Question

Can someone help me to journalize the entry that says Received a check from Calm Waters Board Corporation for the amount due And the entries

Can someone help me to journalize the entry that says "Received a check from Calm Waters Board Corporation for the amount due" And the entries from January 5 onwards?

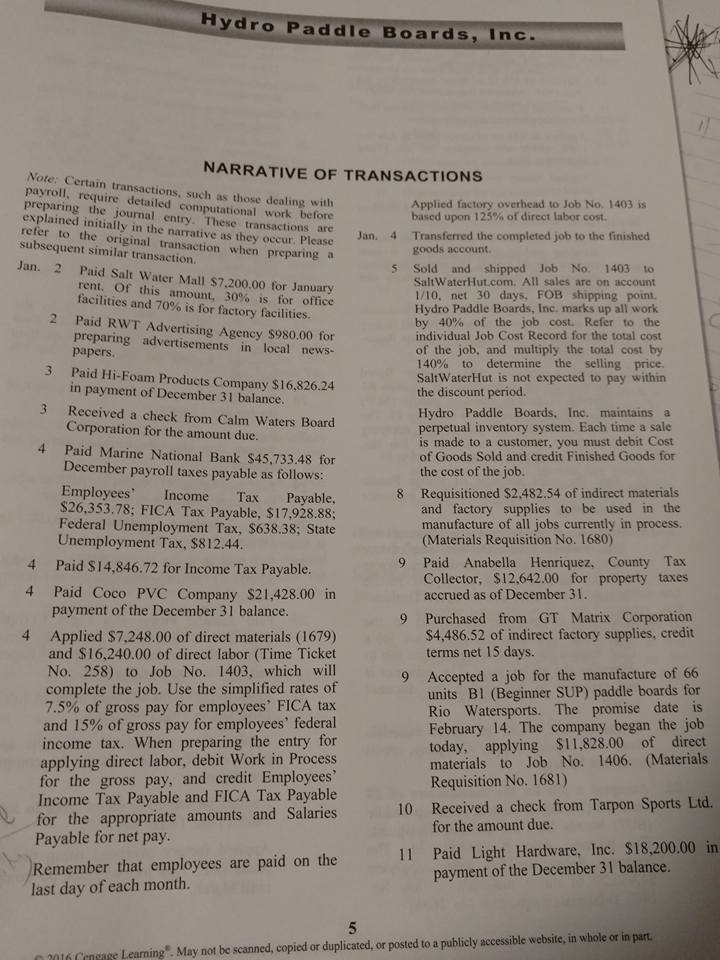

Jan. 2 Paid Salt Water Mall $7,200.00 for January rent. Of this amount, 30% is for office facilities and 70% is for factory facilities.

2. Paid RWT Advertising Agency $980.00 for preparing advertisements in local newspaper.

3. Paid Hi-Foam Products Company $16,826.24 in payment of December 31 balance.

3. Received a check from Calm Waters Board Corporation for the amount due within the discount period.

4. Paid Marine National Bank $45,733.48 for December payroll taxes payable as follows:

Employees' Income Tax Payable, $26,353.78; FICA Tax Payable $17,928.88; Federal Unemployment Tax , $812.44.

4. Paid $14,846.72 for Income Tax Payable.

4. Paid Coco PVC Company $21,428.00 in Payment of the December 31 balance.

4. Applied $7,248.00 of direct materials (1676) and $16,240.00 of direct labor (time ticket No. 258.) to Job No. 1403, which will complete the job. Use the simplified rates of 7.5% of gross pay fro employees? FICA tax and 15% of gross pay for employees? federal income tax. When preparing the entry for applying direct labor, debit Work in Process for the gross pay, and credit Employees? Income Taxes Payable and FICA Tax Payable for the appropriate amounts and Salaries Payable for net pay .

Remember that employees are paid on the last day of each month.

Applied factory overhead to Job No. 1403 is based upon 125% of direct labor cost.

Jan. 4. Transferred the completed Job. 1403 to the appropriate customer. All sales are on account 1/10, net 30 days, FOB shipping point. Hydro Paddle Boards, Inc. marks up all work for by 40% of the job cost. Refer to the individual Job Order Cost Sheet for the total cost of the job and multiply the total cost by 140% to determine the selling price for each job.

Hydro Paddle Boards, Inc. maintains a perpetual inventory system. Each time a sale is made to a customer, you must debit Cost of Goods Sold and credit Finished Goods for the cost of the job.

8. Requisitioned $2,482.54 of indirect materials and factory supplies to eh used in the manufacture of all jobs currently in process. (Materials Requisition N. 1680).

9. Paid Anabella Henriquez County Tax Collector, $12,642.00 for property taxes accrued as of December 31.

9. Purchased from GT Matrix Corporation $4,468.52 of indirect factory supplies, credit terms net 15 days.

9. Accepted a job for the manufacture of 66 units B1 (Beginning SUP) paddle boards for Rio Watersports. The promise date is February 14. The company began the job today, applying $11,828.00 of direct materials to Job No. 1406. (Materials Requisition No. 1681.)

10. Received a check from Tarpon Sports Ltd. For the amount due within the discount period.

Jan. 11 Paid Light Hardware, Inc. $18,200.00 in payment of the December 31 balance.

11. Applied $2,654.28 of direct materials to Job No. 1402. (Materials Requisition No. 1682.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started