Answered step by step

Verified Expert Solution

Question

1 Approved Answer

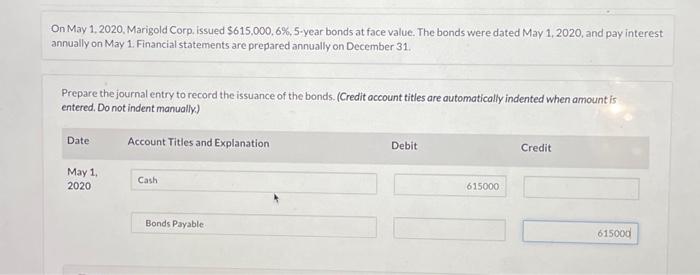

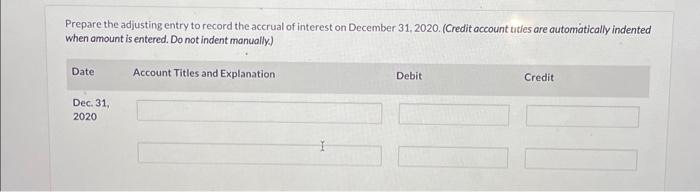

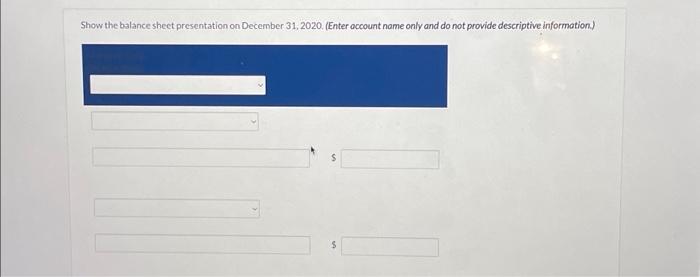

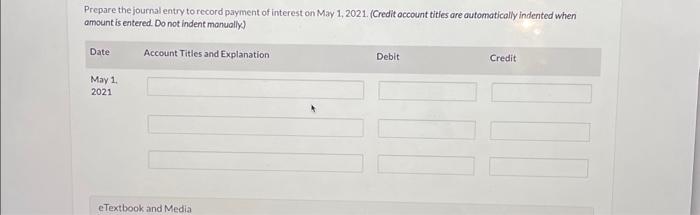

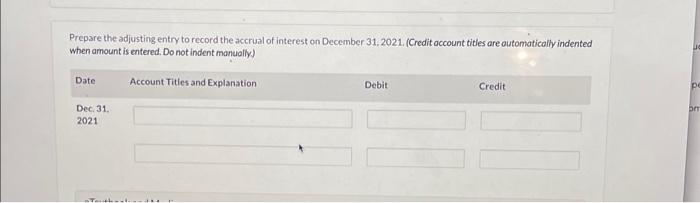

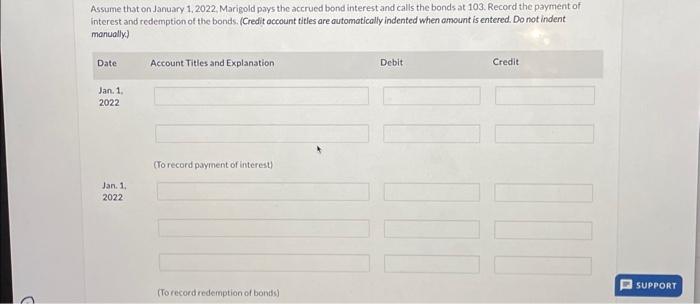

On May 1, 2020, Marigold Corp. issued $615,000, 6%, five year bonds at face value. The bonds were dating May 1, 2020 and pay interest

On May 1, 2020, Marigold Corp. issued $615,000, 6%, five year bonds at face value.

The bonds were dating May 1, 2020 and pay interest annually on May 1. Financial statements are prepared annually on December

31. (This is only one whole question with many parts by the way. Please explain the steps as well, thank you!)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started