Answered step by step

Verified Expert Solution

Question

1 Approved Answer

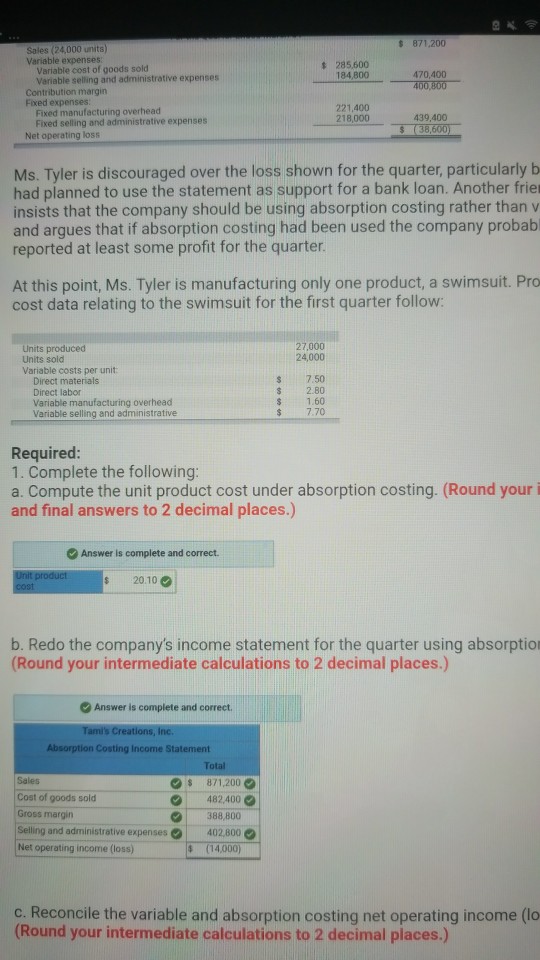

Can someone help me solve this pelase??? 871,200 Sales (24,000 units) Variable expenses Variable cost of goods sold Variable selling and administrative expenses 285.600 184,800

Can someone help me solve this pelase???

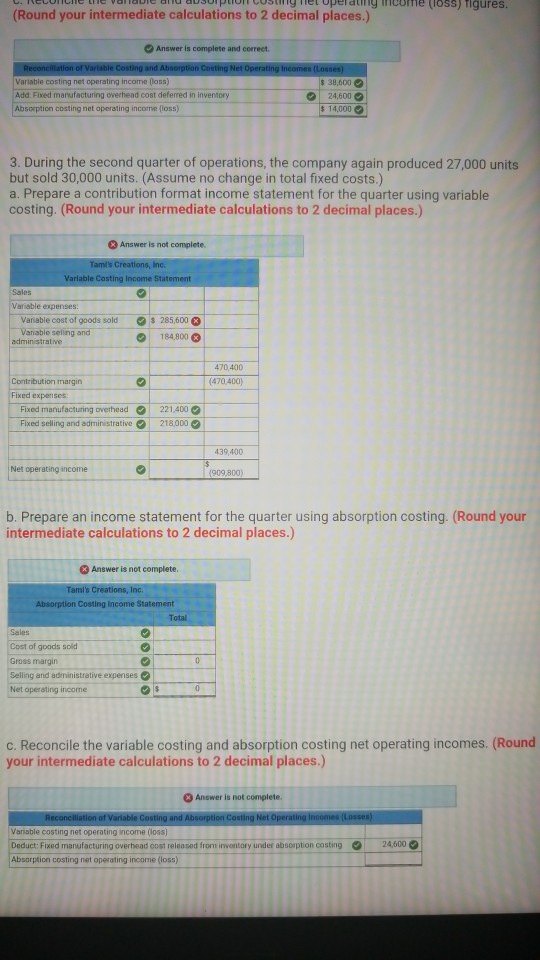

871,200 Sales (24,000 units) Variable expenses Variable cost of goods sold Variable selling and administrative expenses 285.600 184,800 Contribution margin Fixed expenses Fixed manufacturing overhead Fixed selling and administrative expenses 221,400 218,000 439,400 Net operating loss ler is discouraged over the loss shown for the quarter, particularly b Ms. Ty had planned to use the statement as support for a bank loan. Another frier insists that the company should be using absorption costing rather than v and argues that if absorption costing had been used the company probab reported at least some profit for the quarter At this point, Ms. Tyler is manufacturing only one product, a swimsuit. Pro cost data relating to the swimsuit for the first quarter follow: Units produced Units sold Variable costs per unit 24,000 Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative $ 7.50 $ 2.80 $ 1.60 $ 7.70 Required 1. Complete the following: a. Compute the unit product cost under absorption costing. (Round your i and final answers to 2 decimal places.) Answer is complete and correct. 20.10 b. Redo the company's income statement for the quarter using absorption (Round your intermediate calculations to 2 decimal places.) Answer is complete and correct Absorption Costing Income Statement Total 871,200 Cost of goods sold Gross margin 482.400 388,800 Sellingand administrative expenses 402,800 s (14,000) Net operating income (loss) c. Reconcile the variable and absorption costing net operating income (lo Round your intermediate calculations to 2 decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started