Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me with this problem? Attached is an example to help 5.3-5.4b#5 Question 5 1 pts The following table shows the annual effective

Can someone help me with this problem? Attached is an example to help

5.3-5.4b#5

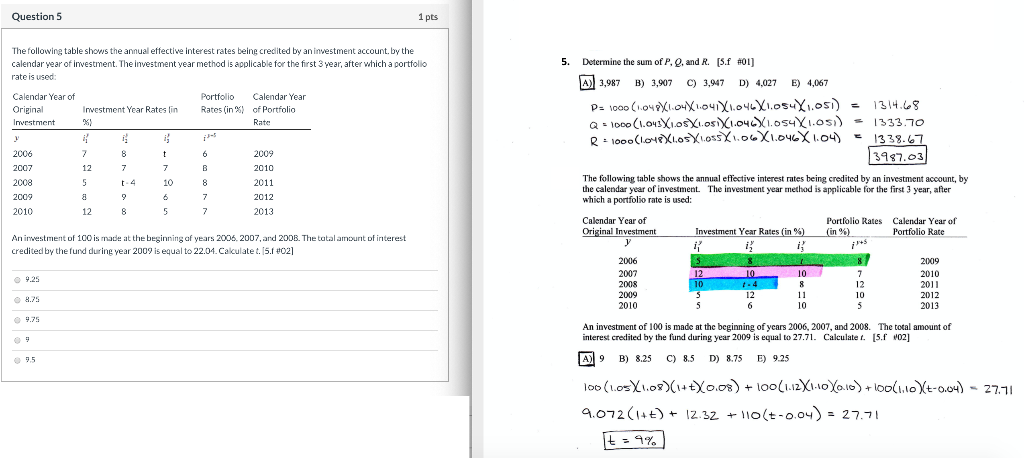

Question 5 1 pts The following table shows the annual effective interest rates being credited by an investment account. by the calendar year of investment. The investment year method is applicable for the first 3 year, after which a portfolio rate is used: 5. Calendar Year of Original Investment Investment Year Rates in Portfolio Calendar Year Rates (in %) of Portfolio Rate Determine the sum of P., and R. (5. 101) A) 3,987 B) 3,907 C) 3,947 D) 4,027 E) 4,067 P= 1000 (14X14X1.041X1.046X1.054X1.051) 1314.63 Q = 1000 (1.043 1.oslosi 1.041.054X1.03) - 1333.70 R = 1000( Xos Xos X1.06X1.646X1.04) 1338.67 3987.03 The following table shows the annual effective interest rates being credited by an investment account, by the calendar year of investment. The investment year method is applicable for the first year, after which a portfolio rate is used: 2006 2007 2008 2009 2010 78 6 1277 5 4 10 8 2009 2010 2011 2012 2013 12 8 5 7 Calendar Year of Original Investment Investment Year Rates (in %) Portfolio Rates (in %) Calendar Year of Portfolio Rate An investment of 100 is made at the beginning of years 2006, 2007, and 2008. The total amount of interest credited by the fund during year 2009 is equal to 22.01.Cakulatet. (5.1002] 11 2006 2007 2008 S88 12 10 10 10 .4 20209 2010 2011 2012 2013 2009 2010 10 An investment of 100 is made at the beginning of years 2006, 2007, and 2008. The total amount of interest credited by the fund during year 2009 is equal to 27.71. Calculatet. 15. 102] A9 B) 8.25 C) 8. 5 D ) 8.75 E) 9.25 100 (1.05X1.08)(1+ t 0.08) + 100 (1.12X100.10)+olut-0.04) - 27.11 9.072(1++) + 12.32 + 110(+-0.04) = 27.71 t-9%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started