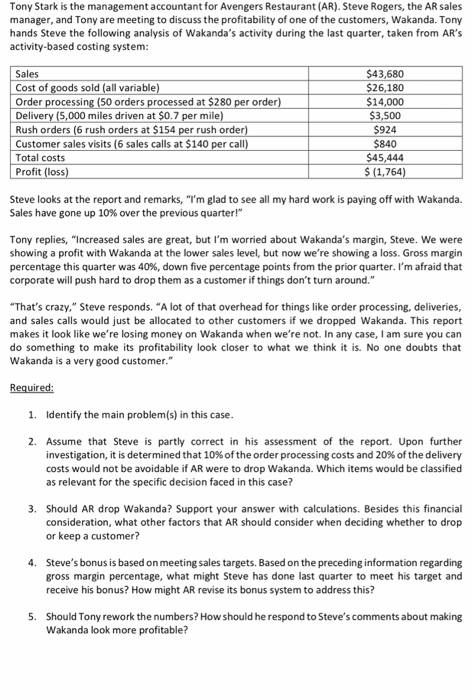

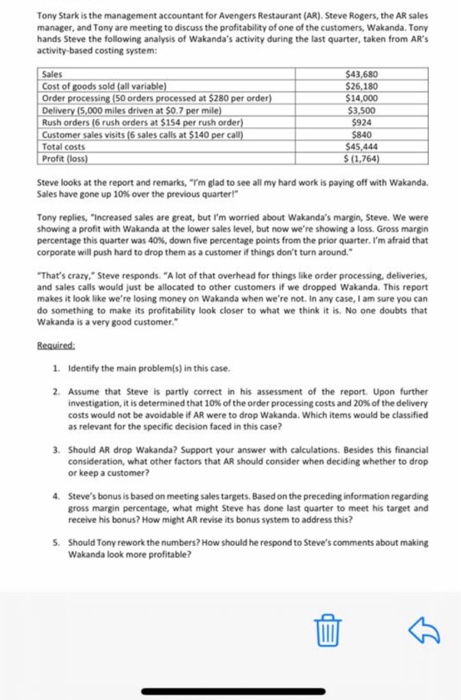

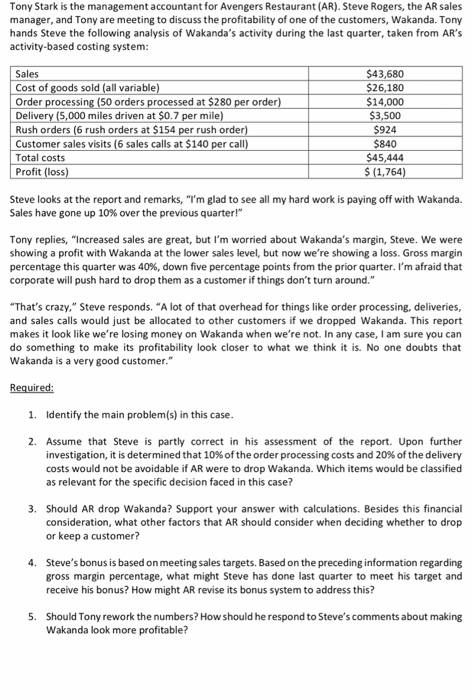

Tony Stark is the management accountant for Avengers Restaurant (AR). Steve Rogers, the AR sales manager, and Tony are meeting to discuss the profitability of one of the customers, Wakanda. Tony hands Steve the following analysis of Wakanda's activity during the last quarter, taken from AR'S activity based costing system: Sales Cost of goods sold (all variable) Order processing (50 orders processed at $280 per order) Delivery 15,000 miles driven at $0.7 per mile) Rush orders (6 rush orders at $154 per rush order) Customer sales visits 16 sales calls at $140 per call) Total costs Profit loss $43,680 $26.180 $14,000 $3,500 $924 5840 $45.444 $(1,764) Steve looks at the report and remarks, "Im glad to see all my hard work is paying off with Wakanda. Sales have gone up 10% over the previous quarter! Tony replies, Increased sales are great, but I'm worried about Wakanda's margin, Steve. We were showing a profit with Wakanda at the lower sales level, but now we're showing a loss. Gross margin percentage this quarter was 40%, down five percentage points from the prior quarter. I'm afraid that corporate will push hard to drop them as a customer if things don't turn around." "That's crazy." Steve responds. "A lot of that overhead for things like order processing, deliveries, and sales calls would just be allocated to other customers if we dropped Wakanda. This report makes it look like we're losing money on Wakanda when we're not in any case, I am sure you can do something to make its profitability look closer to what we think it is. No one doubts that Wakanda is a very good customer Required: 1. Identify the main problem(s) in this case. 2. Assume that Steve is partly correct in his assessment of the report. Upon further investigation, it is determined that 10% of the order processing costs and 20% of the delivery costs would not be avoidable if AR were to drop Wakanda. Which items would be classified as relevant for the specific decision faced in this case? 3. Should AR drop Wakanda? Support your answer with calculations. Besides this financial consideration, what other factors that AR should consider when deciding whether to drop or keep a customer? 4. Steve's bonus is based on meeting sales targets. Based on the preceding information regarding gross margin percentage, what might Steve has done last quarter to meet his target and receive his bonus? How might AR revise its bonus system to address this? 5. Should Tony rework the numbers? How should he respond to Steve's comments about making Wakanda look more profitable? Tony Stark is the management accountant for Avengers Restaurant (AR). Steve Rogers, the AR sales manager, and Tony are meeting to discuss the profitability of one of the customers, Wakanda. Tony hands Steve the following analysis of Wakanda's activity during the last quarter, taken from AR'S activity-based costing system: Sales Cost of goods sold (all variable) Order processing (50 orders processed at $280 per order) Delivery (5,000 miles driven at $0.7 per mile) Rush orders (6 rush orders at $154 per rush order) Customer sales visits (6 sales calls at $140 per call) Total costs Profit (loss) $43,680 $26,180 $14,000 $3,500 $924 $45,444 $ (1,764) Steve looks at the report and remarks, "I'm glad to see all my hard work is paying off with Wakanda. Sales have gone up 10% over the previous quarter!" Tony replies, "Increased sales are great, but I'm worried about Wakanda's margin, Steve. We were showing a profit with Wakanda at the lower sales level, but now we're showing a loss. Gross margin percentage this quarter was 40%, down five percentage points from the prior quarter. I'm afraid that corporate will push hard to drop them as a customer if things don't turn around." "That's crazy," Steve responds. "A lot of that overhead for things like order processing, deliveries, and sales calls would just be allocated to other customers if we dropped Wakanda. This report makes it look like we're losing money on Wakanda when we're not. In any case, I am sure you can do something to make its profitability look closer to what we think it is. No one doubts that Wakanda is a very good customer." Required: 1. Identify the main problem(s) in this case. 2. Assume that Steve is partly correct in his assessment of the report. Upon further investigation, it is determined that 10% of the order processing costs and 20% of the delivery costs would not be avoidable if AR were to drop Wakanda. Which items would be classified as relevant for the specific decision faced in this case? Should AR drop Wakanda? Support your answer with calculations. Besides this financial consideration, what other factors that AR should consider when deciding whether to drop or keep a customer? 4. Steve's bonus is based on meeting sales targets. Based on the preceding information regarding gross margin percentage, what might Steve has done last quarter to meet his target and receive his bonus? How might AR revise its bonus system to address this? 5. Should Tony rework the numbers? How should he respond to Steve's comments about making Wakanda look more profitable