Can someone help me to solve a problem which is similar to another one. I attached both problems below. Anyway i took a picture and it misses some words which is "floating rate investment into fixed rate investment"

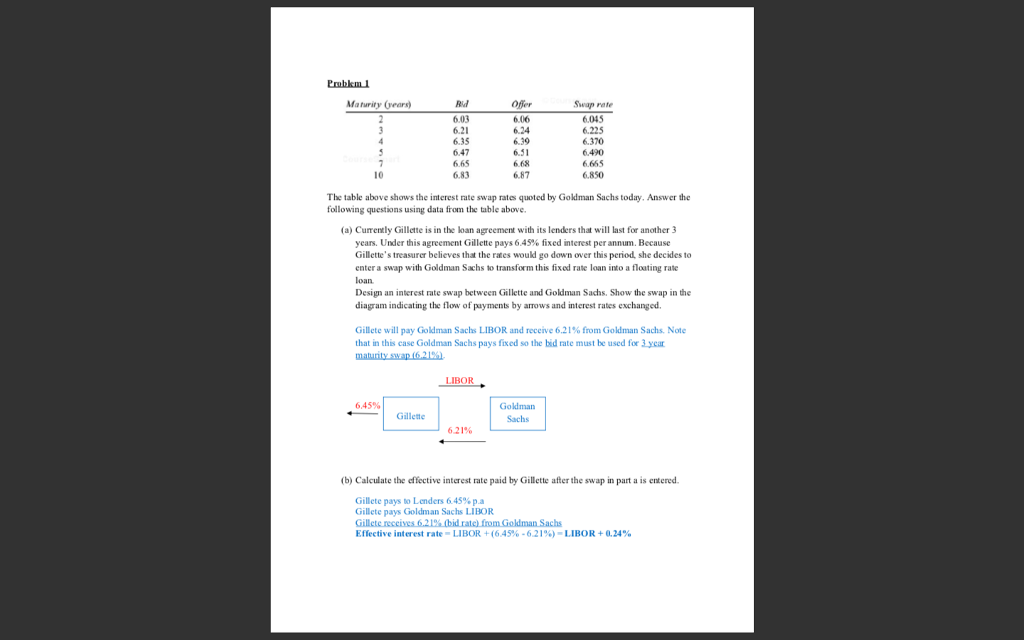

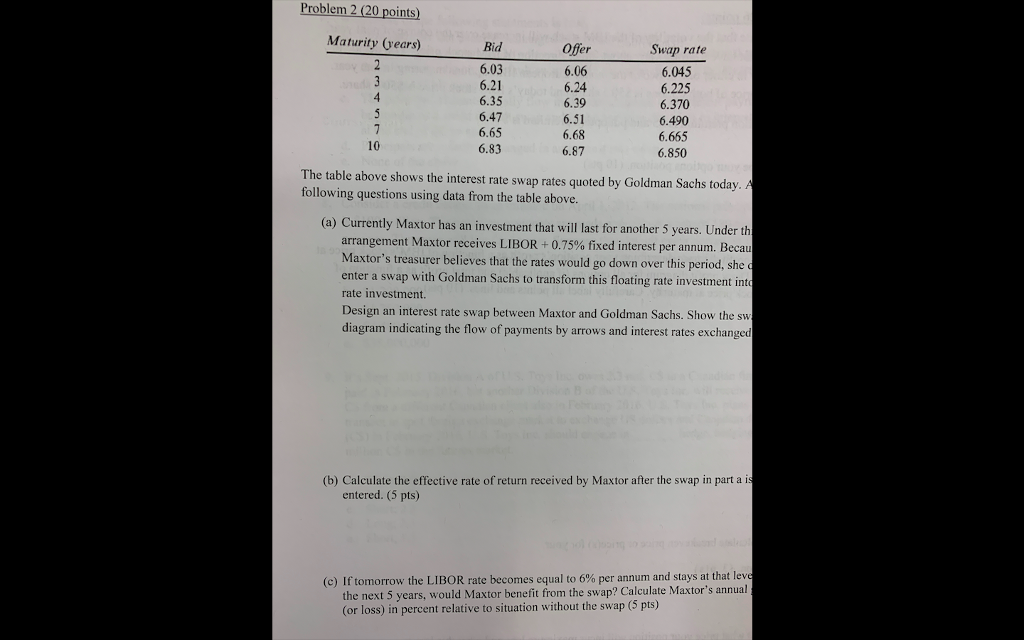

Maturity (ears) Rid 6.03 6.21 6.35 6.47 6.65 6.83 Ofer 6.06 6.24 6.39 6.51 6.68 6.87 Swap rate 6.045 6.225 6.370 6.490 6.665 6.850 10 The table above shows the interest rate swap rates quoted by Goldman Sachs today. Answer the following questions using data from the table above. (a) Curremly Gillette is in the loan agreement with its lenders that will last for another 3 years. Under this agreement Gillette pays 6.49% fixed interest per annum. Because Gillette's treasurer believes that the res would go down over this period, she decides to enter a swap with Goldman Sachs to transform this fixed rate loan into a floating rate Design an interest rate swap between Gillette and Goldman Sachs, Show the swap in the diagram indicating the flow of payments by arrows and interest rates exchanged. Gillete will pay Goldman Sachs LIBOR and receive 6.21% from Goldman Sachs. Note that in this case Goldman Sachs pays fixed so the bid rate must be used for 3 ycar 6.45% Goldman Sachs Gillette 6.21% (b) Calculate the effective interest rate paid by Gillette after the swap in part a is entered Gillete pays to L Gillete pays Goldman Sachs LIBOR enders 645% p.a Effective interest rate-LIBOR +16.45%-6.21%)-LIBOR + 0.24% blem 2 (20 points) Maturity (years) Bid Offer 6.06 6.24 6.39 6.31 6.68 6.87 Swap rate 6.03 6.35 6.47 6.65 6.83 6.045 6.225 6.370 6.490 6.665 6.850 10 The table above shows the interest rate swap rates quoted by Goldman Sachs today lowing questions using data from the table above. (a) Currently Maxtor has an investment that will last for another 5 years. Under th arrangement Maxtor receives LIBOR + 0.75% fixed interest per annum. Becau Maxtor's treasurer believes that the rates would go down over this period, she enter a swap with Goldman Sachs to transform this floating rate investment int rate investment. Design an interest rate swap between Maxtor and Goldman Sachs. Show the sw diagram indicating the flow of payments by arrows and interest rates exchanged (b) Calculate the effective rate of return received by Maxtor after the swap in part a i entered. (5 pts) (c) If tomorrow the LIBOR rate becomes equal to 6% per annum and stays at that lev the next 5 years, would Maxtor benefit from the swap? Calculate Maxtor's annual (or loss) in percent relative to situation without the swap (S pts)