Answered step by step

Verified Expert Solution

Question

1 Approved Answer

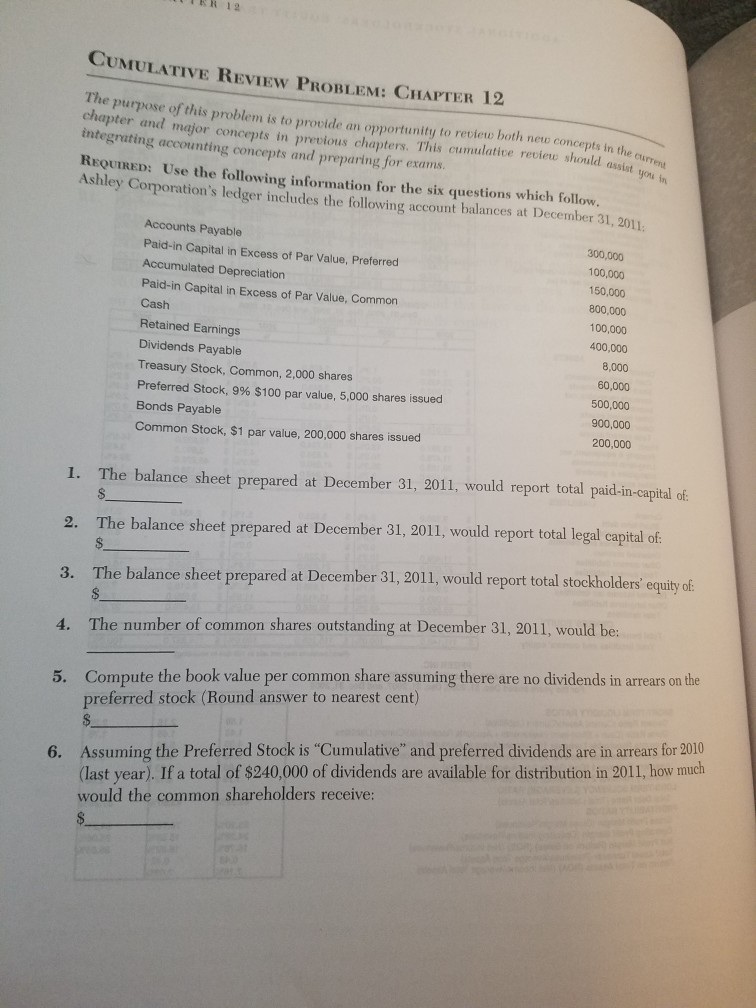

Can someone help me with questions 5 & 6? The answers to 1-4 are 1. 1,600,000 2. 700,000 3. 1,940,000 4. 198,000 R 12 CUMULATIVE

Can someone help me with questions 5 & 6?

The answers to 1-4 are

1. 1,600,000 2. 700,000 3. 1,940,000 4. 198,000

R 12 CUMULATIVE REVIEW PROBLEM: CHAPTER 12 The purpose of this problem is to procide an opportunity to review both new concepts in the chapter and major concepts in previous chapters. This cumulatice reviene should assist integrating accounting concepts and preparing for exams the current REQUIRED: Use the following information for the six questions which follow. Ashley Corporation's ledger includes the following account balances at December 31, 2011. Accounts Payable Paid-in Capital in Excess of Par Value, Preferred Accumulated Depreciation Paid-in Capital in Excess of Par Value, Common Cash Retained Earnings Dividends Payable Treasury Stock, Common, 2,000 shares Preferred Stock, 9% $100 par value, 5,000 shares issued Bonds Payable Common Stock, $1 par value, 200,000 shares issued 300,000 100,000 150,000 800,000 100,000 400,000 8,000 60,000 500,000 900,000 200,000 1. The balance sheet prepared at December 31, 2011, would report total paid-in-capital of 2 The balance sheet prepared at December 31, 2011, would report total legal capital of: 3. The balance sheet prepared at December 31, 2011, would report total stockholders equity of 4. The number of common shares outstanding at December 31, 2011, would be: 5. Compute the book value per common share assuming there are no dividends in arrears on the preferred stock (Round answer to nearest cent) Assuming the Preferred Stock is "Cumulative" and preferred dividends are in arrears for 2010 (last year). If a total of $240,000 of dividends are available for distribution in 2011, how much would the common shareholders receive: 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started